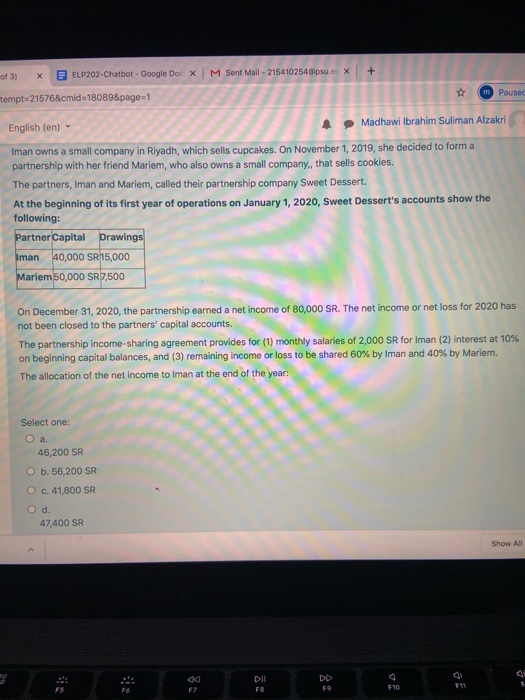

of 3) + X E ELP202-Chatbot - Google Docx M Sent Mail - 215410254 psu.el X m Pause tempt=21576&cmid=18089&page=1 English (en) Madhawi Ibrahim Suliman Alzakri Iman owns a small company in Riyadh, which sells cupcakes. On November 1, 2019, she decided to form a partnership with her friend Mariem, who also owns a small company, that sells cookies. The partners, Iman and Mariem, called their partnership company Sweet Dessert. At the beginning of its first year of operations on January 1, 2020, Sweet Dessert's accounts show the following: Partner Capital Drawings Iman 40,000 SR 15,000 Mariem 50,000 SR7,500 On December 31, 2020, the partnership earned a net income of 80,000 SR. The net income or net loss for 2020 has not been closed to the partners' capital accounts. The partnership income-sharing agreement provides for (1) monthly salaries of 2,000 SR for Iman (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shared 60% by Iman and 40% by Mariem. The allocation of the net income to Iman at the end of the year: Select one: O a. 46,200 SR O b. 56,200 SR O c. 41,800 SR O d. 47,400 SR Show All DII F8 DD F9 F7 F11 FIO of 3) + X E ELP202-Chatbot - Google Docx M Sent Mail - 215410254 psu.el X m Pause tempt=21576&cmid=18089&page=1 English (en) Madhawi Ibrahim Suliman Alzakri Iman owns a small company in Riyadh, which sells cupcakes. On November 1, 2019, she decided to form a partnership with her friend Mariem, who also owns a small company, that sells cookies. The partners, Iman and Mariem, called their partnership company Sweet Dessert. At the beginning of its first year of operations on January 1, 2020, Sweet Dessert's accounts show the following: Partner Capital Drawings Iman 40,000 SR 15,000 Mariem 50,000 SR7,500 On December 31, 2020, the partnership earned a net income of 80,000 SR. The net income or net loss for 2020 has not been closed to the partners' capital accounts. The partnership income-sharing agreement provides for (1) monthly salaries of 2,000 SR for Iman (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shared 60% by Iman and 40% by Mariem. The allocation of the net income to Iman at the end of the year: Select one: O a. 46,200 SR O b. 56,200 SR O c. 41,800 SR O d. 47,400 SR Show All DII F8 DD F9 F7 F11 FIO