Answered step by step

Verified Expert Solution

Question

1 Approved Answer

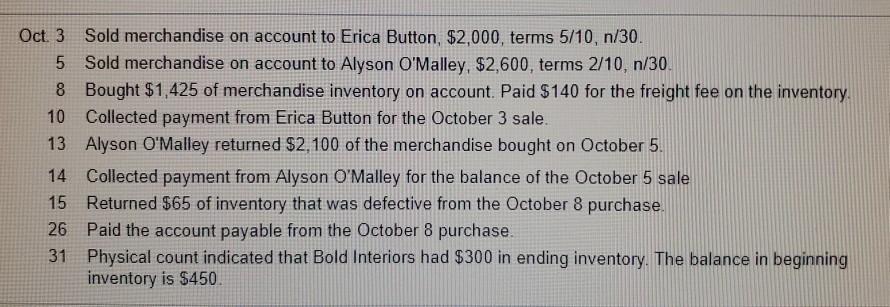

Oct 3 Sold merchandise on account to Erica Button, $2,000, terms 5/10, n/30. 5 Sold merchandise on account to Alyson O'Malley, $2,600, terms 2/10, n/30.

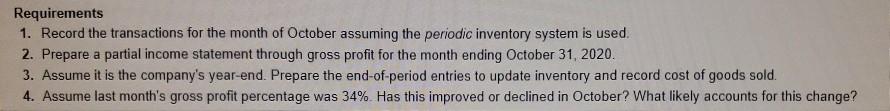

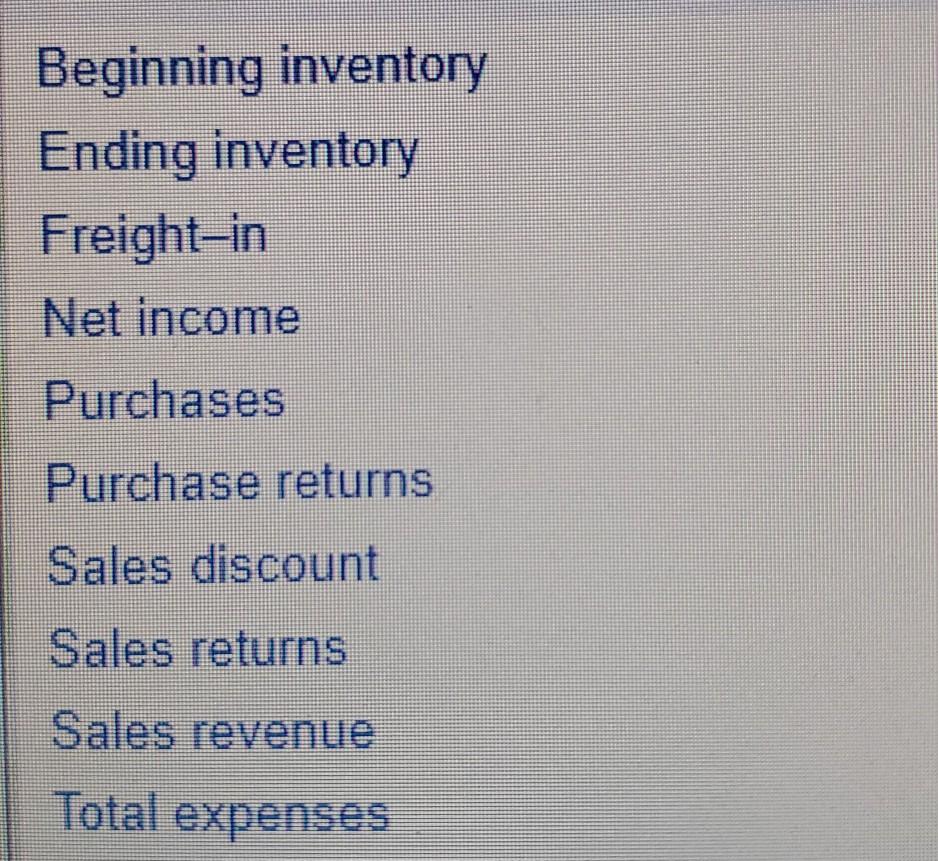

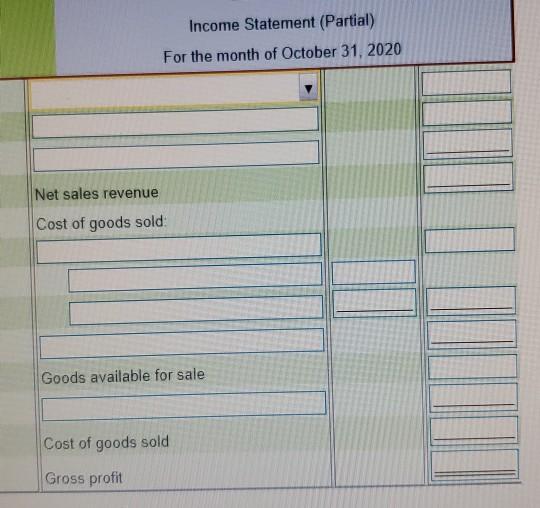

Oct 3 Sold merchandise on account to Erica Button, $2,000, terms 5/10, n/30. 5 Sold merchandise on account to Alyson O'Malley, $2,600, terms 2/10, n/30. 8 Bought $1,425 of merchandise inventory on account. Paid $140 for the freight fee on the inventory 10 Collected payment from Erica Button for the October 3 sale. 13 Alyson O'Malley returned $2,100 of the merchandise bought on October 5. 14 Collected payment from Alyson O'Malley for the balance of the October 5 sale 15 Returned $65 of inventory that was defective from the October 8 purchase 26 Paid the account payable from the October 8 purchase. 31 Physical count indicated that Bold Interiors had $300 in ending inventory. The balance in beginning inventory is $450 Requirements 1. Record the transactions for the month of October assuming the periodic inventory system is used. 2. Prepare a partial income statement through gross profit for the month ending October 31, 2020. 3. Assume it is the company's year-end. Prepare the end-of-period entries to update inventory and record cost of goods sold. 4. Assume last month's gross profit percentage was 34% Has this improved or declined in October? What likely accounts for this change? Beginning inventory Ending inventory Freight-in Net income Purchases Purchase returns Sales discount Sales returns Sales revenue Total expenses Income Statement (Partial) For the month of October 31, 2020 Net sales revenue Cost of goods sold Goods available for sale Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started