Answered step by step

Verified Expert Solution

Question

1 Approved Answer

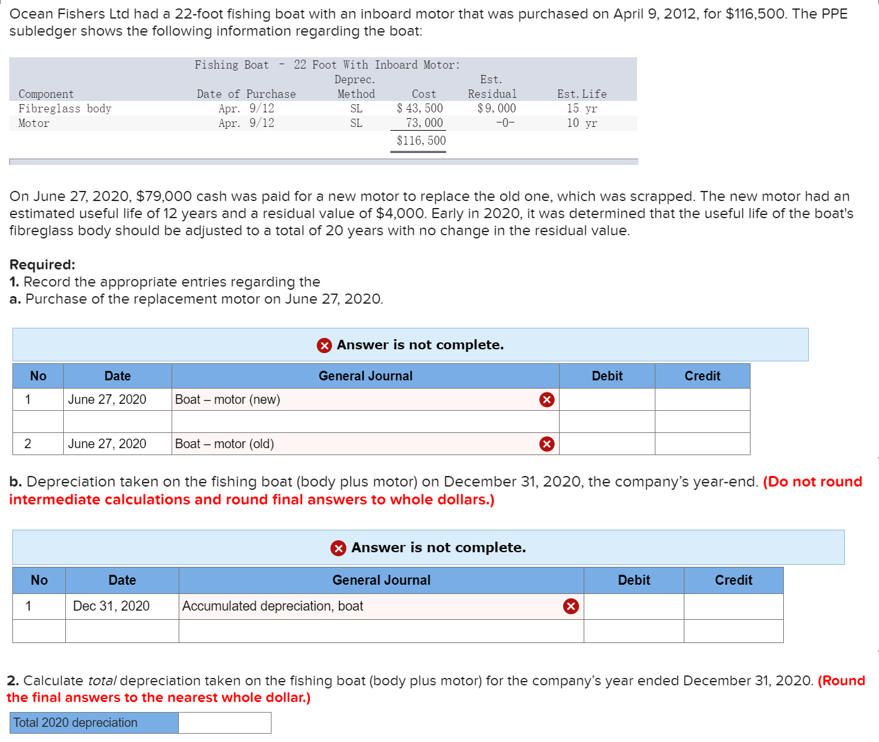

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2012, for $116,500. The PPE subledger

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2012, for $116,500. The PPE subledger shows the following information regarding the boat: Fishing Boat 22 Foot With Inboard Motor: Component Fibreglass body Motor Date of Purchase Deprec. Method Apr. 9/12 SL Apr. 9/12 SL Cost $ 43,500 73,000 $116,500 Est. Residual $9,000 -0- Est. Life 15 yr 10 On June 27, 2020, $79,000 cash was paid for a new motor to replace the old one, which was scrapped. The new motor had an estimated useful life of 12 years and a residual value of $4,000. Early in 2020, it was determined that the useful life of the boat's fibreglass body should be adjusted to a total of 20 years with no change in the residual value. Required: 1. Record the appropriate entries regarding the a. Purchase of the replacement motor on June 27, 2020. Answer is not complete. No 1 Date June 27, 2020 General Journal Debit Credit Boat - motor (new) 2 June 27, 2020 Boat - motor (old) b. Depreciation taken on the fishing boat (body plus motor) on December 31, 2020, the company's year-end. (Do not round intermediate calculations and round final answers to whole dollars.) No 1 Date Dec 31, 2020 Answer is not complete. General Journal Debit Credit Accumulated depreciation, boat 2. Calculate total depreciation taken on the fishing boat (body plus motor) for the company's year ended December 31, 2020. (Round the final answers to the nearest whole dollar.) Total 2020 depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started