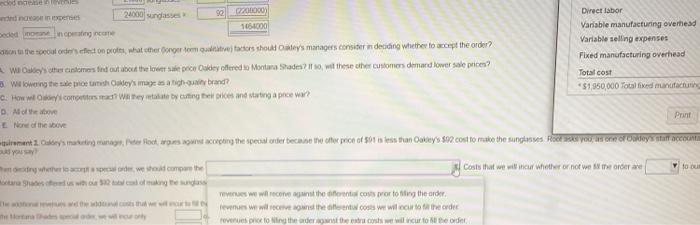

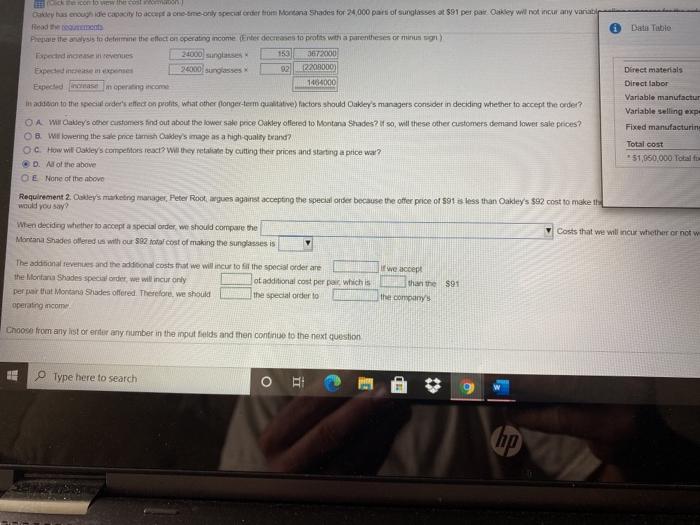

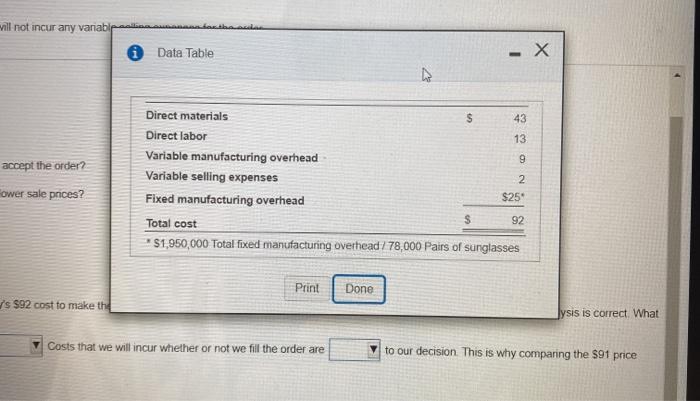

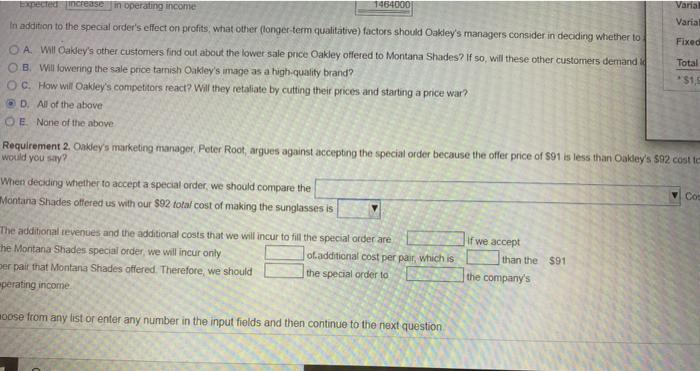

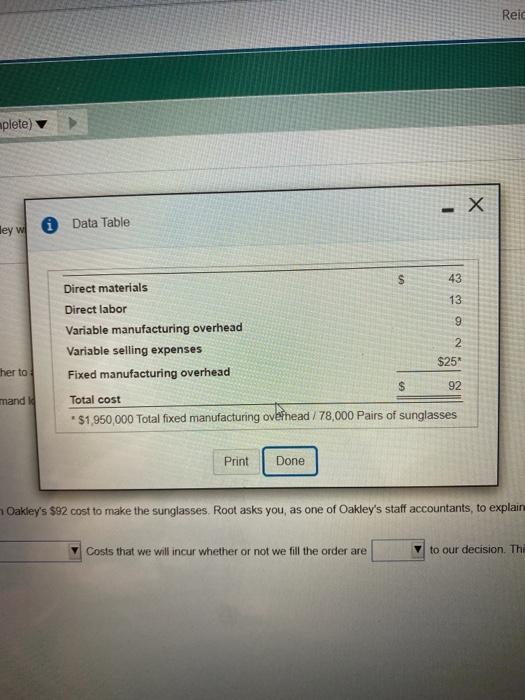

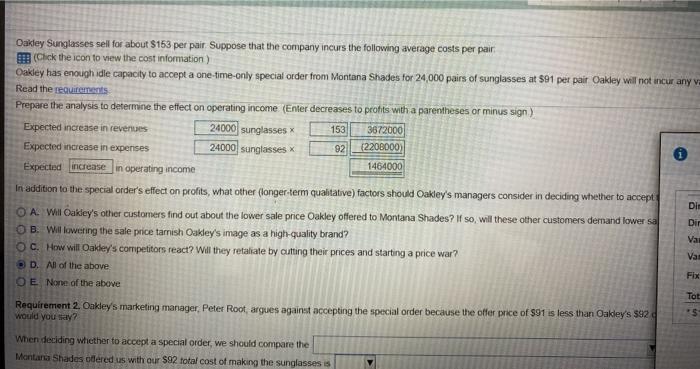

od 92 07200000 20000 sunglasses down Direct labor 10.10 Variable manufacturing overhead eded to come Variable selling expenses the oldested on prot what other orgadors shouley's managers considerin deciding whether to accept the order? Fixed manufacturing overhead wa Okeys other tantomes ind out about the lower le pe Oakley offered to Montana Shades? wil these other customers demand lower sale price? Total cost Willowing the price takley's images-brand? * $1,950,000 Total fixed manufacturing How was como aye yurtinges and stating a price war? of the Print None of the above met 2. des matigas Fotos e corting the special order because the other pros of sot is fess than Colleys 802.cost to make the songs Haryo, esta occasion Say where we had come the Costs that we will incur whether or not we x mere berwagte dass eves we will recome against the different costs portofing the order eves we will recent coses we will of the order revenue to Wing the devotees wil incur for the order to ou Data Tablo con low cost. Dakley has enough ide cocity lo acepta ne-only special order from Montana Shades for 24000 part of sunglasses at 91 per part Oakley will not incur any variati Read More Per te analysis to define the effect on operating income (Ende decreases to protts with a parentheses or minus) Expedinding revenues 24000 sunglasses 159 3672000 Expedeincess 70000 sunglasses 22200000 Expedincasem operating income 1454000 Direct materials Direct labor Variable manufactur Variable selling exp- Fixed manufacturin In addition to the special orders ffect on profits what other long-term qualitative) factors should Oakley's managers consider in deciding whether to accept the order? OA W Caddey's cher customers find out about the lower sale price Oakley offered to Montana Shades? If so, will these other customers demand lower sale prices? O 8 Willowering the sale price tash Oldey's image as a high-quality and OC. How will Oakley's competitors react will they late by cutting their prices and starting a price war? D. A of the above OE None of the above Total cost * 51,950,000 Total Requirement 2. Coley's marketing manager, Peter Root wgues against accepting the special order because the offer price of 591 is less than Oakley's $92 cost to make would you say Wendecide whether to accept a special order, we should compare the Montana Shades offered us with our 592 total cost of making the sunglasses is V Costs that we will incur whether or not w The additional revenue and the addional costs that we will incur to the special orderare the Montar Shades special order, we will incur only of additional cost per pair which is per por that Montana Shades offered. Therefore, we should the special order to operating income Wwe accept than the 991 the company Choose from any lost or endor any number in the input fields and then continue to the next question Type here to search O (hp) Vill not incur any vanabi Data Table $ 43 13 9 accept the order? Direct materials Direct labor Variable manufacturing overhead Variable selling expenses Fixed manufacturing overhead 92 Total cost $1,950,000 Total fixed manufacturing overhead / 78,000 Pairs of sunglasses Power sale prices? 2 $25 $ Print Done 's $92 cost to make the Jysis is correct. What Costs that we will incur whether or not we fill the order are to our decision. This is why comparing the $91 price Total 51 Varial 1464000 Expected increase in operating income Varia! In addition to the special order's effect on profits what other (longer-term qualitative) factors should Oakley's managers consider in deciding whether to Fixed O A Will Oakley's other customers find out about the lower salepnice Oakley offered to Montana Shades? If so, will these other customers demand B. Will lowering the sale price tarnish Oakley's image as a high quality brand? OC. How will Oakley's competitors react? Will they retaliate by cutting their prices and starting a price war? D. All of the above OE None of the above Requirement 2. Oakley's marketing manager, Peter Root, argues against accepting the special order because the offer price of 591 is less than Oakley's $92 cost te would you say? When deciding whether to accept a special order, we should compare the Co Montana Shades offered us with our $92 total cost of making the sunglasses is The additional tevenues and the additional costs that we will incur to fill the special order are the Montana Shades special order, we will incur only of additional cost per pair, which is per pair that Montana Shades offered. Therefore, we should the special order to operating income If we accept than the $91 the company's moose from any list or enter any number in the input fields and then continue to the next question Reic aplete) - X i ey wil Data Table 43 NO S Direct materials 13 Direct labor 9 Variable manufacturing overhead Variable selling expenses $25 Fixed manufacturing overhead $ 92 Total cost * $1,950,000 Total fixed manufacturing ovehead / 78,000 Pairs of sunglasses her to mand la Print Done Oakley's $92 cost to make the sunglasses Root asks you, as one of Oakley's staff accountants, to explain Costs that we will incur whether or not we fill the order are to our decision. The Oakley Sunglasses sell for about $153 per pair Suppose that the company incurs the following average costs per pair Click the icon to view the cost information ) Oakley has enough idle capacity to accept a one-time-only special order from Montana Shades for 24,000 pairs of sunglasses at $91 per pair Oakley will not incur any v Read the requirements Prepare the analysis to determine the effect on operating income (Enter decreases to pronts with a parentheses or minus sign) Expected increase in revenues 24000 sunglasses 153 3672000 Expected increase in expenses 24000 sunglasses 92 (2208000) 1464000 Expected increase in operating income In addition to the special order's effect on profits, what other (longer term qualitative) factors should Oakley's managers consider in deciding whether to accept Dir O A Will Oakley's other customers find out about the lower sale price Oakley offered to Montana Shades? If so, will these other customers demand lower sa Dir OB. Willowering the sale price tarnish Oakley's image as a high-quality brand? OC. How will Oakley's competitors react? Will they retaliate by cutting their prices and starting a price war? Vat D. All of the above OE None of the above Tot $ Requirement 2. Oakley's marketing manager, Peter Root, argues against accepting the special order because the offer price of 591 is less than Oakley's 502 would you say? Va Fix When deciding whether to accept a special order, we should compare the Montana Shades odered us with our $92 total cost of making the sunglasses is od 92 07200000 20000 sunglasses down Direct labor 10.10 Variable manufacturing overhead eded to come Variable selling expenses the oldested on prot what other orgadors shouley's managers considerin deciding whether to accept the order? Fixed manufacturing overhead wa Okeys other tantomes ind out about the lower le pe Oakley offered to Montana Shades? wil these other customers demand lower sale price? Total cost Willowing the price takley's images-brand? * $1,950,000 Total fixed manufacturing How was como aye yurtinges and stating a price war? of the Print None of the above met 2. des matigas Fotos e corting the special order because the other pros of sot is fess than Colleys 802.cost to make the songs Haryo, esta occasion Say where we had come the Costs that we will incur whether or not we x mere berwagte dass eves we will recome against the different costs portofing the order eves we will recent coses we will of the order revenue to Wing the devotees wil incur for the order to ou Data Tablo con low cost. Dakley has enough ide cocity lo acepta ne-only special order from Montana Shades for 24000 part of sunglasses at 91 per part Oakley will not incur any variati Read More Per te analysis to define the effect on operating income (Ende decreases to protts with a parentheses or minus) Expedinding revenues 24000 sunglasses 159 3672000 Expedeincess 70000 sunglasses 22200000 Expedincasem operating income 1454000 Direct materials Direct labor Variable manufactur Variable selling exp- Fixed manufacturin In addition to the special orders ffect on profits what other long-term qualitative) factors should Oakley's managers consider in deciding whether to accept the order? OA W Caddey's cher customers find out about the lower sale price Oakley offered to Montana Shades? If so, will these other customers demand lower sale prices? O 8 Willowering the sale price tash Oldey's image as a high-quality and OC. How will Oakley's competitors react will they late by cutting their prices and starting a price war? D. A of the above OE None of the above Total cost * 51,950,000 Total Requirement 2. Coley's marketing manager, Peter Root wgues against accepting the special order because the offer price of 591 is less than Oakley's $92 cost to make would you say Wendecide whether to accept a special order, we should compare the Montana Shades offered us with our 592 total cost of making the sunglasses is V Costs that we will incur whether or not w The additional revenue and the addional costs that we will incur to the special orderare the Montar Shades special order, we will incur only of additional cost per pair which is per por that Montana Shades offered. Therefore, we should the special order to operating income Wwe accept than the 991 the company Choose from any lost or endor any number in the input fields and then continue to the next question Type here to search O (hp) Vill not incur any vanabi Data Table $ 43 13 9 accept the order? Direct materials Direct labor Variable manufacturing overhead Variable selling expenses Fixed manufacturing overhead 92 Total cost $1,950,000 Total fixed manufacturing overhead / 78,000 Pairs of sunglasses Power sale prices? 2 $25 $ Print Done 's $92 cost to make the Jysis is correct. What Costs that we will incur whether or not we fill the order are to our decision. This is why comparing the $91 price Total 51 Varial 1464000 Expected increase in operating income Varia! In addition to the special order's effect on profits what other (longer-term qualitative) factors should Oakley's managers consider in deciding whether to Fixed O A Will Oakley's other customers find out about the lower salepnice Oakley offered to Montana Shades? If so, will these other customers demand B. Will lowering the sale price tarnish Oakley's image as a high quality brand? OC. How will Oakley's competitors react? Will they retaliate by cutting their prices and starting a price war? D. All of the above OE None of the above Requirement 2. Oakley's marketing manager, Peter Root, argues against accepting the special order because the offer price of 591 is less than Oakley's $92 cost te would you say? When deciding whether to accept a special order, we should compare the Co Montana Shades offered us with our $92 total cost of making the sunglasses is The additional tevenues and the additional costs that we will incur to fill the special order are the Montana Shades special order, we will incur only of additional cost per pair, which is per pair that Montana Shades offered. Therefore, we should the special order to operating income If we accept than the $91 the company's moose from any list or enter any number in the input fields and then continue to the next question Reic aplete) - X i ey wil Data Table 43 NO S Direct materials 13 Direct labor 9 Variable manufacturing overhead Variable selling expenses $25 Fixed manufacturing overhead $ 92 Total cost * $1,950,000 Total fixed manufacturing ovehead / 78,000 Pairs of sunglasses her to mand la Print Done Oakley's $92 cost to make the sunglasses Root asks you, as one of Oakley's staff accountants, to explain Costs that we will incur whether or not we fill the order are to our decision. The Oakley Sunglasses sell for about $153 per pair Suppose that the company incurs the following average costs per pair Click the icon to view the cost information ) Oakley has enough idle capacity to accept a one-time-only special order from Montana Shades for 24,000 pairs of sunglasses at $91 per pair Oakley will not incur any v Read the requirements Prepare the analysis to determine the effect on operating income (Enter decreases to pronts with a parentheses or minus sign) Expected increase in revenues 24000 sunglasses 153 3672000 Expected increase in expenses 24000 sunglasses 92 (2208000) 1464000 Expected increase in operating income In addition to the special order's effect on profits, what other (longer term qualitative) factors should Oakley's managers consider in deciding whether to accept Dir O A Will Oakley's other customers find out about the lower sale price Oakley offered to Montana Shades? If so, will these other customers demand lower sa Dir OB. Willowering the sale price tarnish Oakley's image as a high-quality brand? OC. How will Oakley's competitors react? Will they retaliate by cutting their prices and starting a price war? Vat D. All of the above OE None of the above Tot $ Requirement 2. Oakley's marketing manager, Peter Root, argues against accepting the special order because the offer price of 591 is less than Oakley's 502 would you say? Va Fix When deciding whether to accept a special order, we should compare the Montana Shades odered us with our $92 total cost of making the sunglasses is