Question

Where do you get the value for N without using Excel and what does it mean? Is there some sort of chart or something

Where do you get the value for "N" without using Excel and what does it mean? Is there some sort of chart or something Explain.

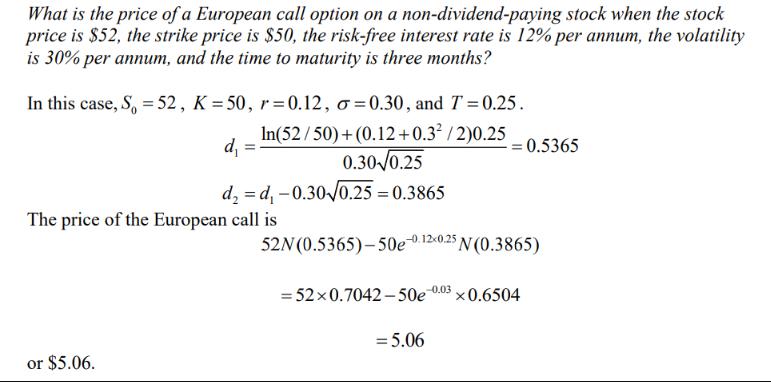

What is the price of a European call option on a non-dividend-paying stock when the stock price is $52, the strike price is $50, the risk-free interest rate is 12% per annum, the volatility is 30% per annum, and the time to maturity is three months? In this case, S = 52, K = 50, r=0.12, o=0.30, and T = 0.25. In(52/50)+(0.12+0.3/2)0.25 0.30-0.25 d= or $5.06. = d=d, -0.30-0.25 = 0.3865 The price of the European call is = 0.5365 52N (0.5365)-50e-0.12x0.25 N(0.3865) = 520.7042-50e 0.03 x0.6504 = 5.06

Step by Step Solution

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The value N that youre asking about refers to the cumulative distribution function CDF for a standar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Management Science A Modeling And Cases Studies Approach With Spreadsheets

Authors: Frederick S. Hillier, Mark S. Hillier

5th Edition

978-0077825560, 78024064, 9780077498948, 007782556X, 77498941, 978-0078024061

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App