Answered step by step

Verified Expert Solution

Question

1 Approved Answer

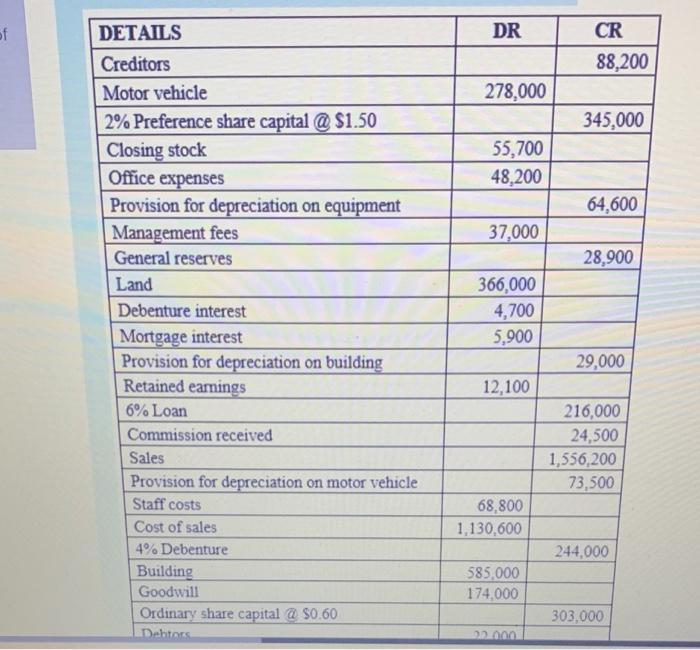

of DETAILS Creditors Motor vehicle 2% Preference share capital @ $1.50 Closing stock Office expenses Provision for depreciation on equipment Management fees General reserves

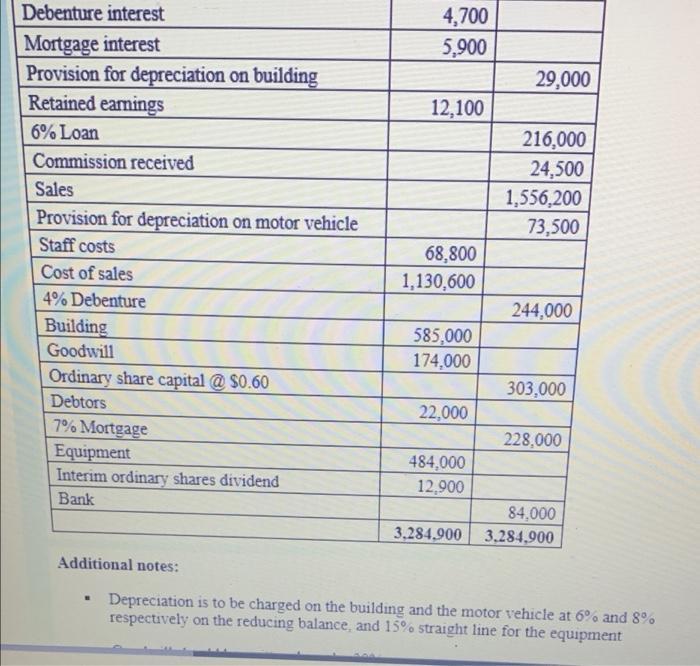

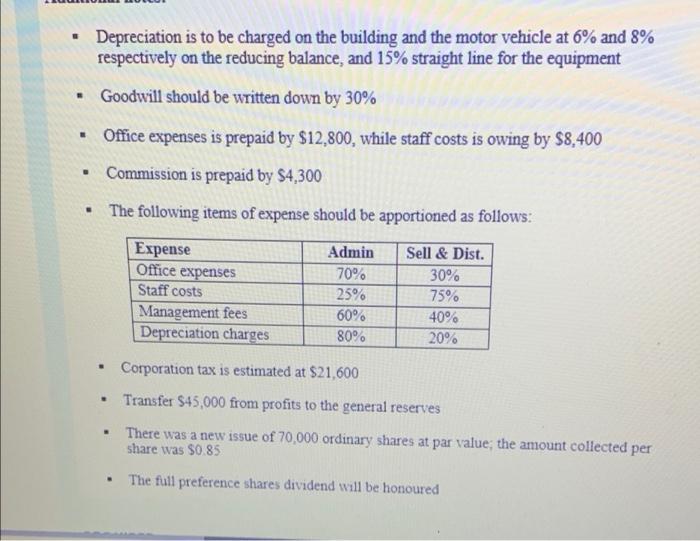

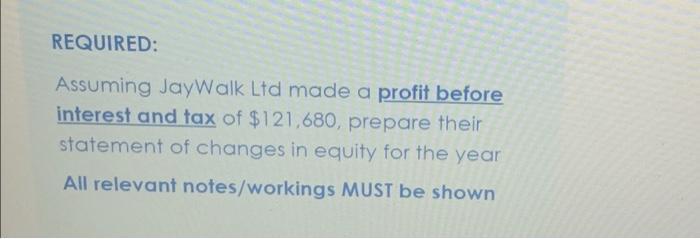

of DETAILS Creditors Motor vehicle 2% Preference share capital @ $1.50 Closing stock Office expenses Provision for depreciation on equipment Management fees General reserves Land Debenture interest Mortgage interest Provision for depreciation on building Retained earnings 6% Loan Commission received Sales Provision for depreciation on motor vehicle Staff costs Cost of sales 4% Debenture Building Goodwill Ordinary share capital @ $0.60 Debtors DR 278,000 55,700 48,200 37,000 366,000 4,700 5,900 12,100 68,800 1,130,600 585,000 174,000 22.000 CR 88,200 345,000 64,600 28,900 29,000 216,000 24,500 1,556,200 73,500 244,000 303,000 4,700 Debenture interest Mortgage interest 5,900 Provision for depreciation on building Retained earnings 12,100 6% Loan Commission received Sales Provision for depreciation on motor vehicle Staff costs 68,800 Cost of sales 1,130,600 4% Debenture 244,000 Building 585,000 Goodwill 174,000 Ordinary share capital @ $0.60 303,000 Debtors 22,000 7% Mortgage 228,000 Equipment 484,000 12,900 Interim ordinary shares dividend Bank 84,000 3,284,900 3,284,900 Additional notes: Depreciation is to be charged on the building and the motor vehicle at 6% and 8% respectively on the reducing balance, and 15% straight line for the equipment 29,000 216,000 24,500 1,556,200 73,500 . Depreciation is to be charged on the building and the motor vehicle at 6% and 8% respectively on the reducing balance, and 15% straight line for the equipment - Goodwill should be written down by 30% Office expenses is prepaid by $12,800, while staff costs is owing by $8,400 . Commission is prepaid by $4,300 . The following items of expense should be apportioned as follows: Expense Admin Sell & Dist. 70% 30% Office expenses Staff costs 25% 75% Management fees 60% 40% Depreciation charges 80% 20% . Corporation tax is estimated at $21,600 .. Transfer $45,000 from profits to the general reserves ... There was a new issue of 70,000 ordinary shares at par value; the amount collected per share was $0.85 The full preference shares dividend will be honoured REQUIRED: Assuming JayWalk Ltd made a profit before interest and tax of $121,680, prepare their statement of changes in equity for the year All relevant notes/workings MUST be shown

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the requirement using excel Formula A 1 2 Particulars 3 Sales 4 COGS 5 Gross Prof...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started