Of Chester Corporations products, which earned the highest Net Margin as a percentage of its sales?Select: 1

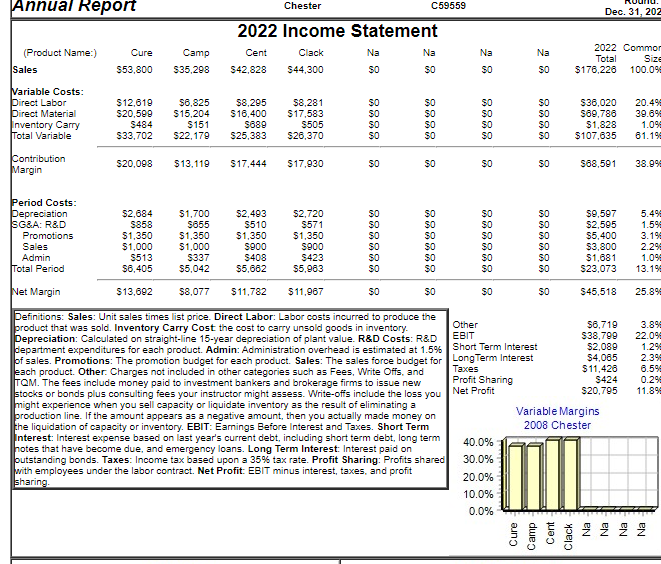

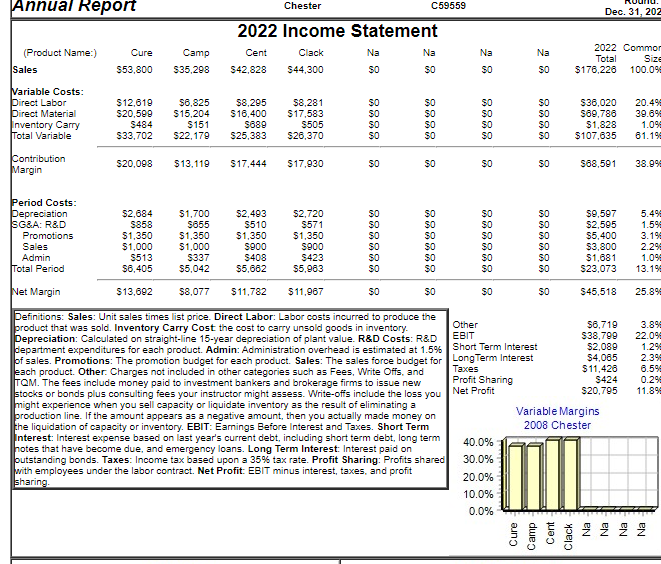

Annual Report Dec. 31, 202 Chester C59559 2022 Income Statement Cent Cent Clack Clack Na Na S42,828 S44,300 (Product Name:) Sales Na Cure S53,800 Camp $35,298 Na $0 2022 Commor Total Size $176,226 100.099 Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable SO SO $12,619 $20,599 S484 $33,702 $6,825 $8,295 $8,281 $15,204 $16,400 $17,583 S1513889S505 S22,179 $25,383 $26,370 $36,020 $69,786 $1,828 $107,635 20.49 39.898 1.099 61.199 Contribution Margin $20,098 $13.119 $17,444 $17,930 $0 $68,591 38.999 Period Costs: Depreciation SG.A: R&D Promotions Sales Admin Total Period $2,684 5858 $1,350 $1,000 S513 $6,405 $1,700 S855 $1,350 $1,000 S337 $5,042 $2,493 S510 $1,350 S900 S408 $5,662 $2,720 S571 $1,350 S900 S423 $5.963 $9,597 $2,595 $5,400 $3,800 $1,681 $23,073 5.498 1.598 3.19 2.29 1.099 13.19 Net Margin $13,692 $8,077 $11,782 $11.967 SO $45,518 25.89 Other EBIT Short Term Interest Long Term Interest Taxes Profit Sharing Net Profit $6,719 $38,799 $2,089 $4,085 $11,426 $424 $20.795 3.898 22.09 1.29 2.39 6.59 0.29 11.89 Definitions: Sales: Unit sales times list price Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for each product. Other. Charges not included in other categories such as Fees, Write Offs, and TQM. The fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest: Interest expense based on last year's current debt, including short term debt, long term notes that have become due, and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing Variable Margins 2008 Chester 40.0% 1 30.0% 20.0% 10.0% 0.0% Cure Camp Cent Clack 2