Answered step by step

Verified Expert Solution

Question

1 Approved Answer

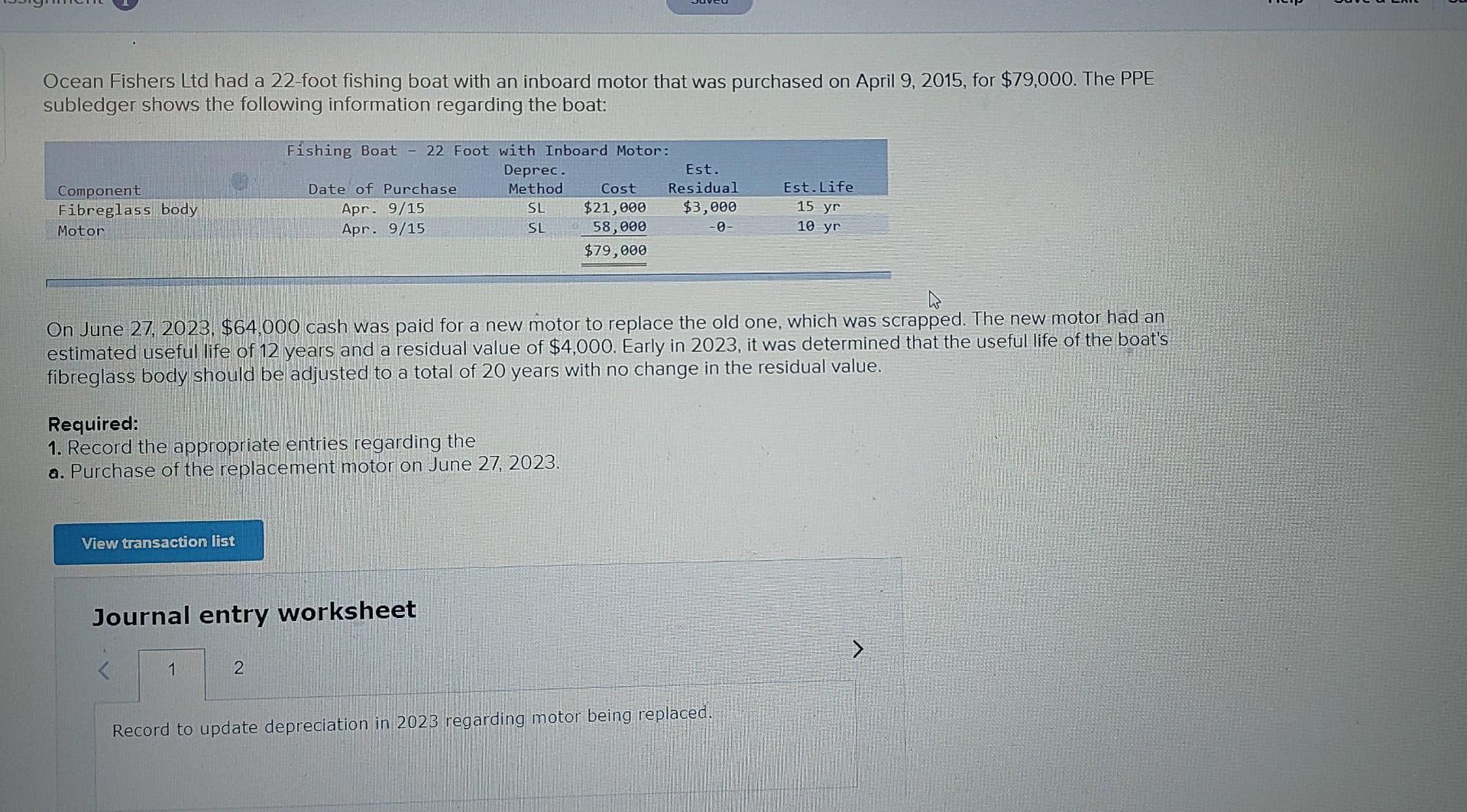

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $79,000. The PPE subledger shows

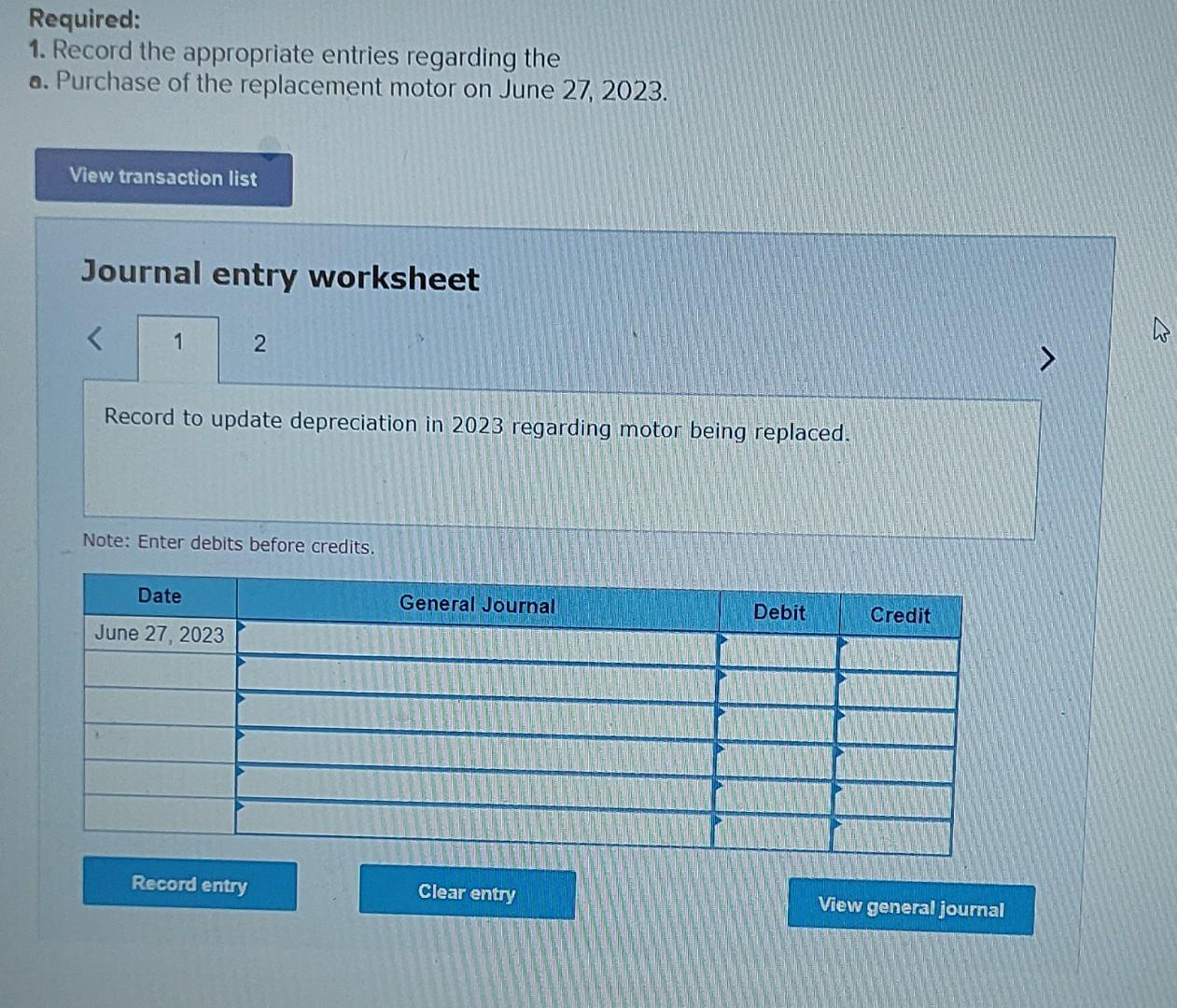

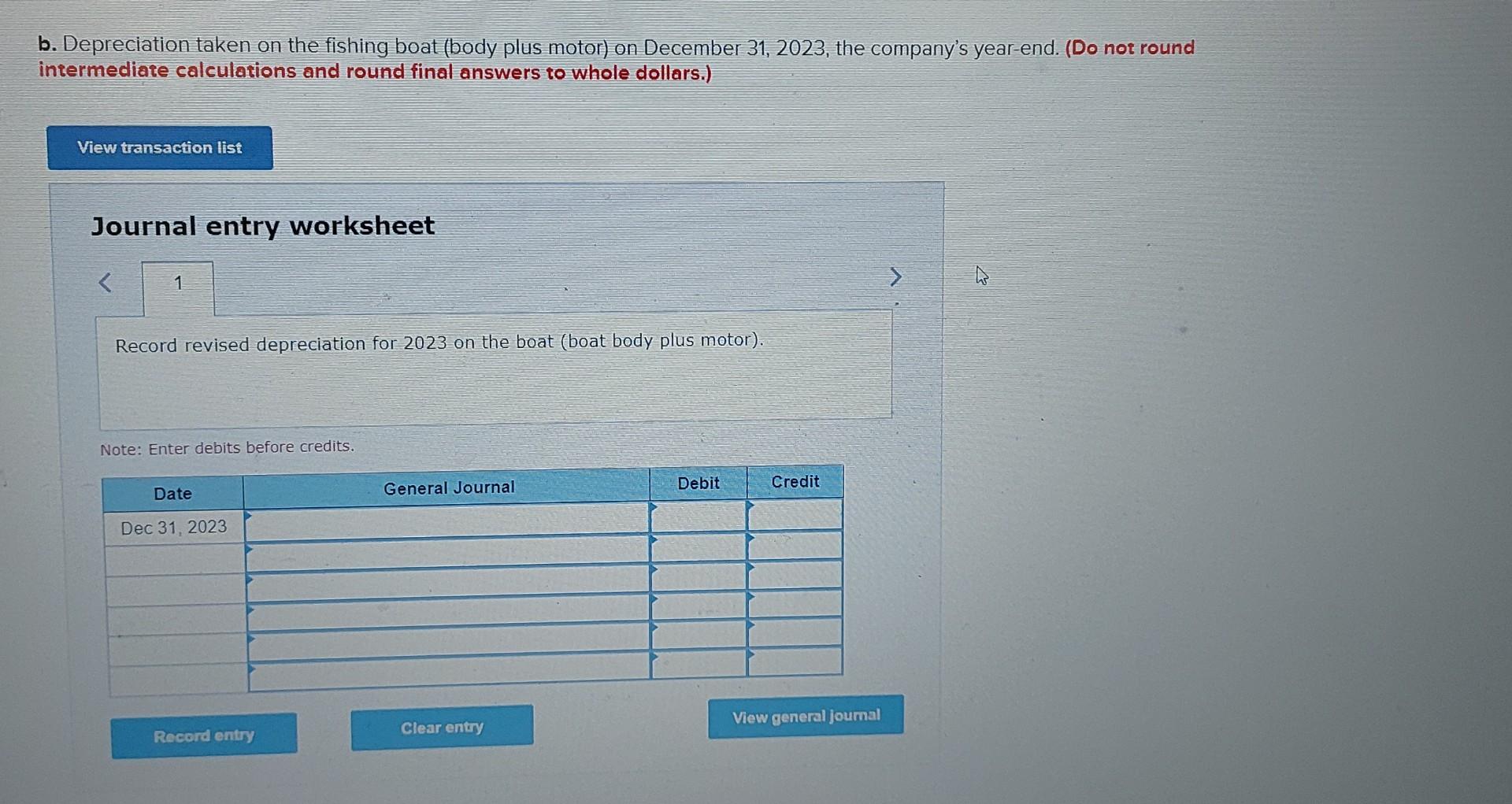

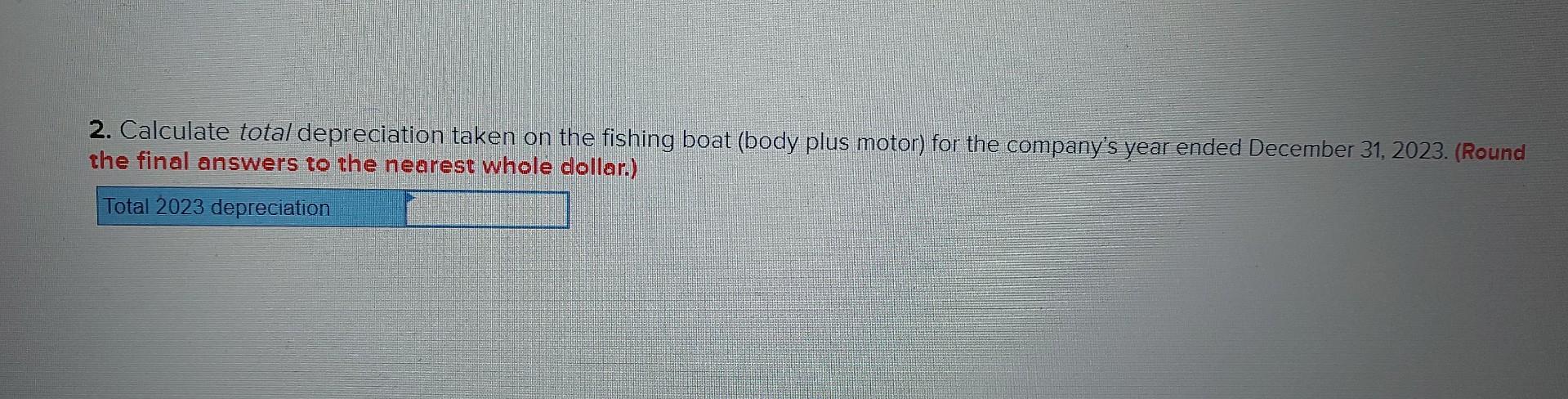

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $79,000. The PPE subledger shows the following information regarding the boat: On June 27, 2023, \$64,000 cash was paid for a new motor to replace the old one, which was scrapped. The new motor had an estimated useful life of 12 years and a residual value of $4,000. Early in 2023 , it was determined that the useful life of the boat's fibreglass body should be adjusted to a total of 20 years with no change in the residual value. Required: 1. Record the appropriate entries regarding the a. Purchase of the replacement motor on June 27,2023. Journal entry worksheet Record to update depreciation in 2023 regarding motor being replaced. Required: 1. Record the appropriate entries regarding the a. Purchase of the replacement motor on June 27, 2023. Journal entry worksheet Record to update depreciation in 2023 regarding motor being replaced. Note: Enter debits before credits. b. Depreciation taken on the fishing boat (body plus motor) on December 31,2023 , the company's year-end. (Do not round intermediate calculations and round final answers to whole dollars.) Journal entry worksheet Record revised depreciation for 2023 on the boat (boat body plus motor). Note: Enter debits before credits. 2. Calculate total depreciation taken on the fishing boat (body plus motor) for the company's year ended December 31,2023 . (Round the final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started