Answered step by step

Verified Expert Solution

Question

1 Approved Answer

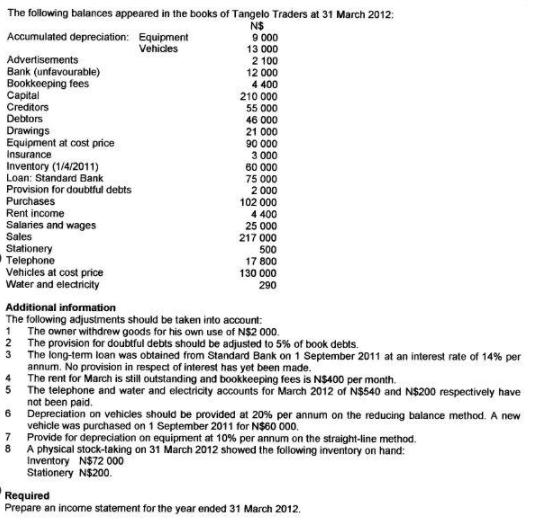

The following balances appeared in the books of Tangelo Traders at 31 March 2012: N$ 9 000 13 000 2 100 12 000 4

The following balances appeared in the books of Tangelo Traders at 31 March 2012: N$ 9 000 13 000 2 100 12 000 4 400 210 000 55 000 46 000 21 000 90 000 3 000 60 000 75 000 2 000 102 000 4 400 25 000 217 000 500 17 800 130 000 290 Accumulated depreciation: Equipment Vehicles Advertisements Bank (unfavourable) Bookkeeping fees Capital Creditors Debtors Drawings Equipment at cost price Insurance Inventory (1/4/2011) Loan: Standard Bank Provision for doubtful debts Purchases Rent income Salaries and wages Sales Stationery Telephone Vehicles at cost price Water and electricity Additional information The following adjustments should be taken into account: 1 The owner withdrew goods for his own use of N$2 000. 2 The provision for doubtful debts should be adjusted to 5% of book debts. 3 The long-tem loan was obtained from Standard Bank on 1 September 2011 at an interest rate of 14% per annum. No provision in respect of interest has yet been made. The rent for March is still outstanding and bookkeeping fees is N$400 per month. 5 4 The telephone and water and electricity accounts for March 2012 of N$540 and N$200 respectively have not been paid. 6 Depreciation on vehicles should be provided at 20% per annum on the reducing balance method. A new vehicle was purchased on 1 September 2011 for N$60 000. 7 Provide for depreciation on equipment at 10% per annum on the straight-line method. 8 A physical stock-taking on 31 March 2012 showed the following inventory on hand: Inventory N$72 000 Stationery N$200. Required Prepare an income statement for the year ended 31 March 2012,

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Note symbol has been used instead of N Before preparing income statement effects of adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started