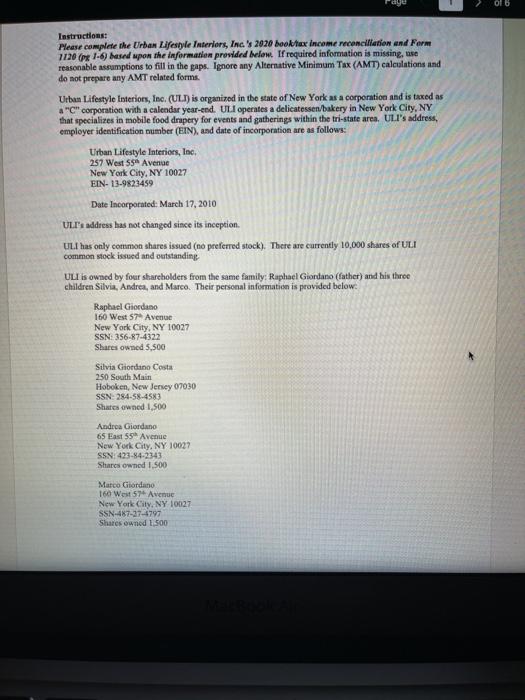

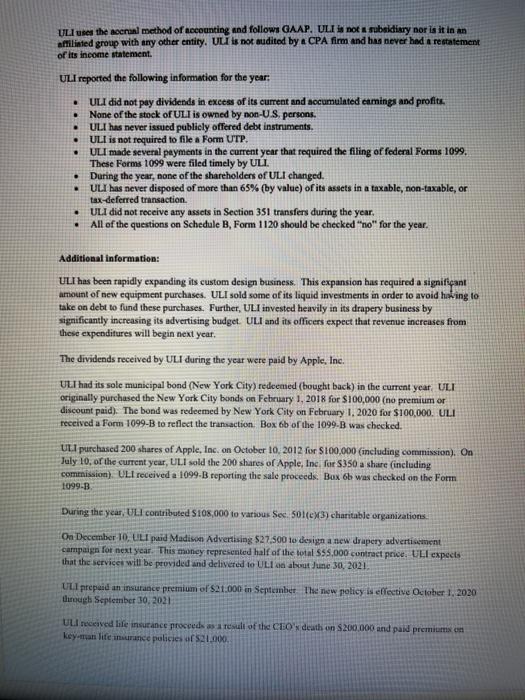

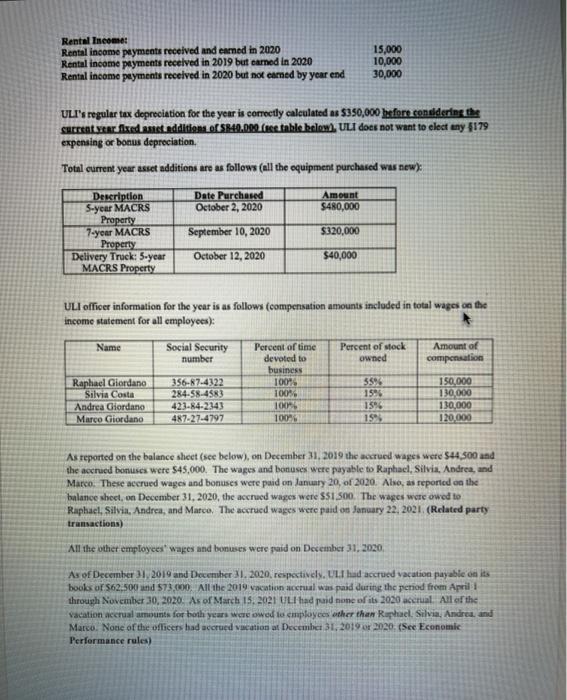

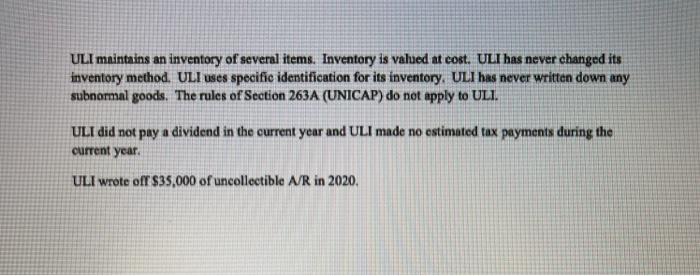

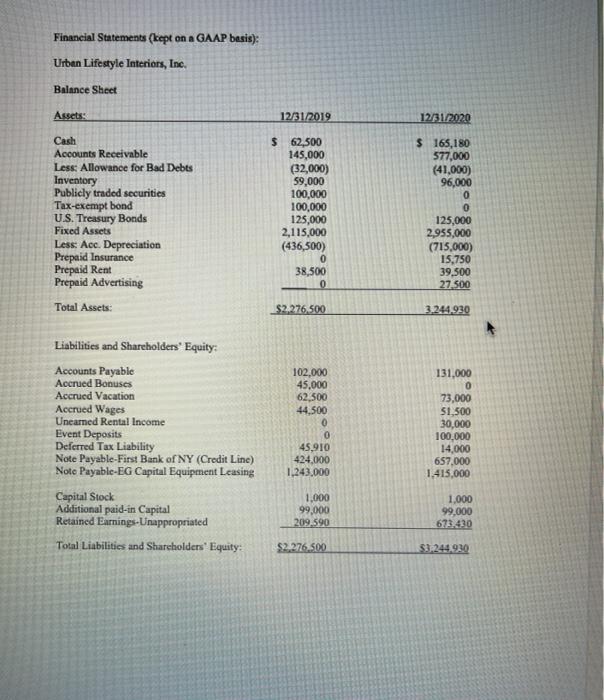

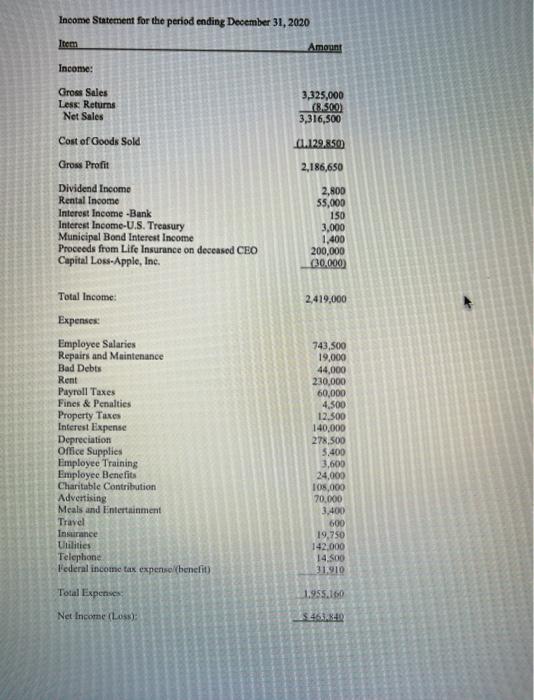

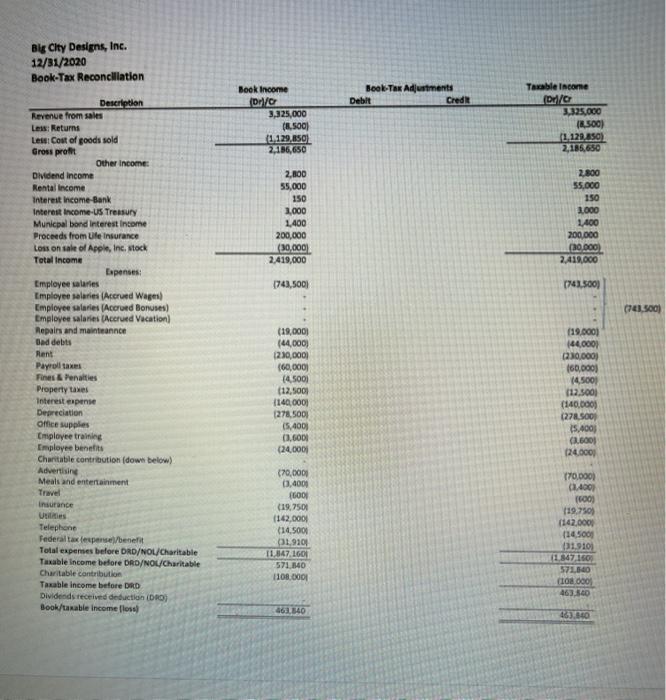

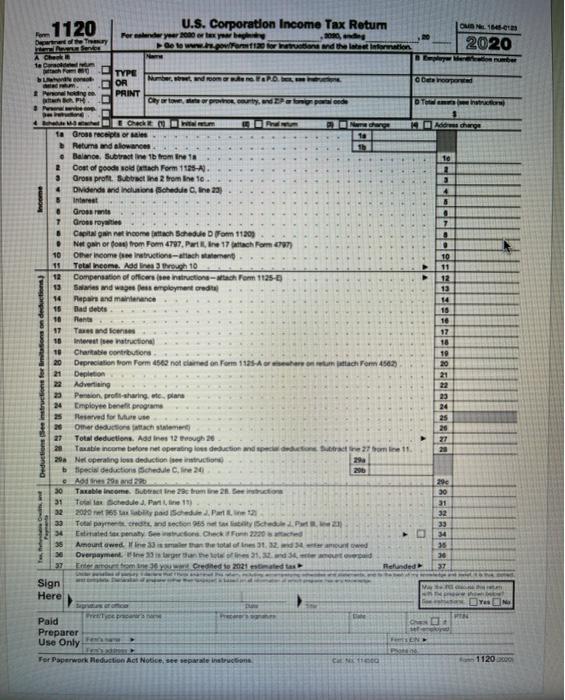

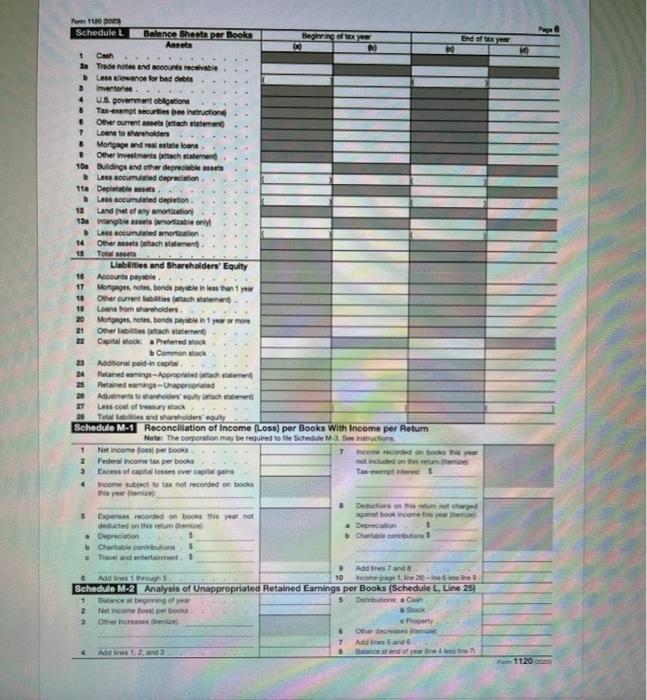

of 6 Instructions: Please complete the Urban Lifestyle Interiors, Inc.'s 2020 book tax income reconciliation and Farm 1120px 1. based upon the information provided below. If required information is missing, Teasonable assumptions to fill in the gaps. Ignore any Alternative Minimum Tax (AMT) calculations and do not prepare any AMT related forms. Urban Lifestyle Interiors, Inc. (ULT) is organized in the state of New York as a corporation and is taxed as a "C"corporation with a calendar year-end. ULI operates a delicatessen/bakery in New York City, NY that specializes in mobile food drapery for events and gatherings within the tri-state area. ULI's address, employer identification number (EIN), and date of incorporation are as follows: Urban Lifestyle Interiors, Inc. 257 West SS Avenac New York City, NY 10027 EIN-13-9823459 Date Incorporated: March 17, 2010 ULI address has not changed since its inception ULI has only common shares issued (no preferred stock). There are currently 10,000 shares of ULI common stock issued and outstanding ULI is owned by four shareholders from the same family: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. Their personal information is provided below. Raphael Giordano 160 West 57 Avenue New York City, NY 10027 SSN: 356-87-4322 Shares owned 5,500 Silvia Giordano Costa 250 South Main Hoboken, New Jersey 07030 SSN: 284-58-4583 Share owned 1,500 Andrea Giordano 65 East 55 Avenue Now York City, NY 10027 SSN: 423-84-2343 Share owned 1.500 Marco Giordano 160 West 57 Avenue New York City, NY 10027 SSN-487-27-4797 Share owned 1.500 ULI use the craal method of accounting and follows GAAP. ULI not a subsidiary nor is it in an affilinted group with any other entity, ULI is not audited by a CPA firm and has never had a restatement of its income statement ULI reported the following information for the year: ULI did not pay dividends in excess of its current and accumulated camnings and profits. None of the stock of ULI is owned by non-U.S. persons ULI has never issued publicly offered debt instruments ULI is not required to file a Form UTP. ULI made several payments in the current year that required the filing of federal Forms 1099, These Forms 1099 were filed timely by ULI During the year, none of the shareholders of ULI changed. ULI has never disposed of more than 65% (by value) of its assets in a taxable, non-taxable, or tax-deferred transaction. ULI did not receive any assets in Section 351 transfers during the year. All of the questions on Schedule B, Form 1120 should be checked "no" for the year. . Additional information: ULI has been rapidly expanding its custom design business. This expansion has required a significant amount of new equipment purchases. ULI sold some of its liquid investments in order to avoid hoking to take on debt to fund these purchases. Further, ULI invested heavily in its drapery business by significantly increasing its advertising budget. ULI and its officers expect that revenue increases from these expenditures will begin next year, The dividends received by ULI during the year were paid by Apple, Inc. ULI had its sole municipal bond (New York City) redeemed (bought back) in the current year. ULI originally purchased the New York City bonds on February 1, 2018 for $100,000 (no premium or discount paid). The bond was redeemed by New York City on February 1, 2020 for $100,000. ULI received a Form 1099-B to reflect the transaction. Box ob of the 1099-B was checked. ULI purchased 200 shares of Apple, Inc. on October 10, 2012 for $100,000 (including commission). On July 10, or the current year, ULI sold the 200 shares of Apple, Inc. for $350 a share (including commission). ULI received a 1099-B reporting the sale proceeds. Bax 6b was checked on the Form 1099-3 During the year, UL. contributed S108,000 to various sec, 501(c)(3) charitable organizations. On December 10, UL paid Madison Advertising $27.500 10 design a new drapery advertisement campaign for next year. This money represented half of the total $55.000 contract price. ULI expects that the services will be provided and delivered to UL about June 30, 2021 ULI prepaid an insurance premium of $21.000 in September the new policy is effective October 1, 2020 through September 30, 2021 ULI received life insurance proceeds a result of the CEO's death on S200,000 and paid premiums en keyan life insurance policies of 21.000 Rental Income Rental income payments received and earned in 2020 Rental income peyments received in 2019 but carned in 2020 Rental income payments received in 2020 but not eamed by year end 15,000 10,000 30,000 ULI's regular tax depreciation for the year is correctly calculated as $350,000 before considering the SHEREHE Yfixed Anet.addition S840.000 fee table below). ULI does not want to elect any $179 expensing or bonus depreciation Total current year asset additions are as follows (all the equipment purchased was new) Date Purchased October 2, 2020 Amount $480,000 Description S-year MACRS Property 7-year MACRS Property Delivery Truck: 5-year MACRS Property September 10, 2020 $320,000 October 12, 2020 $40,000 ULI officer information for the year is as follows (compensation amounts included in total wages on the income statement for all employees): Name Social Security number Percent of stock owned Amount of compensation Raphael Giordano Silvia Costa Andrea Giordano Marco Giordano 356-87.4322 284.58-4583 423-84-2343 487-27-4797 Percent of time devoted to business 10094 100 104 100 1596 15% 150,000 130.000 130,000 120.000 1998 As reported on the balance sheet (see below), on December 31, 2019 the accrued wages were $44.500 and the accrued bonuses were $45,000. The wages and bonuses were payable to Raphael, Silvia, Andrea, and Marco. These accrued wages and bonuses were paid on January 20, of 2020. Also, as reported on the balance sheet, on December 31, 2020, the accrued wages were $51.500. The wages were owed to Raphael. Silvia. Andrea, and Marce, The accrued wages were paid os Sanuary 22, 2021(Related party transactions) All the other employees wages and bonuses were paid on December 31, 2020, As of December 21 2019 and December 31, 2020, respectively. ULI had accrued vacation payable on its books or 562,500 and 573.000. All the 2019 vacuation accrual was paid during the period from April through November 30, 2020. As of March 15, 2021 ULI had paid none of its 2020 accrual. All of the Vacation accrual amounts for both years were owed to employees other than Raphael Silvia, Andrea, and Marco. None of the officers had accrued vacation at December 31, 2019 2020. (See Economic Performance rules) ULI maintains an inventory of several items. Inventory is valued at cost. ULI has never changed its inventory method. ULI uses specific identification for its inventory. ULI has never written down any subnormal goods. The rules of Section 263A (UNICAP) do not apply to ULI. ULI did not pay a dividend in the current year and ULI made no estimated tax payments during the current year. ULI wrote of $35,000 of uncollectible A/R in 2020, Financial Statements (kept on GAAP basis): Urban Lifestyle Interiors, Inc. Balance Sheet Assets: 12/31/2019 121/2020 Cash Accounts Receivable Less: Allowance for Bad Debts Inventory Publicly traded securities Tax-exempt bond U.S. Treasury Bonds Fixed Assets Less: Acc. Depreciation Prepaid Insurance Prepaid Rent Prepaid Advertising Total Assets: $ 62,500 145,000 (32,000) 59,000 100,000 100,000 125,000 2,115,000 (436,500) 0 38,500 0 $ 165,180 577,000 (41,000) 96,000 0 0 125,000 2,955,000 (715,000) 15,750 39.500 27.500 $2,276.500 3.244.930 Liabilities and Shareholders' Equity: Accounts Payable Accrued Bonuses Accrued Vacation Accrued Wages Unearned Rental Income Event Deposits Deferred Tax Liability Note Payable-First Bank of NY (Credit Line) Note Payable-EG Capital Equipment Leasing Capital Stock Additional paid-in Capital Retained Earnings-Unappropriated Total Liabilities and Shareholders' Equity: 102,000 45,000 62,500 44,500 0 0 45,910 424,000 1.243,000 131,000 0 73,000 51.500 30,000 100,000 14,000 657.000 1.415.000 1,000 99,000 209,590 1,000 99,000 673430 S2.276.500 $3244.920 Income Statement for the period ending December 31, 2020 Item Amount Income: Gross Sales Less Returns Net Sales 3,325,000 (8.500) 3,316,500 Cost of Goods Sold 01.129,850 Gross Profit 2,186,650 Dividend Income Rental Income Interest Income -Bank Interest Income-U.S. Treasury Municipal Bond Interest Income Proceeds from Life Insurance on deceased CEO Capital Los-Apple, Inc. 2,800 55,000 150 3,000 1,400 200,000 (30.000) 2,419,000 Total Income Expenses Employee Salaries Repairs and Maintenance Bad Debts Rent Payroll Taxes Fines & Penalties Property Taxes Interest Expense Depreciation Office Supplies Employee Training Employee Benefits Charitable Contribution Advertising Meals and Entertainment Travel Insurance Utilities Telephone Federal income tax expensohenelit) 743,500 19,000 44,000 230,000 60,000 4,500 12.500 140,000 278,500 5.400 3,600 24,000 105,000 70,000 3.400 600 19,750 142.000 14.500 31,910 Total Expenses 1.955.160 Net Income (L03) $460 Big City Designs, Inc. 12/31/2020 Book-Tax Reconciliation Bool-Tax Adjustments Debit Credit Book Income Dr10 3,325,000 (8.500) 1.129.50) 2166,650 Taxable income Dr/C 3325,000 (4.500) (1, 120.250) 2,135,650 Description Revenue from sales Lew: Returns Lese: Cost of goods sold Gross profit Other Income Dividend Income Rental Income Interest income-Bank Interest Income US Treasury Municpal bond Interest income Proceeds from Ufe Insurance Loss on sale of Apple, Inc, stock Total income Expenses: Employee salaries Employee salaries (Accrued Wages) Employee salaries (Accrued Bonuses) Employee salaries (Accrued Vacation) Repairs and maintance Bad debts 2,800 55,000 150 2.000 1,400 200,000 (30,000) 2.419,000 2.800 55.000 150 2.000 1,400 200.000 (30.000 2.410.000 1743,5001 1741.500) Pen.300 ) Rent Payroll taxes Fines & Penalties Property taxes Interest expense Depreciation Office supplies Employee training Employee benefits Charitable contribution (down below) Advertising Meals and entertainment (19,000) (44,000) 12.30,000 (60,000) (4.500 (12,5001 1140,000 1278,500 15,400) GOD! (24.0001 119.000) 144,0001 230,000 160,000 14.500 (12.500 (140,000) (278.500 15.400 (2.600 124.000 Insurance Utilities Telephone Federal tax expenses/benefit Total expenses before DRD/NOL/Charitable Taxable income before DRD/NOL/Charitable Charitable contribution Taxable income before DRD Dividends received deduction (DRO) Book/taxable income foss (70,000 0.4001 600 (19.750 (142,000 (14.500 OL. 9101 11,847 1601 571,640 110.000 170.000 14001 100 119.750 (142.000 (14.500 91.9103 1.47.16 5715 (10.000 463.560 461540 . -1120 2020 U.S. Corporation Income Tax Retum Foreverer 100 w 20 te The A che De ter TYPE UN OR NATURE Geroporc Perodingen PRINT Cyrtowe proudly pode Door 3 & CCM mm 14 Adware ta Grossaceptos Returns and slowances Balance Subtractine 1b from Ene 18 To 2 Cost of goods soldach Form 1125-A. 2 Gross profit. Subtractine 2 from inte 3 4 Dividends and inclusion Schedule ne 23 4 5 Interest 6 . Groete 7 Gross royar 7 6 Capital annet income attach Schedule Form 11209 Ne gain or fou from Form 4797. Partine 17th Fom 0 10 Other income reactionach went 10 11 Total theone. Add lines 10 11 12 Compensation of officer inrich Form 1125- 12 13 Sward was amployment credit 13 14 Repair and maintenance 14 16 tad debts 16 10 Planta 10 17 Trendleri 17 10 Intereste natruction 18 Charable contributors 10 Depreciation from Form 4562 noted Form 1125 A omach Form 4562 20 21 Depletion 21 Advertising Pension prohing, etc. plans 23 24 Employee bent program 24 Fested for Me 25 Omer det med 26 27 Total deductions. Adnes 12h20 27 Tanabe income before net operating om deduction and contracte 27 home 11 20 Nel operating som deduction struction bipeci deduction schedule C, 20 Address 30 Taxable income Subtine 28 from 2 ton 30 31 Total larichedule 3. Plne 15) 31 2020 by die Part 12 32 Total path and 15.2 Ested operate 34 Amount owed line 33 dowed Overpayment wine 30 Ermour homme credited to 2021 Rended 37 Sign M Here YEN Paid PER to praca Preparer Use Only EN Fer Paperwork Reduction Act Notice separate instruccione Citta om 112000 To Deductions See Instructions for Bronson dediction ****888 BENRAA Form 1102 Schedule C Dividenda, Inolusions, and Special Deductions (5.00 Instructions) 1 Dividende from east-20%-owned domestic corporatione other than debt financed Die Pepe 2 padure WA N 50 2 Dividends from 20%-or-more-owned comestic corporations to her an debt financed 85 3 Rene 4 23.3 28.7 6 50 7 65 100 bidende en ontain debt financed stock of domestic and foreign corporation Didence on ostain preferred tack of wo-than-20%-owned public Dividende on certain preferred stock of 20%-mere-owned publice Dividence from than 20%-owned foreign corporations and contain FC Dividends from 20%-or-more-owned foreign corporationem carta Dividence from wholly owned foreign ibtidos Subtotal. Addins 1 Through Structions for tione Dividends from dome corpore received by a business westment company operating under the Small Business Instant Act of 1958 Dividends from aflated group members Dividends from certain FSC Foreign-source portion of dividende roeived from a specified 10 ned foreign corporation ding hybrid dividende rutin Dividend from forson corporations not welded on ine 3, 7, 11, 12, or 13 including wy hybrid dividendal w 10 100 100 12 13 100 100 100 15 Section inclusion 10 Subpart Findlusions derived from the sale by a controlled for corporation ICFO the stock of a lower-tie formign corporation rated as a dividend nach Form 547) intruction Bubpart indhention derved from hybrid dividende offered corporation artahot 5471see instruction Other incontrom CFCs under boat Foncluded on line 15. 16. 16. Or 17 attach Form 5471) instruction 17 Global tarpble Low-Tamad ron (GLTU butach Form 5471 and Form 2002) 10 Gross-up for foreign the dead paid 10 IC-on and former besc diviends not included on line 1.2, 6-3 20 One dividende 21 Deduction for video pind on certain predstock of public 23 Section 210 deduction tech For 990) Total dividends and inclusions. A column. In 9 hou 20. Ested page 1. in Total special deductionsAdd columnes though 22. Con line 290 244 Form 1120 000 Page 3 2 3 4 Form 1100 000 Schedule J Tax Computation and Payment (500 Instructions) Part I-Tex Computation 1 Check the corporation is a member of controled group attach Schedule ofForm 1120. See vatructions 2 neeme tak. Behren 3 ne erosion minimum tax amount (attach Form 1991) 4 Add ines 2 and 3 50 Foreign tax credit attach Form 1118) 50 b Credit from Fonn 1634 (vetlona) e General business credit with Form 3 be Credit for prior year minimum taxatoh Form 1827) Od Bond credits from Fon 012 Total credits. Addines Samoigh 5 7 Subtractine rom line 4 . Personal holding company tax attach Schede PH Form 1120) Os Recapture of investment credit attach Form 426) Recapture of low-income housing creditch For 8011) Interest due under the look back method completed in term contacto Form 66971 De d Interest du under the look back method-income forecast methodech Fone) Aternative tax on qualitying shipping activities tachom soon De tax due under Section 453A) and/or Section 530) Omer see veeton-ach statement 9g 10 Total Address through Total tax Addis A10 war here, and engine Parti Section Payments o instructions 12 2020.00 by put from Form - Parti.com monen Part Ill Payments, Refundable Credits, and Section 065 Net Tax Liability 13 2018 overpayuncredited 2000 14 2020 este tax payment 16 2020 refunded foron Form 4400 10 Combines 13. 14. Md 15 17 Tax deposited with Form 7004 16 Wilholding the 10 Total payment. Addines 16, 17, and 1 20 Pendable from # Form 450 20 Form 41 200 Peserved for free 20 d Other attach statement-struction 200 1 Total crudite Addnes on the 700 22 2020 nel 65 taxabytron Form 965-. Part om dine & Beesten 23 Total payments, credits, and section 95 net tax lubility. Addiries 10.21.22 no me on page 1 Line 39 10 12 13 16 10 10 17 10 19 21 22 23 Fow 1120 00 Yes Form 110 por Schedule Other information son maratons 1 Check counting method: Oh ru/ . Other See the Iratruction date the # Busty code no Bushes My Product or service 3 is the corporation a widiwy in an alted group or a parent cody controled group? # "Yes" entrame and of the parent corporation 4 At the end of the tax year old my foreign or domestic corporation partnership including my entity treated a partnershil tutor tax-exempt organization own direct 20% or more of own, rectly or indirectly, so or more of the total voting power of all classes of the corporation's Hockened to vote7 8 "Yes" complete Parti of Schedule (Form 1120 attach Schedule Did y indidual or own directly 20% or more or own, directly or indreoty, Go or more of the total voting power of class of the corporation's stock entitled to vote? Yes. "compiute Partilof Schedule (Fom 11201 nach Schedule ) At the end of the tax year old the corporation # Own directly 20% or more or own, directly or indirectly on or more of the total voting power of a class of Mook ered to vote of any foreigner domestic corporation not included on Form 801, Afton? For des of constructive owner ...complete through below None of Mera delication Country of Incorporation Owned to HA brock Own directly on to 20 orere, or own directly or indirect, antrest of 0 or more in my foreign of domet pash Including an entity red partnershor in the beneficial trest of trust For es of constructive ownership. so intructions Yes complete through blou NEW con Nimber Country of OM Peren Orari During this tax yw, did the corporation Day dividende for hackadde and divibution change for stock) excess of the corporation's current and counulated Gaming and protta sientos 30 and 310 "Yes, the form 5452, Corporate Report of Nondividend in the instructions for Form 5452 is consolidated retum. answer here for the went corporation and informat for each subsidiary At my time during the tax you, odore foreign person own drectly or indirectly, at least 25% of the total votre power of ces of the corporation's stock entitled to vote or at least 25% of the total value of all of ourporation's stock? Foottinen 318. Yelar Percentage d Owner's country tel The corporation may have to fu Form sera, tomaton Futum of a 21:56 Foreign Owed us Corporation or a Foreign Corporation Engaged in a U. Tre Bonne Enter the number of Form 5472 Mached Check this box if the corporation und publicly offered debtruments with ongek if checked the corporation may have to le for 1201, Womation Relum for public tored valuescourt instruments Enter the wount of mot received or cred the laxy Enter the number of shareholder the end of the tax year 100 or lower if the corporation has a NOL for the tax year and is acting to forego the cabochored the bar instruction If the corporation is fing a consolidated return the mentored by mulation section 1602-21 matched of the election will not be wild Enter the available NOL carryover from or tax years ido reduce it by any deduction reported on pione) S Fm 1120G . 10 Form 11.2000 Schedule K Other Information continued wom papo 13 Are the corporation's tot recepte page 1. Ine 10, plus in 4 through 10 for the taxyne to set the end of the Ye Me tox year less than $250,000? # "Yes, the corporation de not required to complete Schedules L M-1, and M-2. Instead, enter the total amount of canh distribution and the book value of property distributions (other than made during the taxar $ 14 Is the corporation required to me Schedule UTP Fom 1120). Uncertain Tax Position Statement? See auctions "Yes, complete and attach Schedule UTP. 158 Did the corporation make any payment in 2020 that would require it to file Forma 1000 6 "Yes.did or will the corporation file required Form 10997 10 During this tax year, did the corporation have an 80%-or-more change in ownership, including a change due to redemption of Rs own stock? 17 During of subsequent to this tax year, but before the filing of this retum, did the corporation dispose of more than 65% by value of his assets in a taxable, non taxable, or tax deferred transaction? 18 Did the corporation receive Assets in a section 351 transfer in which any of the transferred assets had a fair market basis or far market value of more than $1 million? 10 During the corporation's tax year, did the corporation make any payments that would require it to file Forme 1042 and 1042-5 under chapter 3 sections 1441 through 1464) or chapter 4 sections 1471 through 1474) of the Code? Is the corporation operating on a cooperative basis7. 21 During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section 267A2 See Instructions Yes enter the total amount of the disallowed deductions Does the corporation have gross receipts of at least $500 million in any of the 3 preceding tax years? See sections Sen and H "Yes" complete and attach Form 1991. Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions 24 Does the corporation satisfy one or more of the following? Ste instructions The corporation owns a pass-through antity with current, or prior year carryover, excess business interest expense. The corporation's aggregate average annual gross receipts determined under section 448ch for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense. The corporation is a tax shelter and the corporation has business Interest expense I "Yes" complete and attach Form 1990, 25 is the corporation attaching Form 1996 to certly as a Qualified Opportunity Fund? "Yes" enter amount from Form 8996. Ine 15 $ 26 Since December 22, 2017, did a foreign corporation directly or indirectly acquire substantially all of the properties held directly or indirecty by the corporation, and was the ownership percentage by vote or value for purposes of section 7874 greater than 50% for example, the shareholders held more than 50% of the stock of the foreign corporatie)? "Yes." list the ownership percentage by vote and by value. See instructions Percentage By Vote By Value Form 1120000 Beginning For 10 por ScheduleL Balance Sheeta per Books Assets 1 In Tradenotes and our recevable Lesson for bad debts 4 US government obligatione 6 Tax-exempt securitruction . Other current ach statemen 7 Loans to wholders 8 Mortgage and real estate loans . Other investments that 10 ildings and other deprecies Les and depreciation 18 Depletables Les acud depletion 11 Land of any more 138 tangible or only Les acumular 14 Ostachment To Liabilities and Shareholders' Equity 10 Accounts payable Monges, nobody in any 10 Other current attachment 10 Loans from wareholders 20 Morgenbonds anymore 21 Olabies water Capitulok a Preferred stock Common ock 23 Additional paid in capital 24 Retained great het Retained earning propted 26 Adurowanych Les cost of track Tot i dhartholder Schedule M-1 Reconciliation of Income (LOS) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. Structions Nincones do bocah 2 Federicom per et cided on me a Excess of capital over 6 Income je to tax not recorded on Docks Es died on books this year not deducted on this Depreciation $ Chaconbon + e Travel and were Dorsord book incore Deprecation Chaos 10 Adid 1 Schedule M-2 Analysis of Unappropriated Retained Earnings per Books (Schedule L. Line 25) + Balance begingo Ditonta 2 Net income fontes 3 Once Add Sade ed of dins 12 and 1120 000 of 6 Instructions: Please complete the Urban Lifestyle Interiors, Inc.'s 2020 book tax income reconciliation and Farm 1120px 1. based upon the information provided below. If required information is missing, Teasonable assumptions to fill in the gaps. Ignore any Alternative Minimum Tax (AMT) calculations and do not prepare any AMT related forms. Urban Lifestyle Interiors, Inc. (ULT) is organized in the state of New York as a corporation and is taxed as a "C"corporation with a calendar year-end. ULI operates a delicatessen/bakery in New York City, NY that specializes in mobile food drapery for events and gatherings within the tri-state area. ULI's address, employer identification number (EIN), and date of incorporation are as follows: Urban Lifestyle Interiors, Inc. 257 West SS Avenac New York City, NY 10027 EIN-13-9823459 Date Incorporated: March 17, 2010 ULI address has not changed since its inception ULI has only common shares issued (no preferred stock). There are currently 10,000 shares of ULI common stock issued and outstanding ULI is owned by four shareholders from the same family: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. Their personal information is provided below. Raphael Giordano 160 West 57 Avenue New York City, NY 10027 SSN: 356-87-4322 Shares owned 5,500 Silvia Giordano Costa 250 South Main Hoboken, New Jersey 07030 SSN: 284-58-4583 Share owned 1,500 Andrea Giordano 65 East 55 Avenue Now York City, NY 10027 SSN: 423-84-2343 Share owned 1.500 Marco Giordano 160 West 57 Avenue New York City, NY 10027 SSN-487-27-4797 Share owned 1.500 ULI use the craal method of accounting and follows GAAP. ULI not a subsidiary nor is it in an affilinted group with any other entity, ULI is not audited by a CPA firm and has never had a restatement of its income statement ULI reported the following information for the year: ULI did not pay dividends in excess of its current and accumulated camnings and profits. None of the stock of ULI is owned by non-U.S. persons ULI has never issued publicly offered debt instruments ULI is not required to file a Form UTP. ULI made several payments in the current year that required the filing of federal Forms 1099, These Forms 1099 were filed timely by ULI During the year, none of the shareholders of ULI changed. ULI has never disposed of more than 65% (by value) of its assets in a taxable, non-taxable, or tax-deferred transaction. ULI did not receive any assets in Section 351 transfers during the year. All of the questions on Schedule B, Form 1120 should be checked "no" for the year. . Additional information: ULI has been rapidly expanding its custom design business. This expansion has required a significant amount of new equipment purchases. ULI sold some of its liquid investments in order to avoid hoking to take on debt to fund these purchases. Further, ULI invested heavily in its drapery business by significantly increasing its advertising budget. ULI and its officers expect that revenue increases from these expenditures will begin next year, The dividends received by ULI during the year were paid by Apple, Inc. ULI had its sole municipal bond (New York City) redeemed (bought back) in the current year. ULI originally purchased the New York City bonds on February 1, 2018 for $100,000 (no premium or discount paid). The bond was redeemed by New York City on February 1, 2020 for $100,000. ULI received a Form 1099-B to reflect the transaction. Box ob of the 1099-B was checked. ULI purchased 200 shares of Apple, Inc. on October 10, 2012 for $100,000 (including commission). On July 10, or the current year, ULI sold the 200 shares of Apple, Inc. for $350 a share (including commission). ULI received a 1099-B reporting the sale proceeds. Bax 6b was checked on the Form 1099-3 During the year, UL. contributed S108,000 to various sec, 501(c)(3) charitable organizations. On December 10, UL paid Madison Advertising $27.500 10 design a new drapery advertisement campaign for next year. This money represented half of the total $55.000 contract price. ULI expects that the services will be provided and delivered to UL about June 30, 2021 ULI prepaid an insurance premium of $21.000 in September the new policy is effective October 1, 2020 through September 30, 2021 ULI received life insurance proceeds a result of the CEO's death on S200,000 and paid premiums en keyan life insurance policies of 21.000 Rental Income Rental income payments received and earned in 2020 Rental income peyments received in 2019 but carned in 2020 Rental income payments received in 2020 but not eamed by year end 15,000 10,000 30,000 ULI's regular tax depreciation for the year is correctly calculated as $350,000 before considering the SHEREHE Yfixed Anet.addition S840.000 fee table below). ULI does not want to elect any $179 expensing or bonus depreciation Total current year asset additions are as follows (all the equipment purchased was new) Date Purchased October 2, 2020 Amount $480,000 Description S-year MACRS Property 7-year MACRS Property Delivery Truck: 5-year MACRS Property September 10, 2020 $320,000 October 12, 2020 $40,000 ULI officer information for the year is as follows (compensation amounts included in total wages on the income statement for all employees): Name Social Security number Percent of stock owned Amount of compensation Raphael Giordano Silvia Costa Andrea Giordano Marco Giordano 356-87.4322 284.58-4583 423-84-2343 487-27-4797 Percent of time devoted to business 10094 100 104 100 1596 15% 150,000 130.000 130,000 120.000 1998 As reported on the balance sheet (see below), on December 31, 2019 the accrued wages were $44.500 and the accrued bonuses were $45,000. The wages and bonuses were payable to Raphael, Silvia, Andrea, and Marco. These accrued wages and bonuses were paid on January 20, of 2020. Also, as reported on the balance sheet, on December 31, 2020, the accrued wages were $51.500. The wages were owed to Raphael. Silvia. Andrea, and Marce, The accrued wages were paid os Sanuary 22, 2021(Related party transactions) All the other employees wages and bonuses were paid on December 31, 2020, As of December 21 2019 and December 31, 2020, respectively. ULI had accrued vacation payable on its books or 562,500 and 573.000. All the 2019 vacuation accrual was paid during the period from April through November 30, 2020. As of March 15, 2021 ULI had paid none of its 2020 accrual. All of the Vacation accrual amounts for both years were owed to employees other than Raphael Silvia, Andrea, and Marco. None of the officers had accrued vacation at December 31, 2019 2020. (See Economic Performance rules) ULI maintains an inventory of several items. Inventory is valued at cost. ULI has never changed its inventory method. ULI uses specific identification for its inventory. ULI has never written down any subnormal goods. The rules of Section 263A (UNICAP) do not apply to ULI. ULI did not pay a dividend in the current year and ULI made no estimated tax payments during the current year. ULI wrote of $35,000 of uncollectible A/R in 2020, Financial Statements (kept on GAAP basis): Urban Lifestyle Interiors, Inc. Balance Sheet Assets: 12/31/2019 121/2020 Cash Accounts Receivable Less: Allowance for Bad Debts Inventory Publicly traded securities Tax-exempt bond U.S. Treasury Bonds Fixed Assets Less: Acc. Depreciation Prepaid Insurance Prepaid Rent Prepaid Advertising Total Assets: $ 62,500 145,000 (32,000) 59,000 100,000 100,000 125,000 2,115,000 (436,500) 0 38,500 0 $ 165,180 577,000 (41,000) 96,000 0 0 125,000 2,955,000 (715,000) 15,750 39.500 27.500 $2,276.500 3.244.930 Liabilities and Shareholders' Equity: Accounts Payable Accrued Bonuses Accrued Vacation Accrued Wages Unearned Rental Income Event Deposits Deferred Tax Liability Note Payable-First Bank of NY (Credit Line) Note Payable-EG Capital Equipment Leasing Capital Stock Additional paid-in Capital Retained Earnings-Unappropriated Total Liabilities and Shareholders' Equity: 102,000 45,000 62,500 44,500 0 0 45,910 424,000 1.243,000 131,000 0 73,000 51.500 30,000 100,000 14,000 657.000 1.415.000 1,000 99,000 209,590 1,000 99,000 673430 S2.276.500 $3244.920 Income Statement for the period ending December 31, 2020 Item Amount Income: Gross Sales Less Returns Net Sales 3,325,000 (8.500) 3,316,500 Cost of Goods Sold 01.129,850 Gross Profit 2,186,650 Dividend Income Rental Income Interest Income -Bank Interest Income-U.S. Treasury Municipal Bond Interest Income Proceeds from Life Insurance on deceased CEO Capital Los-Apple, Inc. 2,800 55,000 150 3,000 1,400 200,000 (30.000) 2,419,000 Total Income Expenses Employee Salaries Repairs and Maintenance Bad Debts Rent Payroll Taxes Fines & Penalties Property Taxes Interest Expense Depreciation Office Supplies Employee Training Employee Benefits Charitable Contribution Advertising Meals and Entertainment Travel Insurance Utilities Telephone Federal income tax expensohenelit) 743,500 19,000 44,000 230,000 60,000 4,500 12.500 140,000 278,500 5.400 3,600 24,000 105,000 70,000 3.400 600 19,750 142.000 14.500 31,910 Total Expenses 1.955.160 Net Income (L03) $460 Big City Designs, Inc. 12/31/2020 Book-Tax Reconciliation Bool-Tax Adjustments Debit Credit Book Income Dr10 3,325,000 (8.500) 1.129.50) 2166,650 Taxable income Dr/C 3325,000 (4.500) (1, 120.250) 2,135,650 Description Revenue from sales Lew: Returns Lese: Cost of goods sold Gross profit Other Income Dividend Income Rental Income Interest income-Bank Interest Income US Treasury Municpal bond Interest income Proceeds from Ufe Insurance Loss on sale of Apple, Inc, stock Total income Expenses: Employee salaries Employee salaries (Accrued Wages) Employee salaries (Accrued Bonuses) Employee salaries (Accrued Vacation) Repairs and maintance Bad debts 2,800 55,000 150 2.000 1,400 200,000 (30,000) 2.419,000 2.800 55.000 150 2.000 1,400 200.000 (30.000 2.410.000 1743,5001 1741.500) Pen.300 ) Rent Payroll taxes Fines & Penalties Property taxes Interest expense Depreciation Office supplies Employee training Employee benefits Charitable contribution (down below) Advertising Meals and entertainment (19,000) (44,000) 12.30,000 (60,000) (4.500 (12,5001 1140,000 1278,500 15,400) GOD! (24.0001 119.000) 144,0001 230,000 160,000 14.500 (12.500 (140,000) (278.500 15.400 (2.600 124.000 Insurance Utilities Telephone Federal tax expenses/benefit Total expenses before DRD/NOL/Charitable Taxable income before DRD/NOL/Charitable Charitable contribution Taxable income before DRD Dividends received deduction (DRO) Book/taxable income foss (70,000 0.4001 600 (19.750 (142,000 (14.500 OL. 9101 11,847 1601 571,640 110.000 170.000 14001 100 119.750 (142.000 (14.500 91.9103 1.47.16 5715 (10.000 463.560 461540 . -1120 2020 U.S. Corporation Income Tax Retum Foreverer 100 w 20 te The A che De ter TYPE UN OR NATURE Geroporc Perodingen PRINT Cyrtowe proudly pode Door 3 & CCM mm 14 Adware ta Grossaceptos Returns and slowances Balance Subtractine 1b from Ene 18 To 2 Cost of goods soldach Form 1125-A. 2 Gross profit. Subtractine 2 from inte 3 4 Dividends and inclusion Schedule ne 23 4 5 Interest 6 . Groete 7 Gross royar 7 6 Capital annet income attach Schedule Form 11209 Ne gain or fou from Form 4797. Partine 17th Fom 0 10 Other income reactionach went 10 11 Total theone. Add lines 10 11 12 Compensation of officer inrich Form 1125- 12 13 Sward was amployment credit 13 14 Repair and maintenance 14 16 tad debts 16 10 Planta 10 17 Trendleri 17 10 Intereste natruction 18 Charable contributors 10 Depreciation from Form 4562 noted Form 1125 A omach Form 4562 20 21 Depletion 21 Advertising Pension prohing, etc. plans 23 24 Employee bent program 24 Fested for Me 25 Omer det med 26 27 Total deductions. Adnes 12h20 27 Tanabe income before net operating om deduction and contracte 27 home 11 20 Nel operating som deduction struction bipeci deduction schedule C, 20 Address 30 Taxable income Subtine 28 from 2 ton 30 31 Total larichedule 3. Plne 15) 31 2020 by die Part 12 32 Total path and 15.2 Ested operate 34 Amount owed line 33 dowed Overpayment wine 30 Ermour homme credited to 2021 Rended 37 Sign M Here YEN Paid PER to praca Preparer Use Only EN Fer Paperwork Reduction Act Notice separate instruccione Citta om 112000 To Deductions See Instructions for Bronson dediction ****888 BENRAA Form 1102 Schedule C Dividenda, Inolusions, and Special Deductions (5.00 Instructions) 1 Dividende from east-20%-owned domestic corporatione other than debt financed Die Pepe 2 padure WA N 50 2 Dividends from 20%-or-more-owned comestic corporations to her an debt financed 85 3 Rene 4 23.3 28.7 6 50 7 65 100 bidende en ontain debt financed stock of domestic and foreign corporation Didence on ostain preferred tack of wo-than-20%-owned public Dividende on certain preferred stock of 20%-mere-owned publice Dividence from than 20%-owned foreign corporations and contain FC Dividends from 20%-or-more-owned foreign corporationem carta Dividence from wholly owned foreign ibtidos Subtotal. Addins 1 Through Structions for tione Dividends from dome corpore received by a business westment company operating under the Small Business Instant Act of 1958 Dividends from aflated group members Dividends from certain FSC Foreign-source portion of dividende roeived from a specified 10 ned foreign corporation ding hybrid dividende rutin Dividend from forson corporations not welded on ine 3, 7, 11, 12, or 13 including wy hybrid dividendal w 10 100 100 12 13 100 100 100 15 Section inclusion 10 Subpart Findlusions derived from the sale by a controlled for corporation ICFO the stock of a lower-tie formign corporation rated as a dividend nach Form 547) intruction Bubpart indhention derved from hybrid dividende offered corporation artahot 5471see instruction Other incontrom CFCs under boat Foncluded on line 15. 16. 16. Or 17 attach Form 5471) instruction 17 Global tarpble Low-Tamad ron (GLTU butach Form 5471 and Form 2002) 10 Gross-up for foreign the dead paid 10 IC-on and former besc diviends not included on line 1.2, 6-3 20 One dividende 21 Deduction for video pind on certain predstock of public 23 Section 210 deduction tech For 990) Total dividends and inclusions. A column. In 9 hou 20. Ested page 1. in Total special deductionsAdd columnes though 22. Con line 290 244 Form 1120 000 Page 3 2 3 4 Form 1100 000 Schedule J Tax Computation and Payment (500 Instructions) Part I-Tex Computation 1 Check the corporation is a member of controled group attach Schedule ofForm 1120. See vatructions 2 neeme tak. Behren 3 ne erosion minimum tax amount (attach Form 1991) 4 Add ines 2 and 3 50 Foreign tax credit attach Form 1118) 50 b Credit from Fonn 1634 (vetlona) e General business credit with Form 3 be Credit for prior year minimum taxatoh Form 1827) Od Bond credits from Fon 012 Total credits. Addines Samoigh 5 7 Subtractine rom line 4 . Personal holding company tax attach Schede PH Form 1120) Os Recapture of investment credit attach Form 426) Recapture of low-income housing creditch For 8011) Interest due under the look back method completed in term contacto Form 66971 De d Interest du under the look back method-income forecast methodech Fone) Aternative tax on qualitying shipping activities tachom soon De tax due under Section 453A) and/or Section 530) Omer see veeton-ach statement 9g 10 Total Address through Total tax Addis A10 war here, and engine Parti Section Payments o instructions 12 2020.00 by put from Form - Parti.com monen Part Ill Payments, Refundable Credits, and Section 065 Net Tax Liability 13 2018 overpayuncredited 2000 14 2020 este tax payment 16 2020 refunded foron Form 4400 10 Combines 13. 14. Md 15 17 Tax deposited with Form 7004 16 Wilholding the 10 Total payment. Addines 16, 17, and 1 20 Pendable from # Form 450 20 Form 41 200 Peserved for free 20 d Other attach statement-struction 200 1 Total crudite Addnes on the 700 22 2020 nel 65 taxabytron Form 965-. Part om dine & Beesten 23 Total payments, credits, and section 95 net tax lubility. Addiries 10.21.22 no me on page 1 Line 39 10 12 13 16 10 10 17 10 19 21 22 23 Fow 1120 00 Yes Form 110 por Schedule Other information son maratons 1 Check counting method: Oh ru/ . Other See the Iratruction date the # Busty code no Bushes My Product or service 3 is the corporation a widiwy in an alted group or a parent cody controled group? # "Yes" entrame and of the parent corporation 4 At the end of the tax year old my foreign or domestic corporation partnership including my entity treated a partnershil tutor tax-exempt organization own direct 20% or more of own, rectly or indirectly, so or more of the total voting power of all classes of the corporation's Hockened to vote7 8 "Yes" complete Parti of Schedule (Form 1120 attach Schedule Did y indidual or own directly 20% or more or own, directly or indreoty, Go or more of the total voting power of class of the corporation's stock entitled to vote? Yes. "compiute Partilof Schedule (Fom 11201 nach Schedule ) At the end of the tax year old the corporation # Own directly 20% or more or own, directly or indirectly on or more of the total voting power of a class of Mook ered to vote of any foreigner domestic corporation not included on Form 801, Afton? For des of constructive owner ...complete through below None of Mera delication Country of Incorporation Owned to HA brock Own directly on to 20 orere, or own directly or indirect, antrest of 0 or more in my foreign of domet pash Including an entity red partnershor in the beneficial trest of trust For es of constructive ownership. so intructions Yes complete through blou NEW con Nimber Country of OM Peren Orari During this tax yw, did the corporation Day dividende for hackadde and divibution change for stock) excess of the corporation's current and counulated Gaming and protta sientos 30 and 310 "Yes, the form 5452, Corporate Report of Nondividend in the instructions for Form 5452 is consolidated retum. answer here for the went corporation and informat for each subsidiary At my time during the tax you, odore foreign person own drectly or indirectly, at least 25% of the total votre power of ces of the corporation's stock entitled to vote or at least 25% of the total value of all of ourporation's stock? Foottinen 318. Yelar Percentage d Owner's country tel The corporation may have to fu Form sera, tomaton Futum of a 21:56 Foreign Owed us Corporation or a Foreign Corporation Engaged in a U. Tre Bonne Enter the number of Form 5472 Mached Check this box if the corporation und publicly offered debtruments with ongek if checked the corporation may have to le for 1201, Womation Relum for public tored valuescourt instruments Enter the wount of mot received or cred the laxy Enter the number of shareholder the end of the tax year 100 or lower if the corporation has a NOL for the tax year and is acting to forego the cabochored the bar instruction If the corporation is fing a consolidated return the mentored by mulation section 1602-21 matched of the election will not be wild Enter the available NOL carryover from or tax years ido reduce it by any deduction reported on pione) S Fm 1120G . 10 Form 11.2000 Schedule K Other Information continued wom papo 13 Are the corporation's tot recepte page 1. Ine 10, plus in 4 through 10 for the taxyne to set the end of the Ye Me tox year less than $250,000? # "Yes, the corporation de not required to complete Schedules L M-1, and M-2. Instead, enter the total amount of canh distribution and the book value of property distributions (other than made during the taxar $ 14 Is the corporation required to me Schedule UTP Fom 1120). Uncertain Tax Position Statement? See auctions "Yes, complete and attach Schedule UTP. 158 Did the corporation make any payment in 2020 that would require it to file Forma 1000 6 "Yes.did or will the corporation file required Form 10997 10 During this tax year, did the corporation have an 80%-or-more change in ownership, including a change due to redemption of Rs own stock? 17 During of subsequent to this tax year, but before the filing of this retum, did the corporation dispose of more than 65% by value of his assets in a taxable, non taxable, or tax deferred transaction? 18 Did the corporation receive Assets in a section 351 transfer in which any of the transferred assets had a fair market basis or far market value of more than $1 million? 10 During the corporation's tax year, did the corporation make any payments that would require it to file Forme 1042 and 1042-5 under chapter 3 sections 1441 through 1464) or chapter 4 sections 1471 through 1474) of the Code? Is the corporation operating on a cooperative basis7. 21 During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section 267A2 See Instructions Yes enter the total amount of the disallowed deductions Does the corporation have gross receipts of at least $500 million in any of the 3 preceding tax years? See sections Sen and H "Yes" complete and attach Form 1991. Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions 24 Does the corporation satisfy one or more of the following? Ste instructions The corporation owns a pass-through antity with current, or prior year carryover, excess business interest expense. The corporation's aggregate average annual gross receipts determined under section 448ch for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense. The corporation is a tax shelter and the corporation has business Interest expense I "Yes" complete and attach Form 1990, 25 is the corporation attaching Form 1996 to certly as a Qualified Opportunity Fund? "Yes" enter amount from Form 8996. Ine 15 $ 26 Since December 22, 2017, did a foreign corporation directly or indirectly acquire substantially all of the properties held directly or indirecty by the corporation, and was the ownership percentage by vote or value for purposes of section 7874 greater than 50% for example, the shareholders held more than 50% of the stock of the foreign corporatie)? "Yes." list the ownership percentage by vote and by value. See instructions Percentage By Vote By Value Form 1120000 Beginning For 10 por ScheduleL Balance Sheeta per Books Assets 1 In Tradenotes and our recevable Lesson for bad debts 4 US government obligatione 6 Tax-exempt securitruction . Other current ach statemen 7 Loans to wholders 8 Mortgage and real estate loans . Other investments that 10 ildings and other deprecies Les and depreciation 18 Depletables Les acud depletion 11 Land of any more 138 tangible or only Les acumular 14 Ostachment To Liabilities and Shareholders' Equity 10 Accounts payable Monges, nobody in any 10 Other current attachment 10 Loans from wareholders 20 Morgenbonds anymore 21 Olabies water Capitulok a Preferred stock Common ock 23 Additional paid in capital 24 Retained great het Retained earning propted 26 Adurowanych Les cost of track Tot i dhartholder Schedule M-1 Reconciliation of Income (LOS) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. Structions Nincones do bocah 2 Federicom per et cided on me a Excess of capital over 6 Income je to tax not recorded on Docks Es died on books this year not deducted on this Depreciation $ Chaconbon + e Travel and were Dorsord book incore Deprecation Chaos 10 Adid 1 Schedule M-2 Analysis of Unappropriated Retained Earnings per Books (Schedule L. Line 25) + Balance begingo Ditonta 2 Net income fontes 3 Once Add Sade ed of dins 12 and 1120 000