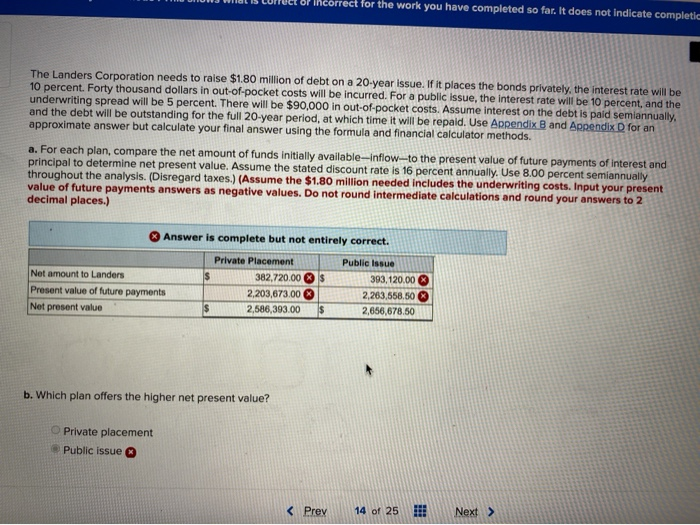

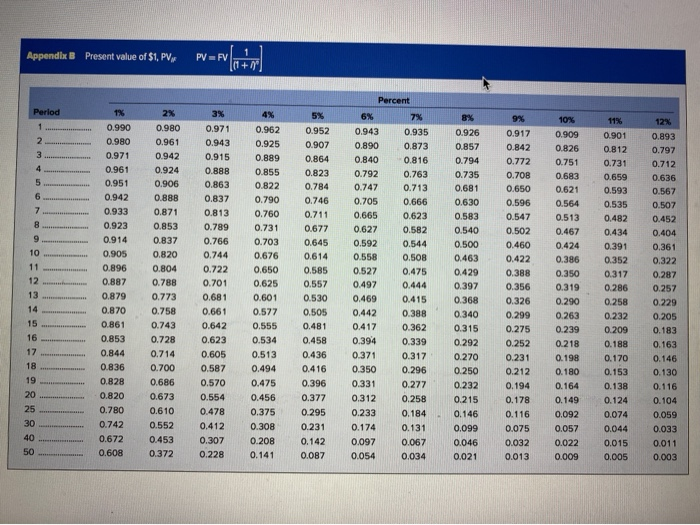

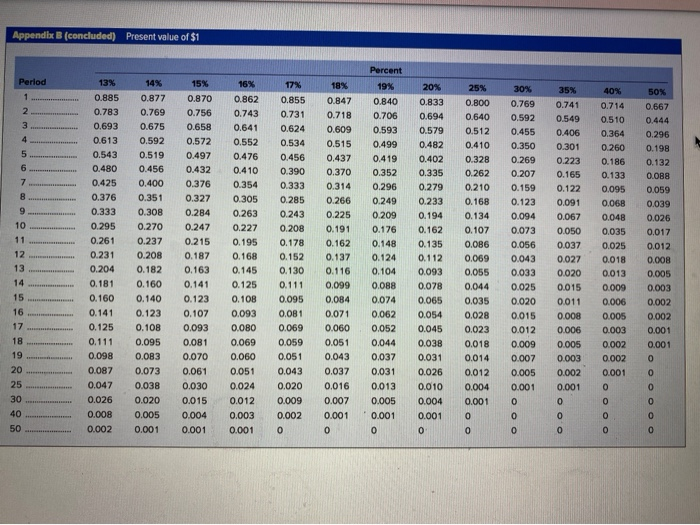

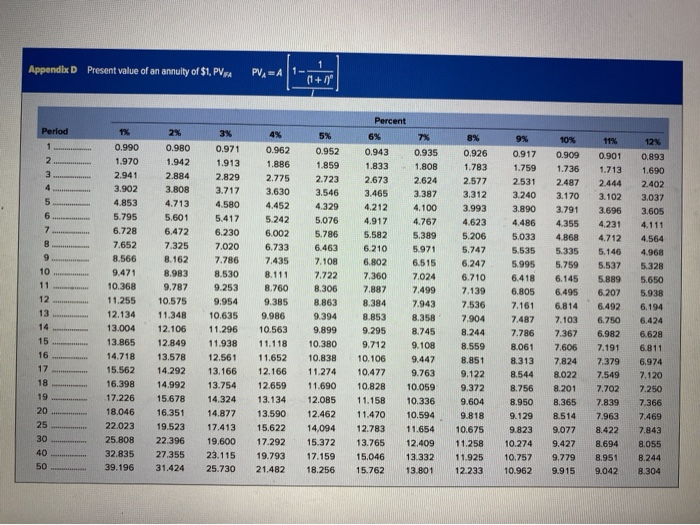

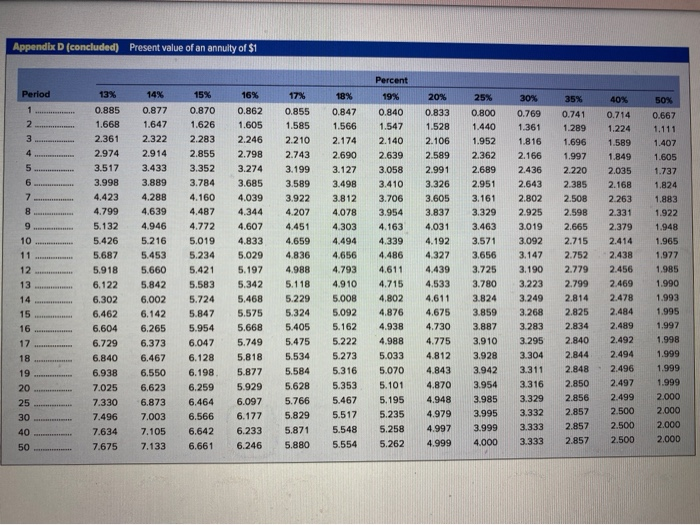

of Thcorrect for the work you have completed so far. It does not indicate completic The Landers Corporation needs to raise $1.80 million of debt on a 20-year issue. If it places the bonds privately, the interest rate will be 10 percent. Forty thousand dollars in out-of-pocket costs will be incurred. For a public issue, the interest rate will be 10 percent, and the underwriting spread will be 5 percent. There will be $90,000 in out-of-pocket costs. Assume interest on the debt is paid semiannually, and the debt will be outstanding for the full 20-year period, at which time it will be repald. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. For each plan, compare the net amount of funds initially available-inflow-to the present value of future payments of interest and principal to determine net present value. Assume the stated discount rate is 16 percent annually. Use 8.00 percent semiannually throughout the analysis. (Disregard taxes.) (Assume the $1.80 million needed includes the underwriting costs. Input your present value of future payments answers as negative values. Do not round intermediate calculations and round your answers to 2 decimal places.) Answer is complete but not entirely correct. Private Placement Public Issue Net amount to Landers $ 382,720.00 393,120.00 Present value of future payments 2,203,673.00 2,263,558,50 Net present value $ 2,586,393.00 2,656,678.50 b. Which plan offers the higher net present value? Private placement Public issue Appendix B Present value of $1, PV PV = FV |(1 + 0 Period 1% 2% 8% 11% 1 2 3 4 5 6 7 10 11 12 13 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0.339 0.371 0.317 0.350 0.296 0.331 0.277 0.312 0.258 0.233 0.184 0.174 0.131 0.097 0.067 0.054 0.034 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 14 15 16 17 18 19 20 25 30 40 50 Appendix B (concluded) Present value of $1 Percent 13 Period 1 20 2 3 4 5 6 7 9 0.885 0.783 0.693 .613 0.543 0.480 0.425 0.376 0.333 0, 295 0.261 0.231 0,204 0. 181 0.160 0.141 0,125 0.111 0.098 .087 0,047 0.026 0.008 .002 10 11 12 13 14 15 16 17 14x 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.100 0.140 . 123 0.108 0.095 . 0.073 0.038 0.020 0.005 0.001 15 .870 0.756 0.658 0,572 0497 0.432 0.376 0.327 0.284 0.247 0215 0.187 0.163 0.141 0.123 0.107 0.093 .081 0.070 0.061 .030 .015 0.004 0.001 16x 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0 263 0.227 0.195 0.168 0.145 0.125 0,100 0.003 . 0.069 0.060 .051 0.024 0.012 0.003 0.001 17 0.855 0.731 0.624 0.534 0.456 0.390 0333 0 285 0.243 0, 208 0.178 0.152 . 130 0.111 .095 0.00 1 0.069 0.059 .051 0.043 0,020 .009 18x 0.847 0.71B 0.609 0.515 0,437 0,370 0.314 0.266 0.225 0.191 0,162 0.137 0.116 0,099 0.084 .071 0.060 0.051 0.043 0.037 0,016 0.007 0.001 19x 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0 209 0.176 0.148 0.124 0,104 0.088 0.074 0.062 0.052 0.044 0,037 0.031 0.013 .005 0.001 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 . 194 0.162 0.135 0,112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.010 0.004 0.001 25% 0.800 0.640 0.512 0.410 0.328 0,262 0, 210 0.168 0.134 0.107 0.06 0.069 0.055 0.044 0,035 0.028 0.023 0.018 0.014 0.012 0.004 0.001 0 40% 0.714 0510 0.364 0.260 . 186 0.133 0,095 0 068 0.048 0.035 0.025 0.018 0.013 0.769 0.592 0.455 0.350 0 269 0.207 . 159 0.123 .094 .073 .056 0.043 0033 0.025 0.020 0015 .012 0.009 0.007 0.005 0.001 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.001 0.067 0.050 0.037 0.027 0 020 0015 0011 0 008 0 006 0.005 0.003 0.002 0.001 .667 0.444 0.296 0.198 0.132 . 0.059 0.039 0.026 0,017 0.012 0.008 0.006 0.003 0.002 0.002 0.001 0.001 0 0.000 0 006 0.005 0.003 0.002 0.002 .001 18 0 19 20 25 30 40 50 0 0.002 0 Appendix D Present value of an annuity of $1, PVKA PVA A 1+1) Period 4% 10% 12% 1 0.909 2 3 1.736 4 5 6 7 ........... 8 9 10 11 12 13 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14,094 15.372 17.159 18.256 Percent 6% 7% 0.943 0.935 1.833 1.80B 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5.389 6.210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 7.943 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 11.654 13.765 12,409 15.046 13.332 15.762 13.801 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 0.917 1.759 2531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.422 8.694 8.951 9.042 2.487 3.170 3.791 4.355 4.868 5.335 5,759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 9.077 9.427 9.779 9.915 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 B.244 8.304 14 15 16 17 18 19 20 25 30 40 50 Appendix D (concluded) Present value of an annulty of $1 Period 14% 15% 35% 1 2 3 5 6 7 8 9 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 10 11 12 13 14 15 16 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 17% 0.855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 5.880 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 5.548 5.554 Percent 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4.339 4.486 4.611 4.715 4.802 4.876 4.938 4.988 5.033 5.070 5.101 5.195 5.235 5.258 5.262 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4.870 4.948 4.979 4.997 4.999 25% 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.000 30% 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.333 3.333 0.741 1.289 1.696 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.856 2.857 2.857 2.857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 17 18 19 20 25 30 40 50 7.025 7.330 7.496 7.634 7.675