Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OCTOBER 2019: Getting ready for the upcoming holiday season is traditionally a busy time for greeting card companies, and it was no exception for Kate.

OCTOBER 2019:

Getting ready for the upcoming holiday season is traditionally a busy time for greeting card companies, and it was no exception for Kate. The following transactions occurred during the month of October:

- Hired an assistant at an hourly rate of $10 per hour to help with some of the computer layouts and administrative chores.

- Supplements her business by teaching a class to aspiring card designers. She charges and receives a total of $450.

- Delivers greeting cards to several new customers. She bills them a total of $3,500.

- Pays a utility bill in the amount of $250 that she determines is the business portion of her utility bill.

- Receives an advance deposit of $500 for a new set of cards she is designing for a new customer.

- Pays her assistant $200 for the work done this month.

- Determines that the assistant has worked 10 additional hours this month that have not yet been paid.

- Ordered and receives additional supplies in the amount of $1,000. These were paid for during the month.

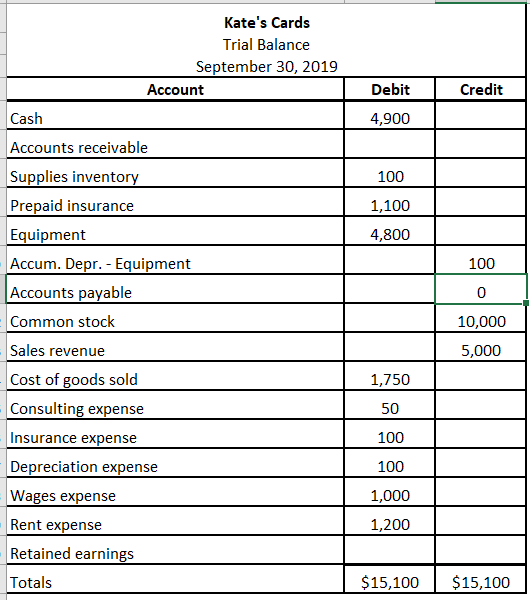

- Counts her remaining inventory of supplies at the end of the month and determines the balance to be $300. Dont forget to consider the supplies inventory balance at September 30, from Chapter 2. (Hint: This expense will be a debit to Cost of Goods Sold.)

- Records the adjusting entries for depreciation and insurance expense for the month.

- Pays herself a salary of $1,000.

- Paid monthly rent of $1,200 in cash.

- Receives her next utility bill during December and determines $85 applies to Octobers operations.

- Deciding she needs a little more cash, Kate pays herself a $100 dividend.

October Requirements:

- Journalize the above transactions and adjusting entries.

- Post the October transactions and adjusting entries. (Use the general ledger accounts prepared in September and add any new accounts that you may need.)

- Prepare a trial balance as of October 31, 2019.

- Prepare an income statement and a statement of stockholders equity for the two-month period ending October 31, 2019, and a balance sheet as of October 31, 2019.

- Prepare the closing entries as of October 31, 2019.

- Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started