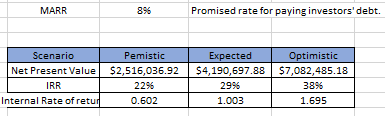

Obtain the WACC (Weighted Average Cost of Capital) of these three different scenarios named (Expected, Optimistic and Realistic:

Extra data that could help:

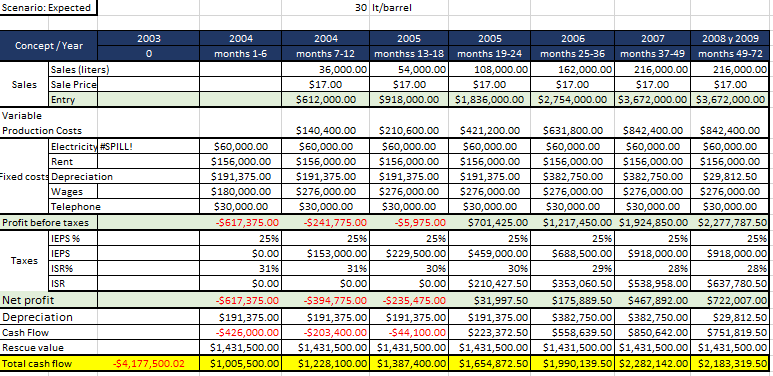

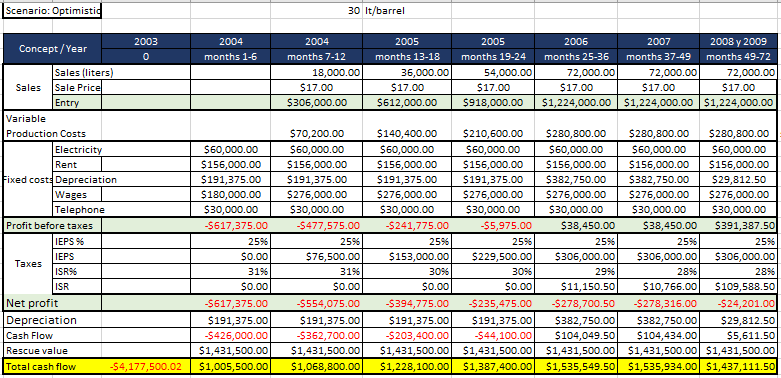

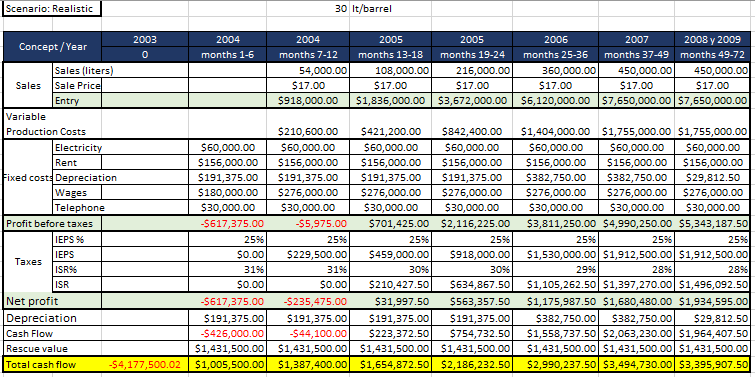

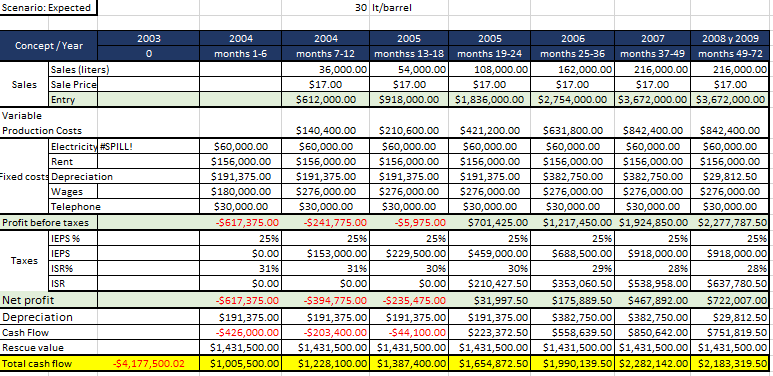

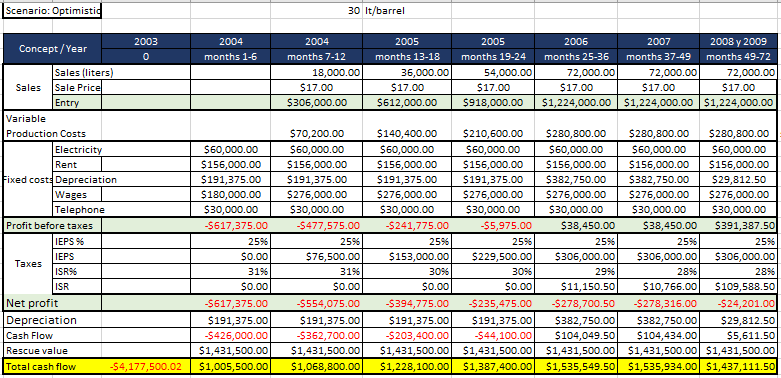

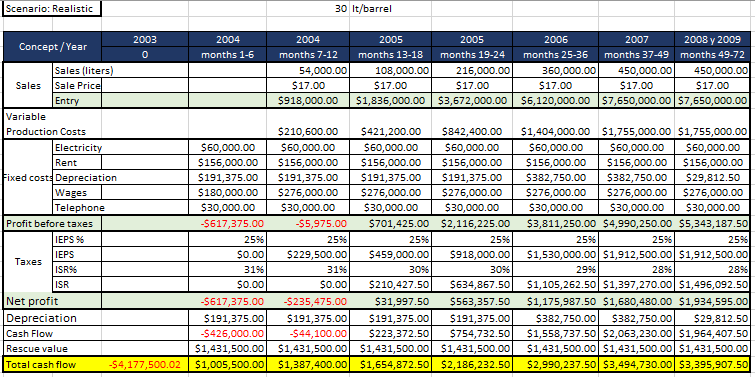

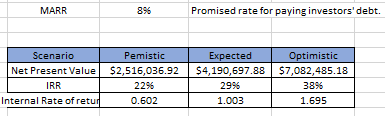

Scenario: Expected 30 It/barrel 2004 months 1-6 2004 months 7-12 36,000.00 $17.00 $612,000.00 2005 monthss 13-18 54,000.00 $17.00 $918,000.00 2005 months 19-24 108,000.00 $17.00 $1,836,000.00 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 162,000.00 216,000.00 216,000.00 $17.00 $17.00 $17.00 $2,754,000.00 $3,672,000.00 $3,672,000.00 2003 Concept/Year 0 Sales (liters) Sales Sale Price Entry Variable Production Costs Electricity #SPILL! Rent Fixed cost: Depreciation Wages Telephone Profit before taxes IEPS 96 IEPS Taxes ISR96 ISR Net profit Depreciation Cash Flow Rescue value Total cash flow $4,177,500.02 $60,000.00 $156,000.00 $191,375.00 $180,000.00 $30,000.00 $617,375.00 2596 $0.00 3196 $0.00 $617,375.00 $191,375.00 $426,000.00 $1,431,500.00 $1,005,500.00 $140,400.00 $210,600.00 $421,200.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $191,375.00 $191,375.00 $191,375.00 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $241,775.00 $5,975.00 $701,425.00 2596 2596 2596 $153,000.00 $229,500.00 $459,000.00 3196 3096 3096 $0.00 $0.00 $210,427.50 $394,775.00 -$235,475.00 $31,997.50 $191,375.00 $191,375.00 $191,375.00 $203,400.00 -$44,100.00 $223,372.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,228,100.00 $1,387,400.00 $1,654,872.50 $631,800.00 $842,400.00 $842,400.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $1,217,450.00 $1,924,850.00 $2,277,787.50 2596 2596 2596 $688,500.00 $918,000.00 $918,000.00 2996 2896 2896 $353,060.50 $538,958.00 $637,780.50 $175,889.50 $467,892.00 $722,007.00 $382,750.00 $382,750.00 $29,812.50 $558,639.50 $850,642.00 $751,819.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,990,139.50 $2,282,142.00 $2,183,319.50 Scenario: Optimistid 30 It/barrel 2004 months 1-6 2004 months 7-12 18,000.00 $17.00 $306,000.00 2005 months 13-18 36,000.00 $17.00 $612,000.00 2005 months 19-24 54,000.00 $17.00 $918,000.00 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 72,000.00 72,000.00 72,000.00 $17.00 $17.00 $17.00 $1,224,000.00 $1,224,000.00 $1,224,000.00 2003 Concept/Year 0 Sales (liters) Sales Sale Price Entry Variable Production Costs Electricity Rent Fixed cost: Depreciation Wages Telephone Profit before taxes IEPS 95 IEPS Taxes ISR96 ISR Net profit Depreciation Cash Flow Rescue value Total cash flow $4,177,500.02 $60,000.00 $156,000.00 $191,375.00 $180,000.00 $30,000.00 $617,375.00 2596 $0.00 3196 $0.00 $617,375.00 $191,375.00 $426,000.00 $1,431,500.00 $1,005,500.00 $70,200.00 $60,000.00 $156,000.00 $191,375.00 $276,000.00 $30,000.00 -$477,575.00 2596 $76,500.00 3196 $0.00 -$554,075.00 $191,375.00 -$362,700.00 $1,431,500.00 $1,068,800.00 $140,400.00 $210,600.00 $280,800.00 $280,800.00 $280,800.00 $60,000.00 $60,000.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $156,000.00 $156,000.00 $191,375.00 $191,375.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $241,775.00 $5,975.00 $38,450.00 $38,450.00 $391,387.50 2596 2596 2596 2596 2596 $153,000.00 $229,500.00 $306,000.00 $306,000.00 $306,000.00 3096 3096 2996 2896 2896 $0.00 $0.00 $11,150.50 $10,766.00 $109,588.50 $394,775.00 -$235,475.00 -$278,700.50 -$278,316.00 -$24,201.00 $191,375.00 $191,375.00 $382,750.00 $382,750.00 $29,812.50 $203,400.000 -$44,100.00 $104,049.50 $104,434.00 $5,611.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,228,100.00 $1,387,400.00 $1,535,549.50 $1,535,934.00 $1,437,111.50 Scenario: Realistic 30 lt/barrel 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 360,000.00 450,000.00 450,000.00 $17.00 $17.00 $17.00 $6,120,000.00 $7,650,000.00 $7,650,000.00 2003 2004 2004 2005 2005 Concept/Year 0 months 1-6 months 7-12 months 13-18 months 19-24 Sales (liters) 54,000.00 108,000.00 216,000.00 Sales Sale Pricel $17.00 $17.00 $17.00 Entry $918,000.00 $1,836,000.00 $3,672,000.00 Variable Production Costs $210,600.00 $421,200.00 $842,400.00 Electricity $60,000.00 $60,000.00 $60,000.00 $60,000.00 Rent $156,000.00 $156,000.00 $156,000.00 $156,000.00 Fixed costs Depreciation $191,375.00 $191,375.00 $191,375.00 $191,375.00 Wages $180,000.00 $276,000.00 $276,000.00 $276,000.00 Telephone $30,000.00 $30,000.00 $30,000.00 $30,000.00 Profit before taxes $617,375.00 $5,975.00 $701,425.00 $2,116,225.00 IEPS 96 2596 2596 2596 2596 IEPS $0.00 Taxes $229,500.00 $459,000.00 $918,000.00 ISR96 3196 3196 3096 3096 ISR $0.00 $0.00 $210,427.50 $634,867.50 Net profit $617,375.00 -$235,475.00 $31,997.50 $563,357.50 Depreciation $191,375.00 $191,375.00 $191,375.00 $191,375.00 Cash Flow $426,000.00 $44,100.00 $223,372.50 $754,732.50 Rescue value $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 Total cash flow $4,177,500.02 $1,005,500.00 $1,387,400.00 $1,654,872.50 $2,186,232.50 $1,404,000.00 $1,755,000.00 $1,755,000.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $3,811,250.00 $4,990,250.00 $5,343,187.50 2596 2596 2596 $1,530,000.00 $1,912,500.00 $1,912,500.00 2996 2896 2896 $1,105,262.50 $1,397,270.00 $1,496,092.50 $1,175,987.50 $1,680,480.00 $1,934,595.00 $382,750.00 $382,750.00 $29,812.50 $1,558,737.50 $2,063,230.00 $1,964,407.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $2,990,237.50 $3,494,730.00 $3,395,907.50 MARR 896 Promised rate for paying investors' debt. Scenario Net Present Value IRR Internal Rate of retur Pemistic $2,516,036.92 2296 0.602 Expected $4,190,697.88 2996 1.003 Optimistic $7,082,485.18 3896 1.695 Scenario: Expected 30 It/barrel 2004 months 1-6 2004 months 7-12 36,000.00 $17.00 $612,000.00 2005 monthss 13-18 54,000.00 $17.00 $918,000.00 2005 months 19-24 108,000.00 $17.00 $1,836,000.00 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 162,000.00 216,000.00 216,000.00 $17.00 $17.00 $17.00 $2,754,000.00 $3,672,000.00 $3,672,000.00 2003 Concept/Year 0 Sales (liters) Sales Sale Price Entry Variable Production Costs Electricity #SPILL! Rent Fixed cost: Depreciation Wages Telephone Profit before taxes IEPS 96 IEPS Taxes ISR96 ISR Net profit Depreciation Cash Flow Rescue value Total cash flow $4,177,500.02 $60,000.00 $156,000.00 $191,375.00 $180,000.00 $30,000.00 $617,375.00 2596 $0.00 3196 $0.00 $617,375.00 $191,375.00 $426,000.00 $1,431,500.00 $1,005,500.00 $140,400.00 $210,600.00 $421,200.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $191,375.00 $191,375.00 $191,375.00 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $241,775.00 $5,975.00 $701,425.00 2596 2596 2596 $153,000.00 $229,500.00 $459,000.00 3196 3096 3096 $0.00 $0.00 $210,427.50 $394,775.00 -$235,475.00 $31,997.50 $191,375.00 $191,375.00 $191,375.00 $203,400.00 -$44,100.00 $223,372.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,228,100.00 $1,387,400.00 $1,654,872.50 $631,800.00 $842,400.00 $842,400.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $1,217,450.00 $1,924,850.00 $2,277,787.50 2596 2596 2596 $688,500.00 $918,000.00 $918,000.00 2996 2896 2896 $353,060.50 $538,958.00 $637,780.50 $175,889.50 $467,892.00 $722,007.00 $382,750.00 $382,750.00 $29,812.50 $558,639.50 $850,642.00 $751,819.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,990,139.50 $2,282,142.00 $2,183,319.50 Scenario: Optimistid 30 It/barrel 2004 months 1-6 2004 months 7-12 18,000.00 $17.00 $306,000.00 2005 months 13-18 36,000.00 $17.00 $612,000.00 2005 months 19-24 54,000.00 $17.00 $918,000.00 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 72,000.00 72,000.00 72,000.00 $17.00 $17.00 $17.00 $1,224,000.00 $1,224,000.00 $1,224,000.00 2003 Concept/Year 0 Sales (liters) Sales Sale Price Entry Variable Production Costs Electricity Rent Fixed cost: Depreciation Wages Telephone Profit before taxes IEPS 95 IEPS Taxes ISR96 ISR Net profit Depreciation Cash Flow Rescue value Total cash flow $4,177,500.02 $60,000.00 $156,000.00 $191,375.00 $180,000.00 $30,000.00 $617,375.00 2596 $0.00 3196 $0.00 $617,375.00 $191,375.00 $426,000.00 $1,431,500.00 $1,005,500.00 $70,200.00 $60,000.00 $156,000.00 $191,375.00 $276,000.00 $30,000.00 -$477,575.00 2596 $76,500.00 3196 $0.00 -$554,075.00 $191,375.00 -$362,700.00 $1,431,500.00 $1,068,800.00 $140,400.00 $210,600.00 $280,800.00 $280,800.00 $280,800.00 $60,000.00 $60,000.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $156,000.00 $156,000.00 $191,375.00 $191,375.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $241,775.00 $5,975.00 $38,450.00 $38,450.00 $391,387.50 2596 2596 2596 2596 2596 $153,000.00 $229,500.00 $306,000.00 $306,000.00 $306,000.00 3096 3096 2996 2896 2896 $0.00 $0.00 $11,150.50 $10,766.00 $109,588.50 $394,775.00 -$235,475.00 -$278,700.50 -$278,316.00 -$24,201.00 $191,375.00 $191,375.00 $382,750.00 $382,750.00 $29,812.50 $203,400.000 -$44,100.00 $104,049.50 $104,434.00 $5,611.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,228,100.00 $1,387,400.00 $1,535,549.50 $1,535,934.00 $1,437,111.50 Scenario: Realistic 30 lt/barrel 2006 2007 2008 y 2009 months 25-36 months 37-49 months 49-72 360,000.00 450,000.00 450,000.00 $17.00 $17.00 $17.00 $6,120,000.00 $7,650,000.00 $7,650,000.00 2003 2004 2004 2005 2005 Concept/Year 0 months 1-6 months 7-12 months 13-18 months 19-24 Sales (liters) 54,000.00 108,000.00 216,000.00 Sales Sale Pricel $17.00 $17.00 $17.00 Entry $918,000.00 $1,836,000.00 $3,672,000.00 Variable Production Costs $210,600.00 $421,200.00 $842,400.00 Electricity $60,000.00 $60,000.00 $60,000.00 $60,000.00 Rent $156,000.00 $156,000.00 $156,000.00 $156,000.00 Fixed costs Depreciation $191,375.00 $191,375.00 $191,375.00 $191,375.00 Wages $180,000.00 $276,000.00 $276,000.00 $276,000.00 Telephone $30,000.00 $30,000.00 $30,000.00 $30,000.00 Profit before taxes $617,375.00 $5,975.00 $701,425.00 $2,116,225.00 IEPS 96 2596 2596 2596 2596 IEPS $0.00 Taxes $229,500.00 $459,000.00 $918,000.00 ISR96 3196 3196 3096 3096 ISR $0.00 $0.00 $210,427.50 $634,867.50 Net profit $617,375.00 -$235,475.00 $31,997.50 $563,357.50 Depreciation $191,375.00 $191,375.00 $191,375.00 $191,375.00 Cash Flow $426,000.00 $44,100.00 $223,372.50 $754,732.50 Rescue value $1,431,500.00 $1,431,500.00 $1,431,500.00 $1,431,500.00 Total cash flow $4,177,500.02 $1,005,500.00 $1,387,400.00 $1,654,872.50 $2,186,232.50 $1,404,000.00 $1,755,000.00 $1,755,000.00 $60,000.00 $60,000.00 $60,000.00 $156,000.00 $156,000.00 $156,000.00 $382,750.00 $382,750.00 $29,812.50 $276,000.00 $276,000.00 $276,000.00 $30,000.00 $30,000.00 $30,000.00 $3,811,250.00 $4,990,250.00 $5,343,187.50 2596 2596 2596 $1,530,000.00 $1,912,500.00 $1,912,500.00 2996 2896 2896 $1,105,262.50 $1,397,270.00 $1,496,092.50 $1,175,987.50 $1,680,480.00 $1,934,595.00 $382,750.00 $382,750.00 $29,812.50 $1,558,737.50 $2,063,230.00 $1,964,407.50 $1,431,500.00 $1,431,500.00 $1,431,500.00 $2,990,237.50 $3,494,730.00 $3,395,907.50 MARR 896 Promised rate for paying investors' debt. Scenario Net Present Value IRR Internal Rate of retur Pemistic $2,516,036.92 2296 0.602 Expected $4,190,697.88 2996 1.003 Optimistic $7,082,485.18 3896 1.695