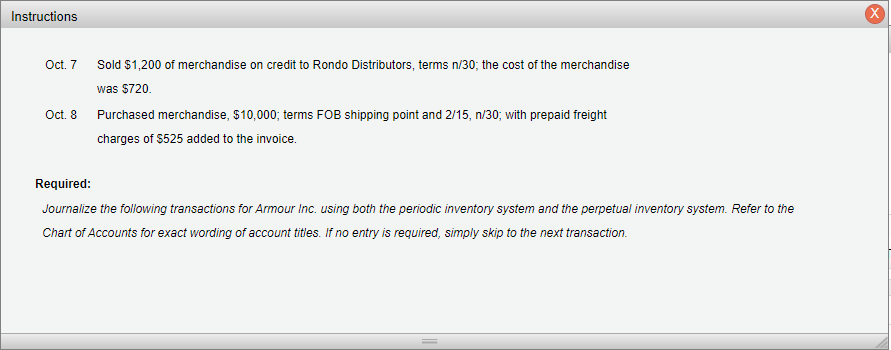

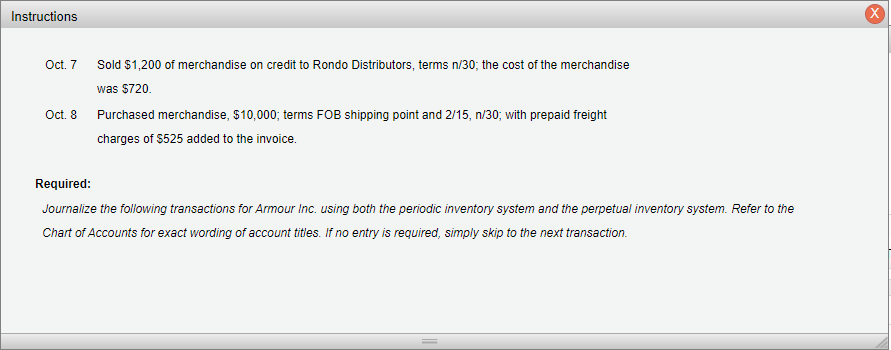

| Oct. 7 | Sold $1,200 of merchandise on credit to Rondo Distributors, terms n/30; the cost of the merchandise was $720. |

| Oct. 8 | Purchased merchandise, $10,000; terms FOB shipping point and 2/15, n/30; with prepaid freight charges of $525 added to the invoice. |

Required:

| | Journalize the following transactions for Armour Inc. using both the periodic inventory system and the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. If no entry is required, simply skip to the next transaction. |

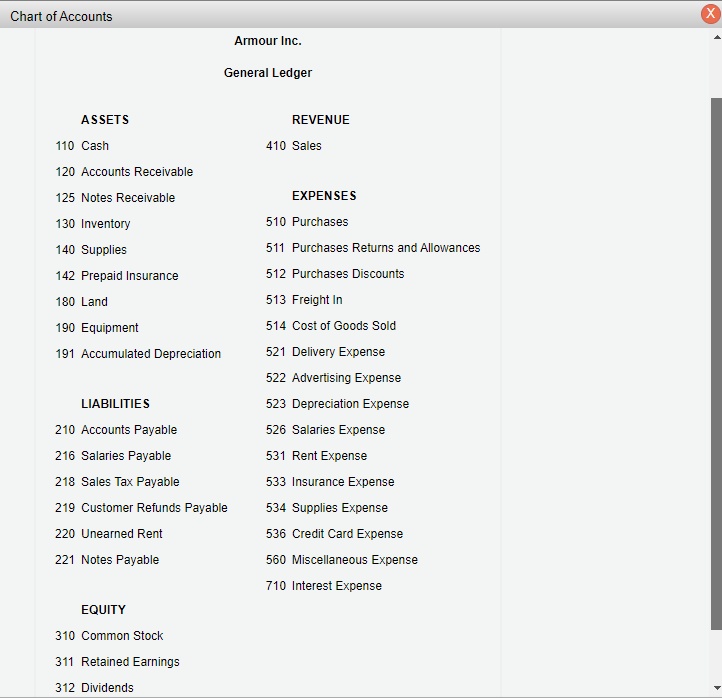

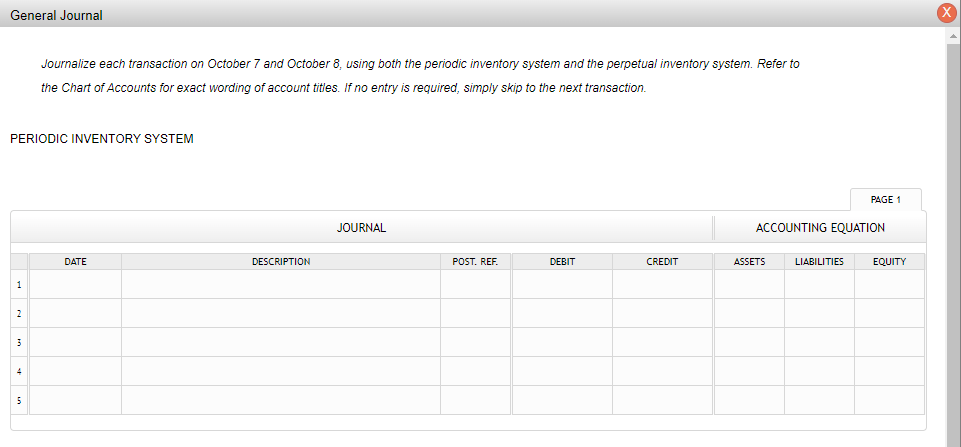

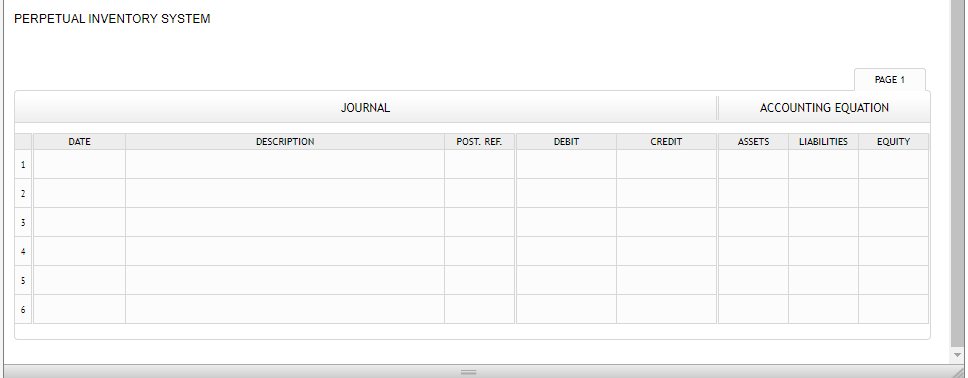

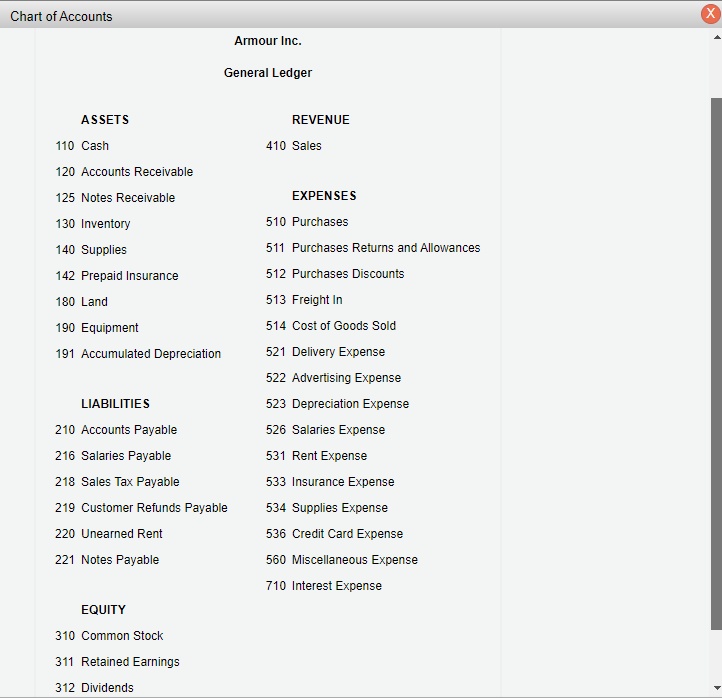

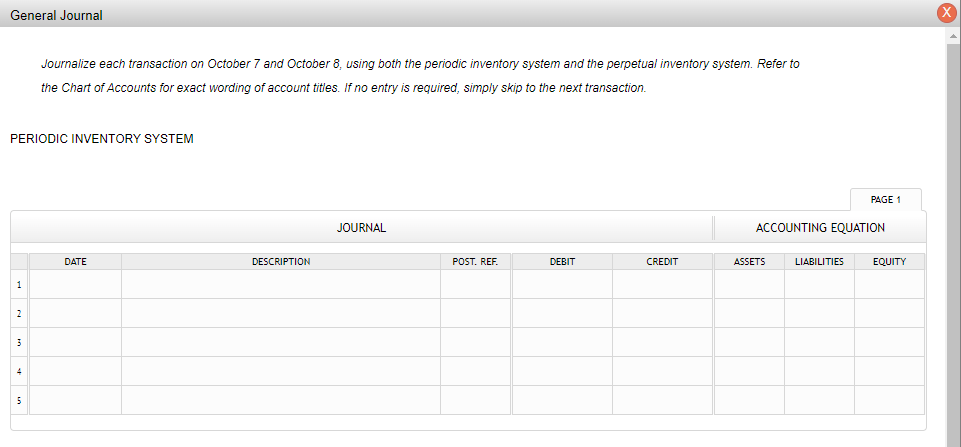

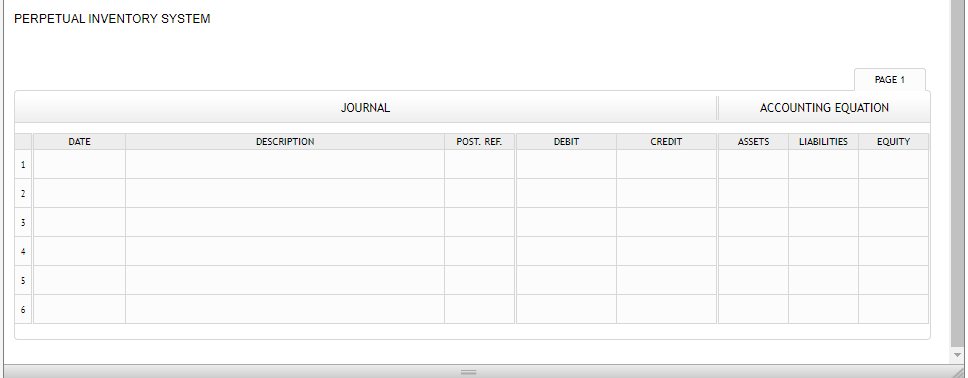

Chart of Accounts Armour Inc. General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable REVENUE 410 Sales EXPENSES 510 Purchases 511 Purchases Returns and Allowances 512 Purchases Discounts 513 Freight In 514 Cost of Goods Sold 521 Delivery Expense 522 Advertising Expense 523 Depreciation Expense 526 Salaries Expense 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 536 Credit Card Expense 560 Miscellaneous Expense 710 Interest Expense EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Oct. 7 Sold $1,200 of merchandise on credit to Rondo Distributors, terms n/30; the cost of the merchandise was $720. Oct. 8 Purchased merchandise, $10,000; terms FOB shipping point and 2/15,n/30; with prepaid freight charges of $525 added to the invoice. Required: Journalize the following transactions for Armour Inc. using both the periodic inventory system and the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. If no entry is required, simply skip to the next transaction. Journalize each transaction on October 7 and October 8 , using both the periodic inventory system and the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. If no entry is required, simply skip to the next transaction. PERIODIC INVENTORY SYSTEM PERPETUAL INVENTORY SYSTEM Chart of Accounts Armour Inc. General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable REVENUE 410 Sales EXPENSES 510 Purchases 511 Purchases Returns and Allowances 512 Purchases Discounts 513 Freight In 514 Cost of Goods Sold 521 Delivery Expense 522 Advertising Expense 523 Depreciation Expense 526 Salaries Expense 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 536 Credit Card Expense 560 Miscellaneous Expense 710 Interest Expense EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Oct. 7 Sold $1,200 of merchandise on credit to Rondo Distributors, terms n/30; the cost of the merchandise was $720. Oct. 8 Purchased merchandise, $10,000; terms FOB shipping point and 2/15,n/30; with prepaid freight charges of $525 added to the invoice. Required: Journalize the following transactions for Armour Inc. using both the periodic inventory system and the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. If no entry is required, simply skip to the next transaction