Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Inc. produces a machine that washes and dries your laundry in a single, compact unit that doesn't require existing washer/dryer hookups or venting.

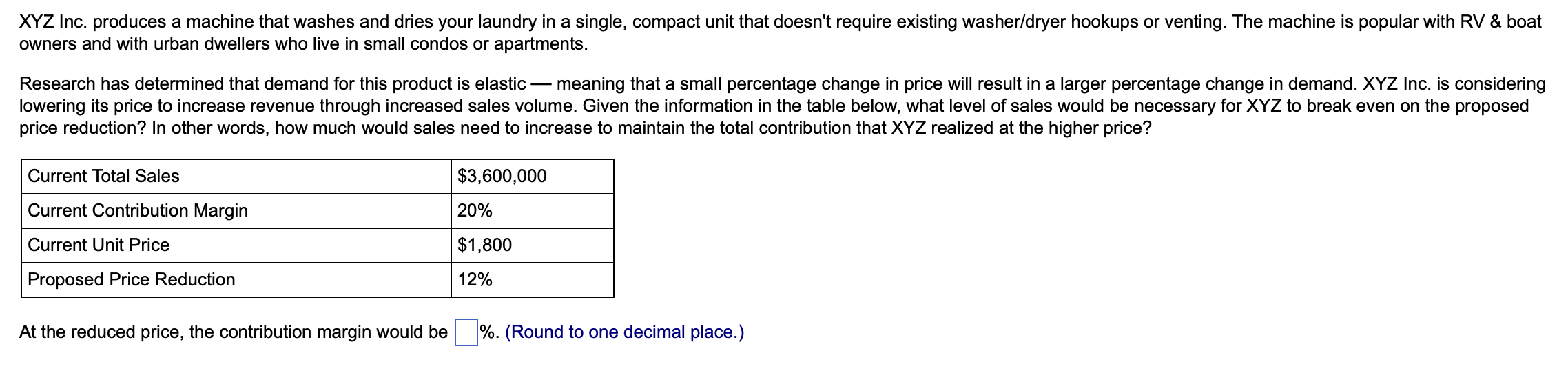

XYZ Inc. produces a machine that washes and dries your laundry in a single, compact unit that doesn't require existing washer/dryer hookups or venting. The machine is popular with RV & boat owners and with urban dwellers who live in small condos or apartments. Research has determined that demand for this product is elastic - meaning that a small percentage change in price will result in a larger percentage change in demand. XYZ Inc. is considering lowering its price to increase revenue through increased sales volume. Given the information in the table below, what level of sales would be necessary for XYZ to break even on the proposed price reduction? In other words, how much would sales need to increase to maintain the total contribution that XYZ realized at the higher price? Current Total Sales Current Contribution Margin $3,600,000 20% Current Unit Price $1,800 Proposed Price Reduction 12% At the reduced price, the contribution margin would be %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BreakEven Sales for XYZ Inc with Price Reduction 1 Calculate the Current Contribution per Unit Contribution Margin Unit Price Contribution per Unit 20 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started