Answered step by step

Verified Expert Solution

Question

1 Approved Answer

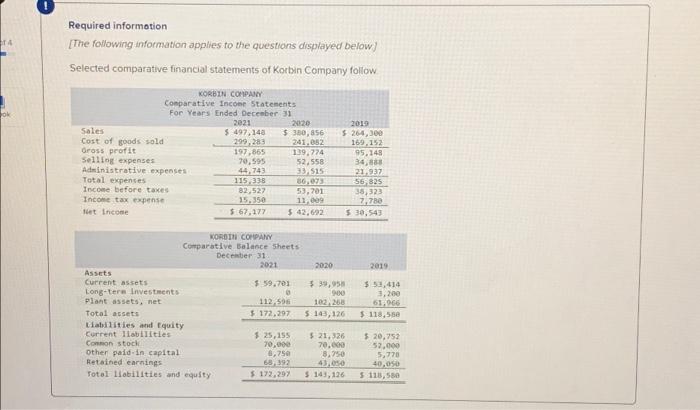

of 4 bok Required information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative

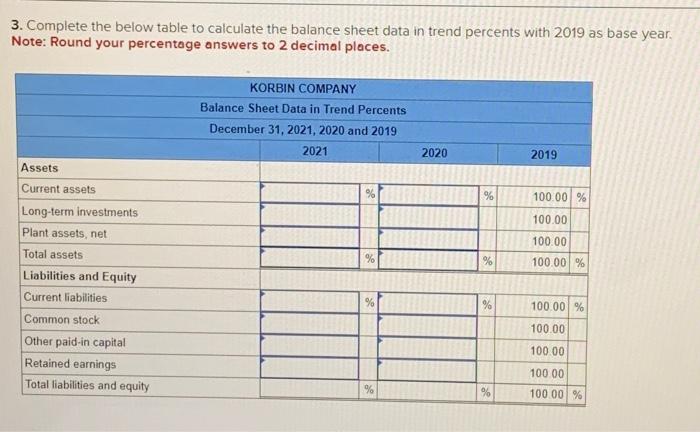

of 4 bok Required information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets 2021 2020 $ 497,148 $ 380,856 299,283 241,082 197,865 70,595 44,743 115,338 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 82,527 15,350 $ 67,177 KORBIN COMPANY Comparative Balance Sheets December 31 139,774 52,558 33,515 86,073 53,701 11,009 $ 42,692 2021 $ 59,701 0 112,596 $ 172,297 $ 25,155 70,000 8,750 68,392 $ 172,297 2020 2019 $ 264,300 169,152 $ 39,958 900 102,268 $ 143,126 $ 21,326 70,000 8,750 43,050 $ 143, 126 95,148 34,888 21,937 56,825 38,323 7,780 $ 30,543 2019 $53,414 3,200 61,966 $ 118,580 $ 20,752 52,000 5,778 40,050 $ 118,580

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started