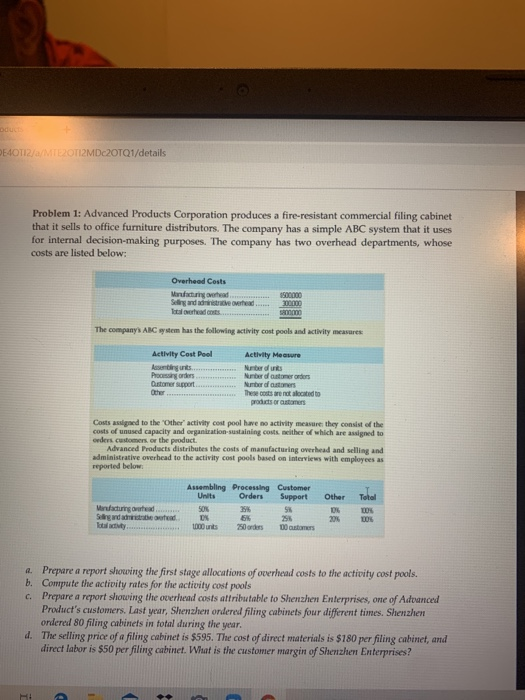

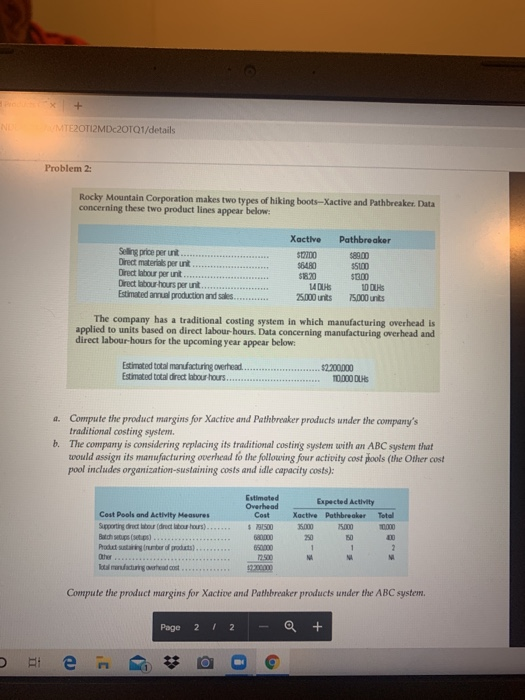

Od E40112/a/MTE2OTI2MDC2OTQ1/details Problem 1: Advanced Products Corporation produces a fire-resistant commercial filing cabinet that it sells to office furniture distributors. The company has a simple ABC system that it uses for internal decision-making purposes. The company has two overhead departments, whose costs are listed below: Overhead Costs Manufacturing and Selling and drive overed 00000 200000 sam The company ABC system has the following activity cost pools and activity measures Activity Cost Pool Asennus Processing orders Dustomer Sport Activity Measure Number of Number of atomer orders Number of time These constructed to products or astomers Costs assigned to the other activity cost pool have no activity measure they consist of the costs of unused capacity and organization sustaining costs neither of which are assigned to orders customers or the product. Advanced Products distributes the costs of manufacturing overhead and selling and administrative overhead to the activity cost pools based on interviews with employees as reported below Other Total Manufacturingotead Saling and defend Assembling Processing Customer Units Orders Support 50% 5x 6% 1000 units Datomers DOX a. Prepare a report showing the first stage allocations of overhead costs to the activity cost pools. b. Compute the activity rates for the activity cost pools c. Prepare a report showing the overhead costs attributable to Shenzhen Enterprises, one of Advanced Product's customers. Last year, Shenzhen ordered filing cabinets four different times. Shenzhen ordered 80 filing cabinets in total during the year. d. The selling price of a filing cabinet is $595. The cost of direct materials is $180 per filing cabinet, and direct labor is $50 per filing cabinet. What is the customer margin of Shenzhen Enterprises? + NA MTE2OTI2MDc2OTQ1/details Problem 2: Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Xactive Selling price per unit Direct materials per un Direct labour per unit Direct labour hours perunt Estimated annual production and sales 512200 $64.80 $1820 140 25.000 units Pathbreaker $89.00 55100 56.00 10 DHS 75,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labour hours. Data concerning manufacturing overhead and direct labour-hours for the upcoming year appear below: Estimated total manufacturing overhead $2.200.000 Estimated total direct labour hours... 10.000 DHS 4. Compute the product margins for Xactive and Pathbreaker products under the company's traditional costing system. b. The company is considering replacing its traditional costing system with an ABC systent that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Estimated Overhead Cost Cost Pools and Activity Measures Supporting directeur director hours)... Expected Activity Xactive Pathbreaker Total 35.000 75.000 00 1 1 2 NA N ODO Products of products Tot machine Compute the product margins for Xactive and Pathbreaker products under the ABC system. Page 2 / 2 1 Od E40112/a/MTE2OTI2MDC2OTQ1/details Problem 1: Advanced Products Corporation produces a fire-resistant commercial filing cabinet that it sells to office furniture distributors. The company has a simple ABC system that it uses for internal decision-making purposes. The company has two overhead departments, whose costs are listed below: Overhead Costs Manufacturing and Selling and drive overed 00000 200000 sam The company ABC system has the following activity cost pools and activity measures Activity Cost Pool Asennus Processing orders Dustomer Sport Activity Measure Number of Number of atomer orders Number of time These constructed to products or astomers Costs assigned to the other activity cost pool have no activity measure they consist of the costs of unused capacity and organization sustaining costs neither of which are assigned to orders customers or the product. Advanced Products distributes the costs of manufacturing overhead and selling and administrative overhead to the activity cost pools based on interviews with employees as reported below Other Total Manufacturingotead Saling and defend Assembling Processing Customer Units Orders Support 50% 5x 6% 1000 units Datomers DOX a. Prepare a report showing the first stage allocations of overhead costs to the activity cost pools. b. Compute the activity rates for the activity cost pools c. Prepare a report showing the overhead costs attributable to Shenzhen Enterprises, one of Advanced Product's customers. Last year, Shenzhen ordered filing cabinets four different times. Shenzhen ordered 80 filing cabinets in total during the year. d. The selling price of a filing cabinet is $595. The cost of direct materials is $180 per filing cabinet, and direct labor is $50 per filing cabinet. What is the customer margin of Shenzhen Enterprises? + NA MTE2OTI2MDc2OTQ1/details Problem 2: Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Xactive Selling price per unit Direct materials per un Direct labour per unit Direct labour hours perunt Estimated annual production and sales 512200 $64.80 $1820 140 25.000 units Pathbreaker $89.00 55100 56.00 10 DHS 75,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labour hours. Data concerning manufacturing overhead and direct labour-hours for the upcoming year appear below: Estimated total manufacturing overhead $2.200.000 Estimated total direct labour hours... 10.000 DHS 4. Compute the product margins for Xactive and Pathbreaker products under the company's traditional costing system. b. The company is considering replacing its traditional costing system with an ABC systent that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Estimated Overhead Cost Cost Pools and Activity Measures Supporting directeur director hours)... Expected Activity Xactive Pathbreaker Total 35.000 75.000 00 1 1 2 NA N ODO Products of products Tot machine Compute the product margins for Xactive and Pathbreaker products under the ABC system. Page 2 / 2 1