Answered step by step

Verified Expert Solution

Question

1 Approved Answer

October 3 October 3 October 4 October 4 October 5 October 6 October 10 Create a journal entry for each of the transactions below

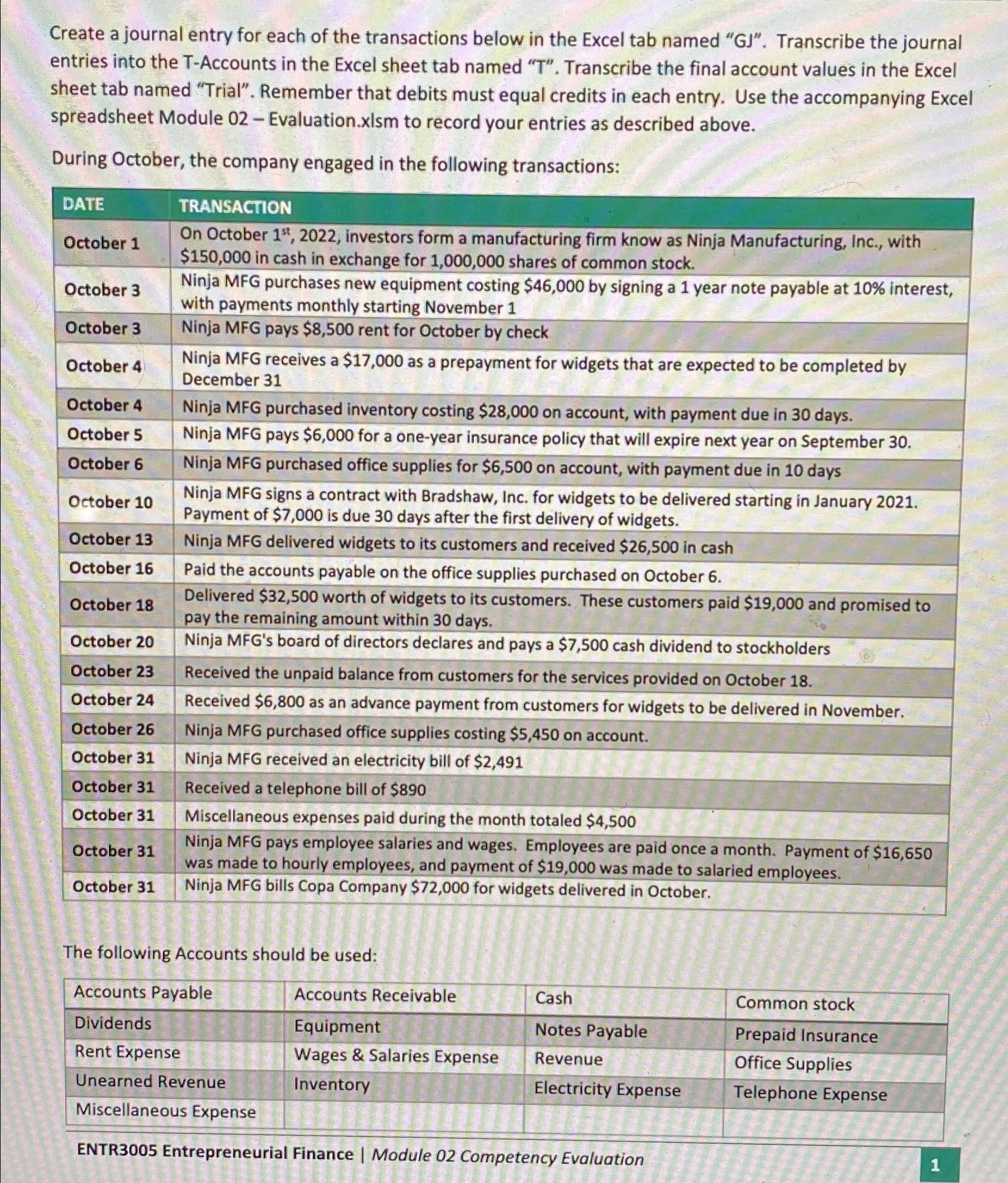

October 3 October 3 October 4 October 4 October 5 October 6 October 10 Create a journal entry for each of the transactions below in the Excel tab named "GJ". Transcribe the journal entries into the T-Accounts in the Excel sheet tab named "T". Transcribe the final account values in the Excel sheet tab named "Trial". Remember that debits must equal credits in each entry. Use the accompanying Excel spreadsheet Module 02 - Evaluation.xlsm to record your entries as described above. During October, the company engaged in the following transactions: DATE October 1 TRANSACTION On October 1st, 2022, investors form a manufacturing firm know as Ninja Manufacturing, Inc., with $150,000 in cash in exchange for 1,000,000 shares of common stock. Ninja MFG purchases new equipment costing $46,000 by signing a 1 year note payable at 10% interest, with payments monthly starting November 1 Ninja MFG pays $8,500 rent for October by check Ninja MFG receives a $17,000 as a prepayment for widgets that are expected to be completed by December 31 Ninja MFG purchased inventory costing $28,000 on account, with payment due in 30 days. Ninja MFG pays $6,000 for a one-year insurance policy that will expire next year on September 30. Ninja MFG purchased office supplies for $6,500 on account, with payment due in 10 days Ninja MFG signs a contract with Bradshaw, Inc. for widgets to be delivered starting in January 2021. Payment of $7,000 is due 30 days after the first delivery of widgets. October 13 October 16 Ninja MFG delivered widgets to its customers and received $26,500 in cash Paid the accounts payable on the office supplies purchased on October 6. October 18 October 20 October 23 October 24 October 26 October 31 October 31 October 31 October 31 October 31 Delivered $32,500 worth of widgets to its customers. These customers paid $19,000 and promised to pay the remaining amount within 30 days. Ninja MFG's board of directors declares and pays a $7,500 cash dividend to stockholders Received the unpaid balance from customers for the services provided on October 18. Received $6,800 as an advance payment from customers for widgets to be delivered in November. Ninja MFG purchased office supplies costing $5,450 on account. Ninja MFG received an electricity bill of $2,491 Received a telephone bill of $890 Miscellaneous expenses paid during the month totaled $4,500 Ninja MFG pays employee salaries and wages. Employees are paid once a month. Payment of $16,650 was made to hourly employees, and payment of $19,000 was made to salaried employees. Ninja MFG bills Copa Company $72,000 for widgets delivered in October. The following Accounts should be used: Accounts Payable Dividends Rent Expense Unearned Revenue Miscellaneous Expense Accounts Receivable Equipment Wages & Salaries Expense Inventory Cash Notes Payable Revenue Electricity Expense Common stock Prepaid Insurance Office Supplies Telephone Expense ENTR3005 Entrepreneurial Finance | Module 02 Competency Evaluation ance | Module

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started