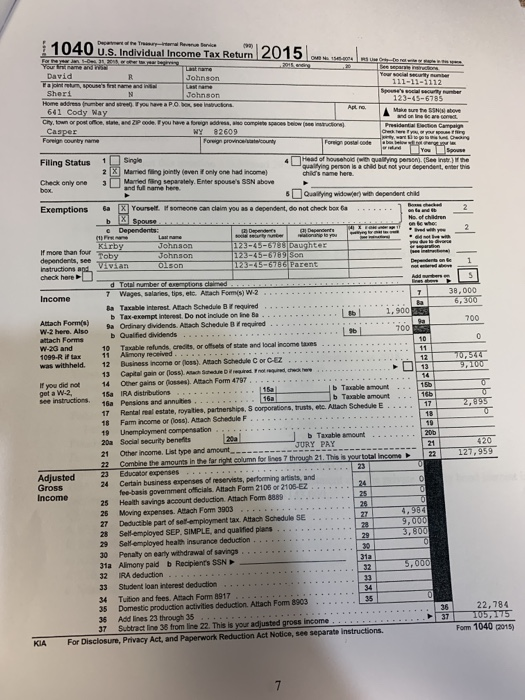

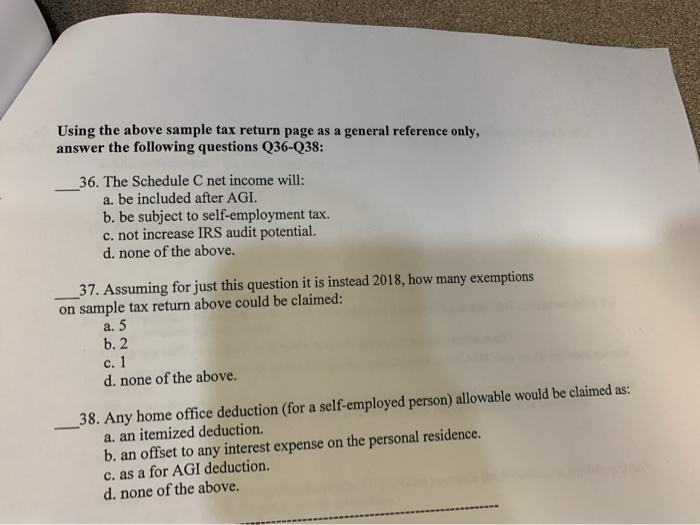

od 1040 U.S. Individual Income Tax Return 2015 David Johnson Johnson you malo borencions Home rrumber and 641 Cody Way Cry, town or pos s a Casper Foreign country and ZIP code you are a foreign dress, to compito WY 82609 e Bewe rtion) Filing Status Check only one Exemptions 1 Single Head of t h e gamen Bebe qualifying person is a child but not your dependent, enter this 2 x Married fling jointly even if only one had income Married in separately. Eller spouse's SSN above and M Name here 5 Qualifying widower with dependent child 6a X Yourself of someone can claim you as a dependent, do not check box .... b X Spouse Dependents: Lamane Krby Johnson 123-45-6700 Daughter Johnson 123-456789150 Vivian Olson 1123-45-678 6 Parent If more han fout Toby on 700 00 127.959 d Total number ons med .... Income 7 Wages, salaries, tips, etc. Anach Form W2... Ba Taxable interest. Attach Schedule B required...... Tax-exempt interest. Do not include on Ine Be.... 1.900 Attach Form(s) Sa Ordinary dividends. Anach Schedule W-2 here. Also required. - Qualified dividends attach Forms ..... W-23 and 10 Taxable refunds credits, or ots of state and local income taxes 1099-R ifta 11 Alimony received ..... ........ .... . 11 was withheld. 12 Business Income or loss). Attach Schedule CorCEZ .. 13 Capital gain or loss). A r e If you did not 14 Other gains or losses). Attach Form 4797.... get a W-2 15a IRA distributions ...... 15a_ see instructions. 16 Pensions and annuities ........... 160 Tale amount 17 Rental real estate, royalties, partnerships. S corporation, trusts, etc. Altach Schedule E 18 Farm income or oss). Attach Schedule F .............. 19 Unemployment compensation............ 20a Social security benefits 2011 Taxable amount 21 Other Income List type and amount_-_------ JURY PAY 22 Combine the amounts in the far right column for lines 7 through 21. This is you Adiusted 23 Educator expenses ............ .......... 24 Certain business expenses of reservists, performing artists, and fee-basis povernment officials. Attach Form 2106 or 2105-EZ Income 25 Health savings account deduction. Attach Form 8889 .. 25 Moving expenses. Attach Form 3003 .. . 4.982 27 Deductible part of self-employment tax. Attach Schedule SE 28 Self-employed SEP. SIMPLE, and qualified plans... 3,8001 29 Self-employed health insurance deduction ....... 30 Penalty on early withdrawal of savings ....... 31a Alimony paid b Recipient's SSN 5,000 32 RA deduction .. 33 Student loan interest deduction ....... 34 Tuition and foes. Anach Form 1917.... 35 Domestic production activities deduction. Altach Form 8903....... 36 Add lines 23 through 35 .. ...... 37 37 Subtract line 38 from line 22. This is your adjusted gross income ........ KIA For Disclosure Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Gross 9,000 .... 22,784 105, 175 Form 1040 (2015) Using the above sample tax return page as a general reference only, answer the following questions Q36-Q38: 36. The Schedule C net income will: a. be included after AGI. b. be subject to self-employment tax. c. not increase IRS audit potential. d. none of the above. 37. Assuming for just this question it is instead 2018, how many exemptions on sample tax return above could be claimed: a. 5 b.2 c. 1 d. none of the above. _38. Any home office deduction (for a self-employed person) allowable would be claimed as: a. an itemized deduction. b. an offset to any interest expense on the personal residence. c. as a for AGI deduction. d. none of the above