Answered step by step

Verified Expert Solution

Question

1 Approved Answer

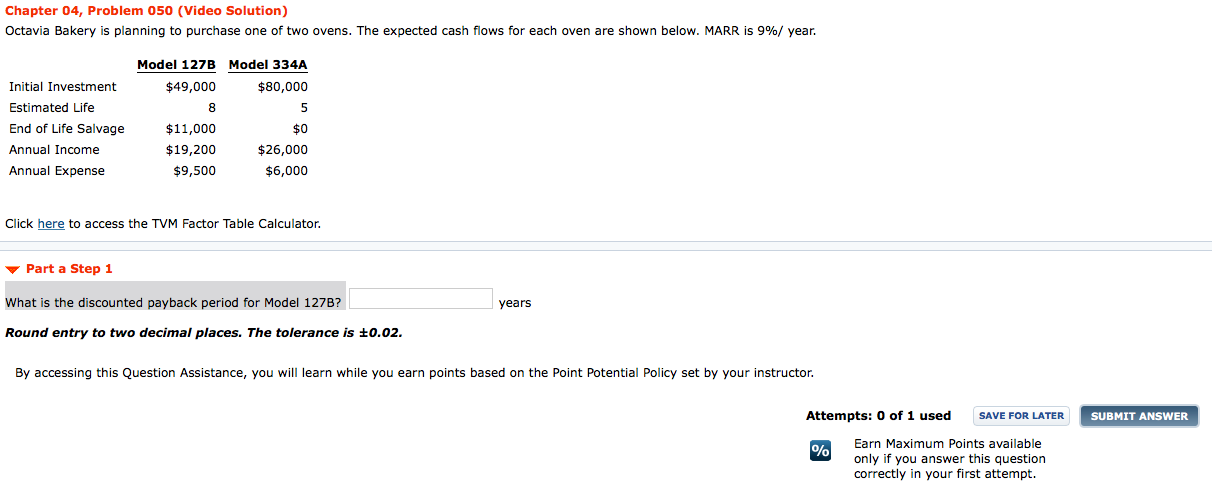

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year. What

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year. What is the discounted payback period for Model 127B and model 334A? (years)

Chapter 04, Problem 050 (Video Solution) Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year Model 127B Model 334A Initial Investment Estimated Life End of Life Salvage Annual Income Annual Expense $49,000 8 $11,000 $19,200 $9,500 $80,000 $0 $26,000 $6,000 Click here to access the TVM Factor Table Calculator Part a Step 1 What is the discounted payback period for Model 127B? Round entry to two decimal places. The tolerance is 0.02 years By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER Earn Maximum Points available only if you answer this question correctly in your first attempt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started