Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Of the following, which is the best general description of operating assets? a. Assets which changes are shown on the operating section of the

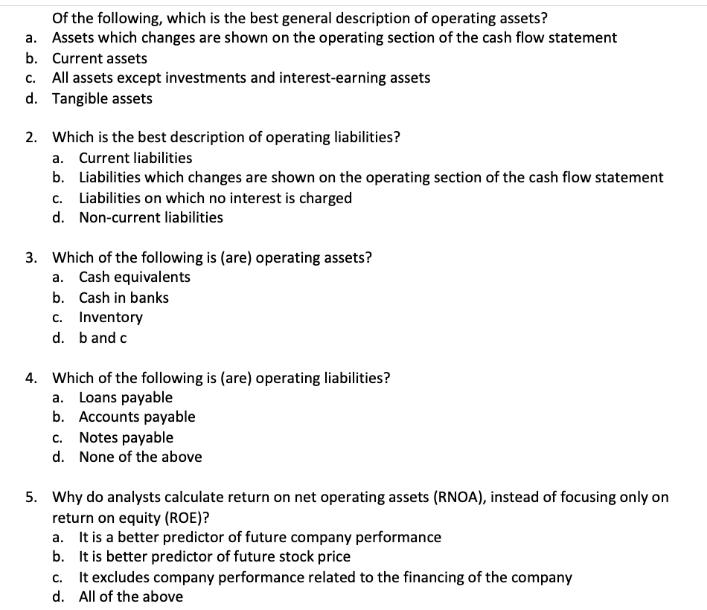

Of the following, which is the best general description of operating assets? a. Assets which changes are shown on the operating section of the cash flow statement b. Current assets c. All assets except investments and interest-earning assets d. Tangible assets 2. Which is the best description of operating liabilities? a. Current liabilities b. Liabilities which changes are shown on the operating section of the cash flow statement c. Liabilities on which no interest is charged d. Non-current liabilities 3. Which of the following is (are) operating assets? a. Cash equivalents b. Cash in banks c. Inventory d. b and c 4. Which of the following is (are) operating liabilities? a. Loans payable b. Accounts payable c. Notes payable d. None of the above 5. Why do analysts calculate return on net operating assets (RNOA), instead of focusing only on return on equity (ROE)? a. It is a better predictor of future company performance b. It is better predictor of future stock price c. It excludes company performance related to the financing of the company d. All of the above

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The best general description of operating assets is a Assets which changes are shown on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started