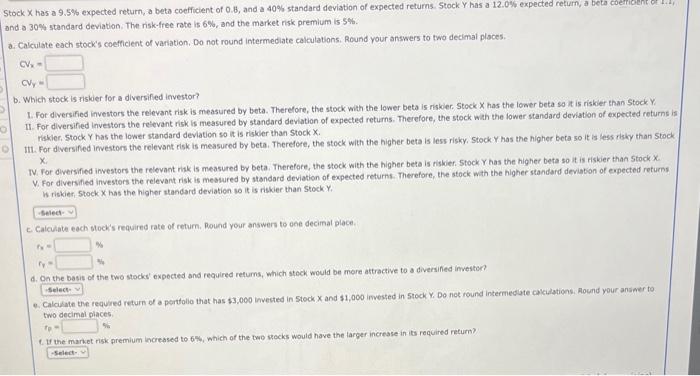

ock X has a 9.5% expected return, a beta coefficient of 0.8 , and a 40% standard deviation of expected returns. 5 tock Y has a 12.0% expected return, a beta coericent of ad a 30% standard deviation. The risk-free rate is 6%, and the market risk premium is $5. Calculate each stock's coefficient of variation. Do not round intermediate calculations. Round your answers to two decimal places. CV=CVy= b. Which stock is riskier for a diversified investor? 1. For diversified investors the relevant riak is measured by beta. Therefore, the stock with the lower beta is riskier. Stock X has the lower beta sa it is risker than Stock Y. 11. For diversified investors the reievant risk is measured by standard deviation of expected returns. Therefore, the stock wath the lower standard deviation of expected roturns riskler, Stock Y has the lower standard deviation so it is risker than Stock X. II. For diversified ievestors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky, Stock Y has the higher beta so it is less risky than Stoc N. For diversified investors the relevant riak is measured by beta. Therefore, the stock with the higher beta is riskier. Stock Y has the higher beta so it is fiskier than Stock X. X V. For diversifed investors the relevant risk is meawured by standard deviation of expected returns. Therefore, the stock with the higher standard deviabon of expected returns W riskier, 5tock X has the higher standard deviation so it is riskier than stock Y. c. Calculate each stock's required rate of return. Round your answers to one decimal place. d. Qn the basis of the two stocks' expected and required retums, which stock would be more attractive to a diversifed imvestor? e. Calcilate the required return of a pertolio that has $3,000 invected in 5 tock X and $1,000 invested in 5 tock Y. Do not round intermediate cakidations. Alound your ansier to two decimal piaces: 1. If the market risk premium increased to 6%, which of the two kecks would have the larger increase in its required return