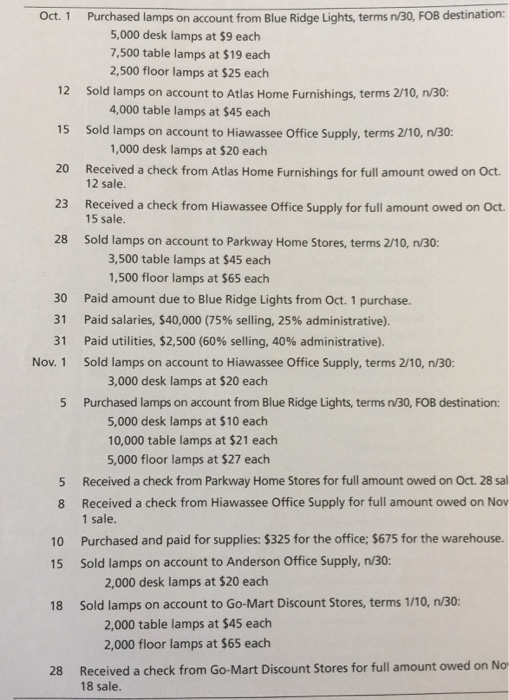

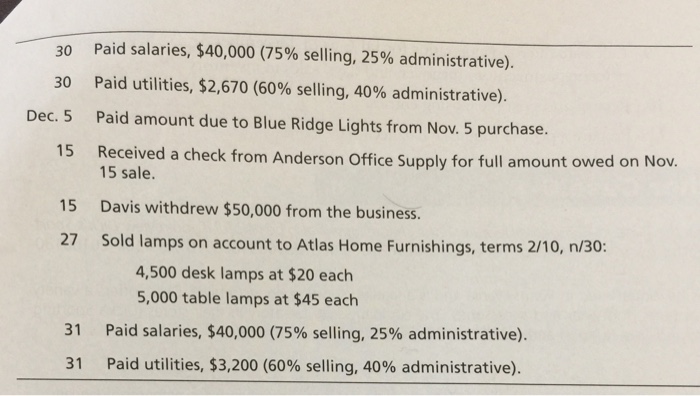

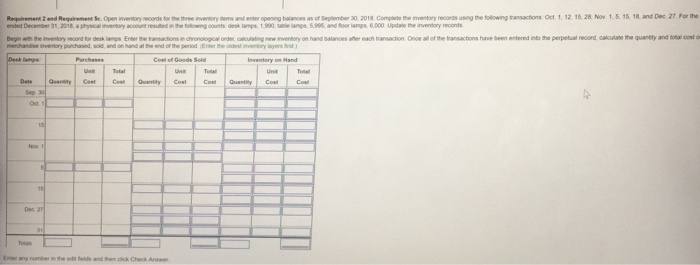

Oct. 1 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $9 each 7,500 table lamps at $19 each 2,500 floor lamps at $25 each 12 Sold lamps on account to Atlas Home Furnishings, terms 2/10, n/30: 15 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 20 Received a check from Atlas Home Furnishings for full amount owed on Oct. 23 Received a check from Hiawassee Office Supply for full amount owed on Oct. 28 Sold lamps on account to Parkway Home Stores, terms 2/10, n/30: 4,000 table lamps at $45 each 1,000 desk lamps at $20 each 12 sale 15 sale 3,500 table lamps at $45 each 1,500 floor lamps at $65 each Paid amount due to Blue Ridge Lights from Oct. 1 purchase. Paid salaries, $40,000 (75% selling, 25% administrative). Paid utilities, $2,500 (60% selling, 40% administrative). 30 31 Nov. 1 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 3,000 desk lamps at $20 each 5 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $10 each 10,000 table lamps at $21 each 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount owed on Oct. 28 sal 8 Received a check from Hiawassee Office Supply for full amount owed on Nov 1 sale. Purchased and paid for supplies: $325 for the office: $675 for the warehouse. Sold lamps on account to Anderson Office Supply, n/30: 10 15 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10, n/30 2,000 table lamps at $45 each 2,000 floor lamps at $65 each Received a check from Go-Mart Discount Stores for full amount owed on No 18 sale. 28 Oct. 1 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $9 each 7,500 table lamps at $19 each 2,500 floor lamps at $25 each 12 Sold lamps on account to Atlas Home Furnishings, terms 2/10, n/30: 15 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 20 Received a check from Atlas Home Furnishings for full amount owed on Oct. 23 Received a check from Hiawassee Office Supply for full amount owed on Oct. 28 Sold lamps on account to Parkway Home Stores, terms 2/10, n/30: 4,000 table lamps at $45 each 1,000 desk lamps at $20 each 12 sale 15 sale 3,500 table lamps at $45 each 1,500 floor lamps at $65 each Paid amount due to Blue Ridge Lights from Oct. 1 purchase. Paid salaries, $40,000 (75% selling, 25% administrative). Paid utilities, $2,500 (60% selling, 40% administrative). 30 31 Nov. 1 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 3,000 desk lamps at $20 each 5 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $10 each 10,000 table lamps at $21 each 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount owed on Oct. 28 sal 8 Received a check from Hiawassee Office Supply for full amount owed on Nov 1 sale. Purchased and paid for supplies: $325 for the office: $675 for the warehouse. Sold lamps on account to Anderson Office Supply, n/30: 10 15 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10, n/30 2,000 table lamps at $45 each 2,000 floor lamps at $65 each Received a check from Go-Mart Discount Stores for full amount owed on No 18 sale. 28