Answered step by step

Verified Expert Solution

Question

1 Approved Answer

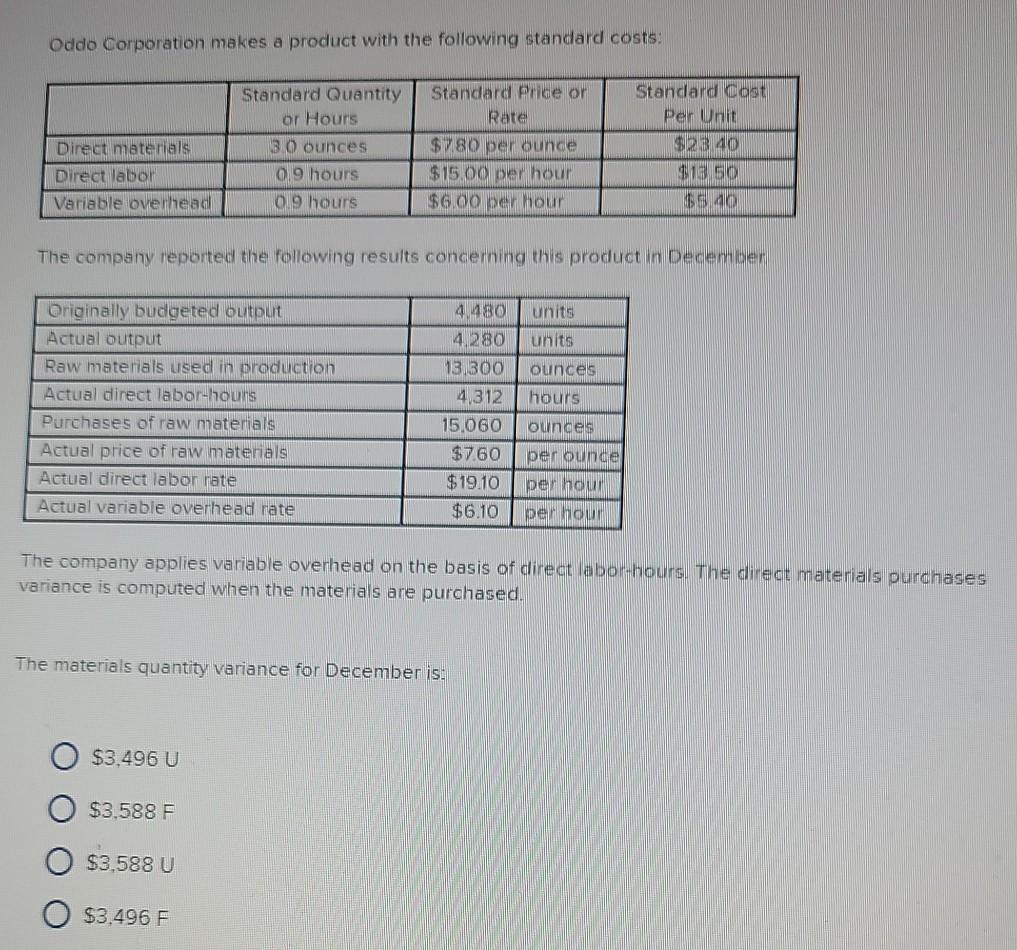

Oddo Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate 3.0 Ounces Direct materials Direct labor Variable

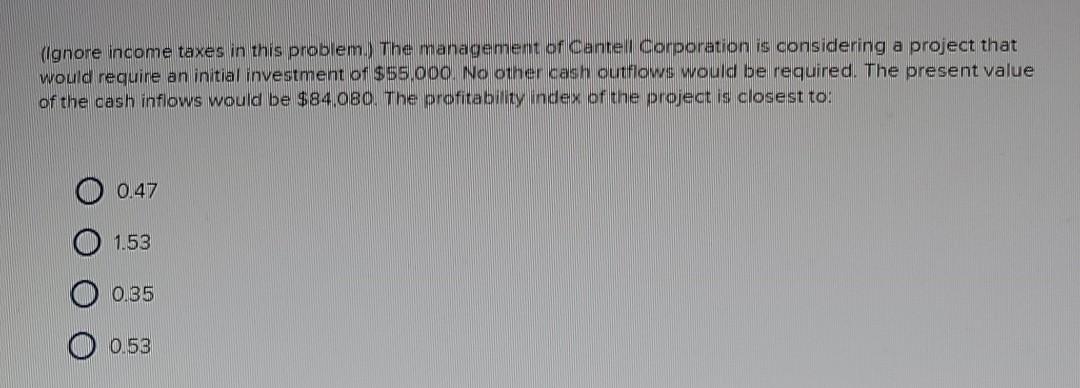

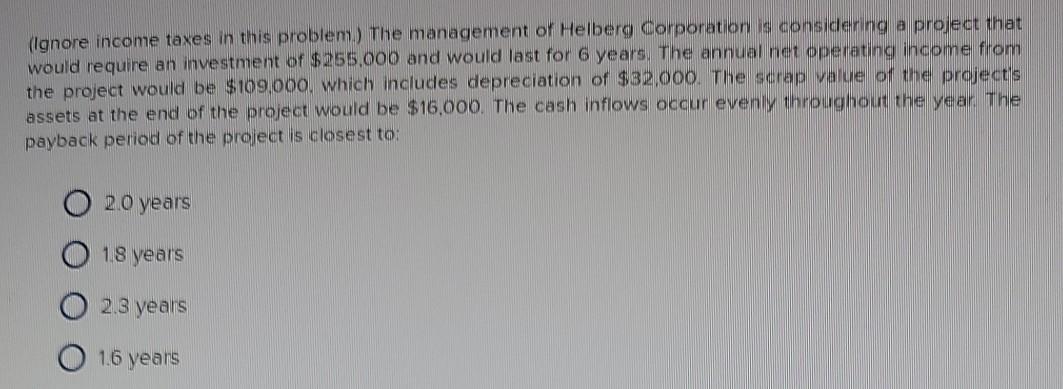

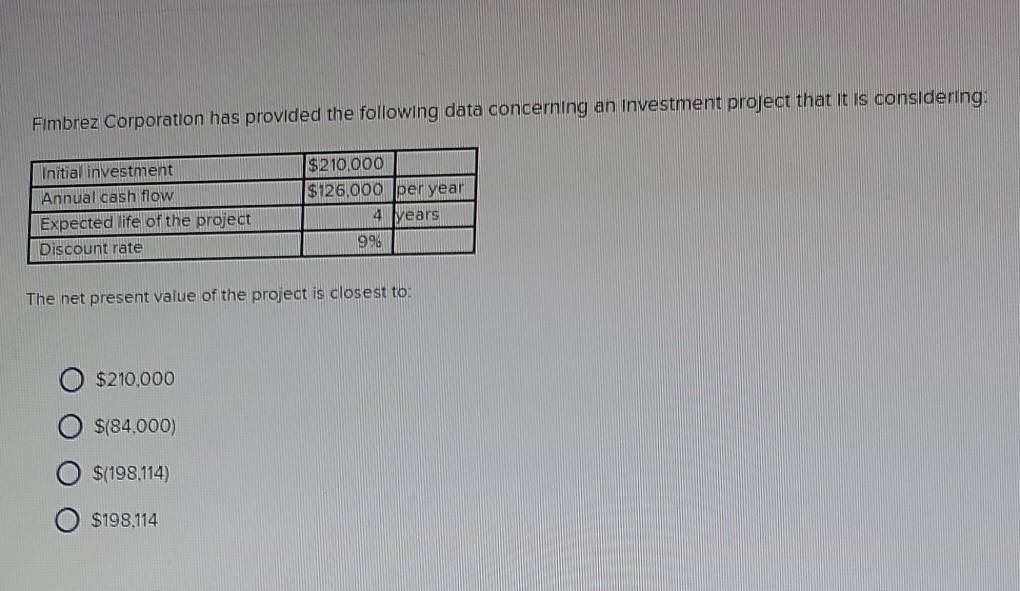

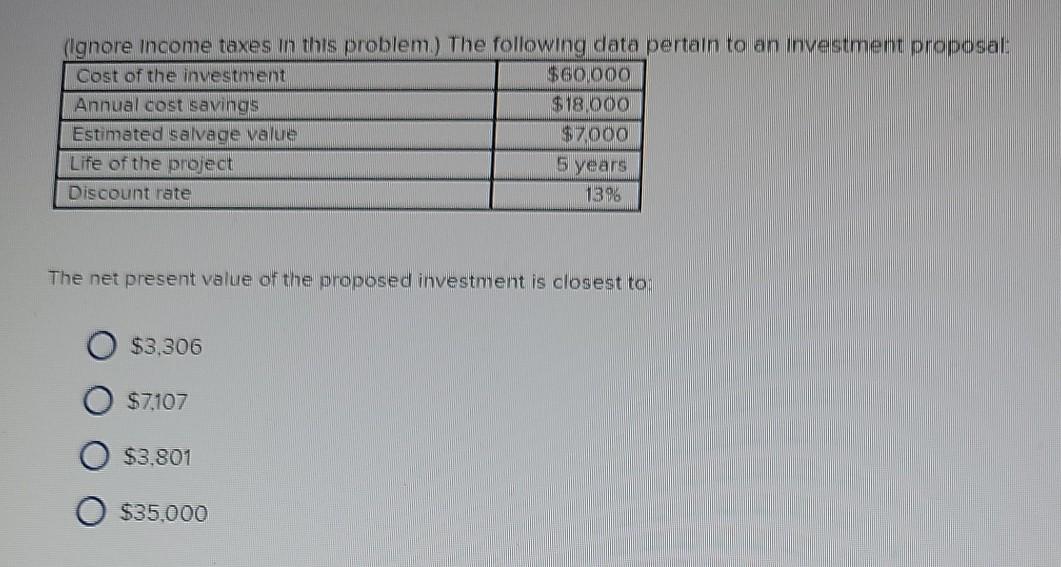

Oddo Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate 3.0 Ounces Direct materials Direct labor Variable overhead Standard cost Per Unit $2340 210.50 $40 $7.80 per ounce $15.00 per hour $6.00 per hour 0.9 hours 09 hours The company reported the following results concerning this product in December units units ounces hours Originally budgeted output Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials Actual direct labor rate Actual variable overhead rate 4180 4,280 13,300 4,312 15,060 $7.60 $19.10 $6.10 Ounces per Ounce per hour per hour The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for December is: $3,496 U $3.588 F $3,588 U 0 $3,496 F (Ignore income taxes in this problem.) The management of Cantell Corporation is considering a project that would require an initial investment of $55.000. No other cash outflows would be required. The present value of the cash inflows would be $84.080. The profitability index of the project is closest to: 0.47 1.53 0.35 0.53 (Ignore income taxes in this problem.) The management of Helberg Corporation is considering a project that would require an investment of $255.000 and would last for 6 years. The annual net operating income from the project would be $109,000, which includes depreciation of $32,000. The scrap value of the project's assets at the end of the project would be $16,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: 2.0 years 1.8 years 2.3 years 1.6 years Fimbrez Corporation has provided the following data concerning an investment project that it is considering: Initial investment Annual cash flow Expected life of the project Discount rate $210.000 $126.000 per year 4 lears 998 The net present value of the project is closest to $210,000 $(84,000) $(198.114) $198.114 (Ignore income taxes in this problem) The following date pertain to an investment proposat Cost of the investment $60,000 Annual cost savings $18.000 Estimated salvage value $7000 Life of the project 5 years Discount rate 1396 The net present value of the proposed investment is closest to $3.306 $7,107 $3.801 $35.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started