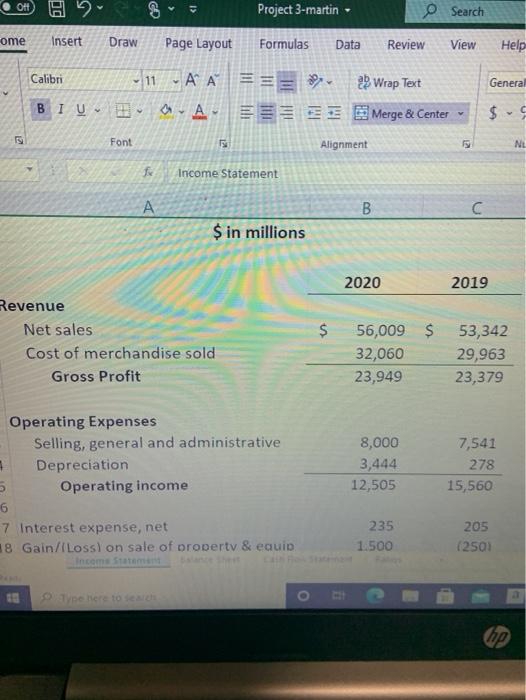

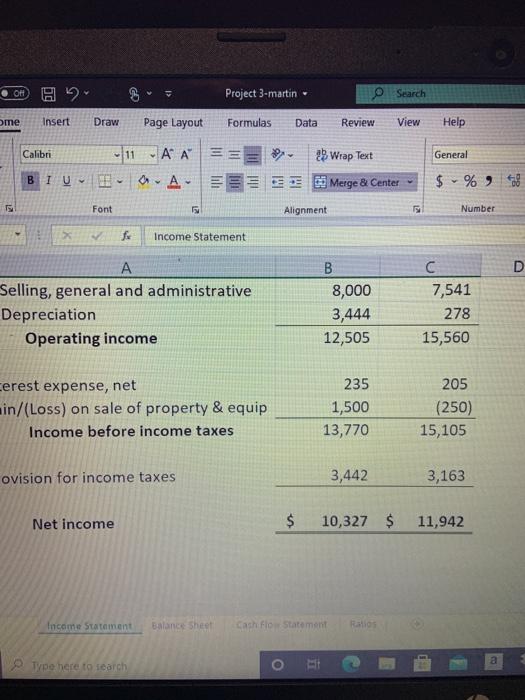

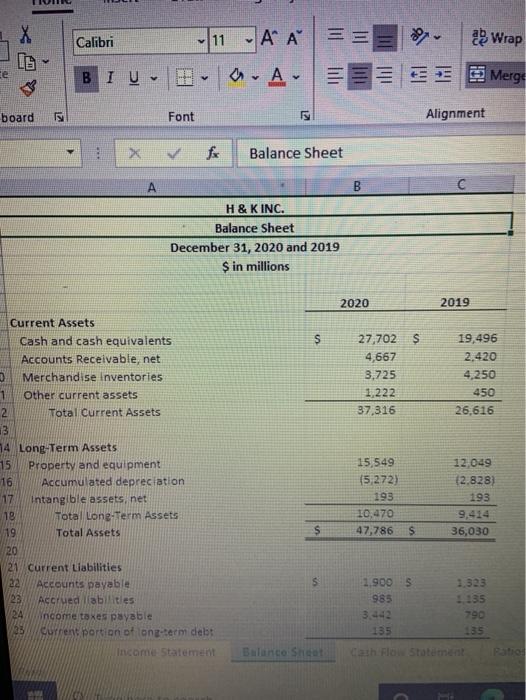

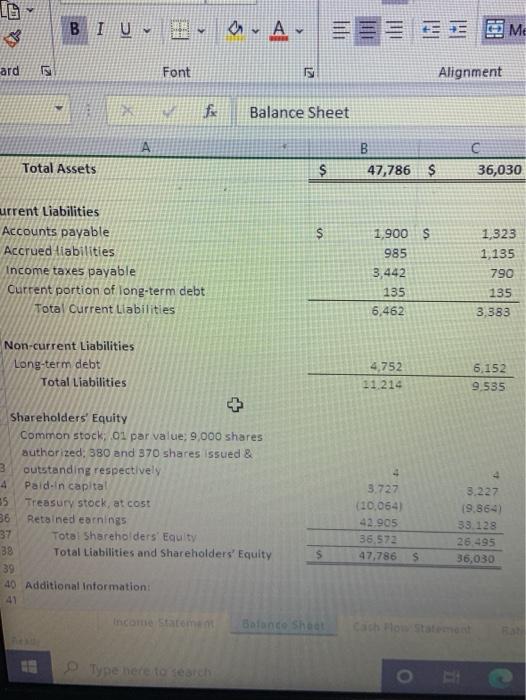

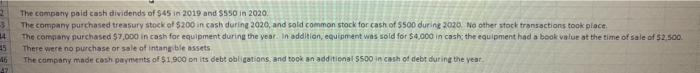

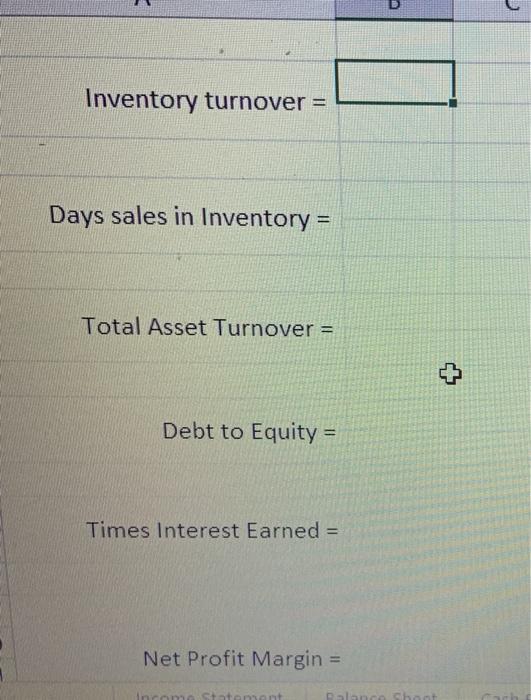

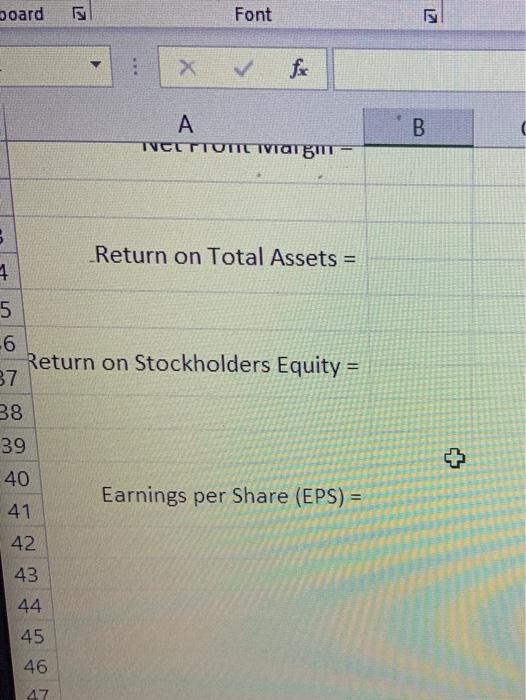

of B Project 3-martin O Search ome Insert Draw Page Layout Formulas Data Review View Help Calibri General 11 AA a. A 25 Wrap Text 3 Merge & Center $ % 918 Font Alignment Number Income Statement D A Selling, general and administrative Depreciation Operating income B 8,000 3,444 12,505 C 7,541 278 15,560 erest expense, net in/(Loss) on sale of property & equip Income before income taxes 235 1,500 13,770 205 (250) 15,105 ovision for income taxes 3,442 3,163 Net income $ 10,327 $ 11,942 Income Statement Balance Sheet cash flo Statement Ratios Type here to search a o Calibri 11 A A Wrap e BIUD av A. 3 Merge board Font Alignment V Balance Sheet A B H&K INC. Balance Sheet December 31, 2020 and 2019 $ in millions 2020 2019 S 27,702 $ 4,667 3,725 1.222 37,316 19,496 2.420 4,250 450 26,616 Current Assets Cash and cash equivalents Accounts Receivable, net 3 Merchandise Inventories 1 Other current assets 2 Total Current Assets 3 4 Long-Term Assets 15 Property and equipment 16 Accumulated depreciation 17 Intangible assets, net 18 Total Lone-Term Assets 19 Total Assets 20 21 Current Liabilities 22 Accounts payable 23 Accrued abilities 24 ncome taxes payable 33 Current portion of long-term debt 15,549 (5,272) 193 10,470 47,786 12.049 (2.828) 193 S S 36,030 5 1.900 5 985 3.442 135 1.323 135 790 135 Balance Sheet cathlon Statement 44 15 Mb 47 The company paid cash dividends of $45 in 2019 and S550 in 2020 The company purchased treasury stock of $200 in cash during 2020, and sold common stock for cash of 5500 durine 2020. No other stock transactions took place The company purchased $7,000 in cash for equipment during the year. In addition, equipment was sold for $4,000 in cash the equipment had a book value at the time of sale of $2.500 There were no purchase or sale of intang ble assets The company made cash payments of $1.900 on its debt obligations and took an additional $500 in cash of debt during the year board Font KZ X B . TVEITT TIL VIATGT B 3 Return on Total Assets = 4. 5 -6 Return on Stockholders Equity = 87 38 39 40 Earnings per Share (EPS) = 41 42 43 44 45 46 47