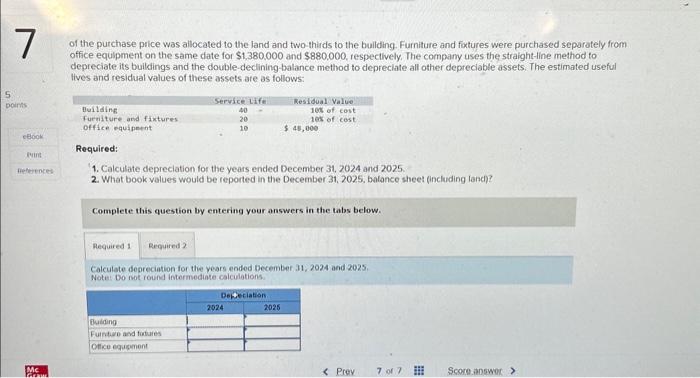

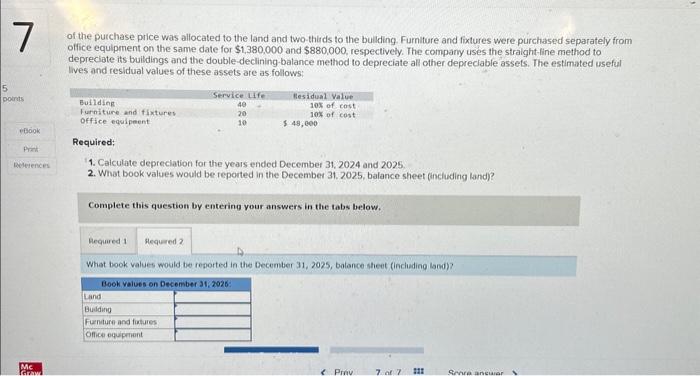

of the purchase price was allocated to the land and two-thirds to the building. Furniture and foxtures were purchased sepurately from office equipment on the same date for $1,380,000 and $880,000, respectively. The company uses the straight-line method to depreciate its buildings and the double-declining-balance method to depreclate all other depreciable assets. The estimated useful lives and residual values of these assets ate as follows: Required: 1. Calculate depreciation for the years ended December 31,2024 and 2025 2. What book values would be reported in the December 31, 2025, balance sheet (including land)? Complete this question by entering your answers in the tabs below. Calculate deoreciation for the vears eoded December 31,2024 and 2025. Note: Do not round intermediate calculations. of the purchase price was allocated to the land and two-thirds to the buliding. Furniture and fixtures were purchased separately from office equipment on the same date for $1,380,000 and $880,000, respectively. The company uses the straight-line method to depreciate its buildings and the double-declining-balance method to depreciate all other depreciable assets. The estimated useful lives and residual values of these assets are as follows: Required: 1. Calculate depreciation for the years ended December 31,2024 and 2025 2. What book values would be reported in the December 31.2025 , balance sheet (including land)? Complete this question by entering your answers in the tabs below. What book values wovid toe reported in the December 31,2025 , bolance sheet (including land)? of the purchase price was allocated to the land and two-thirds to the building. Furniture and foxtures were purchased sepurately from office equipment on the same date for $1,380,000 and $880,000, respectively. The company uses the straight-line method to depreciate its buildings and the double-declining-balance method to depreclate all other depreciable assets. The estimated useful lives and residual values of these assets ate as follows: Required: 1. Calculate depreciation for the years ended December 31,2024 and 2025 2. What book values would be reported in the December 31, 2025, balance sheet (including land)? Complete this question by entering your answers in the tabs below. Calculate deoreciation for the vears eoded December 31,2024 and 2025. Note: Do not round intermediate calculations. of the purchase price was allocated to the land and two-thirds to the buliding. Furniture and fixtures were purchased separately from office equipment on the same date for $1,380,000 and $880,000, respectively. The company uses the straight-line method to depreciate its buildings and the double-declining-balance method to depreciate all other depreciable assets. The estimated useful lives and residual values of these assets are as follows: Required: 1. Calculate depreciation for the years ended December 31,2024 and 2025 2. What book values would be reported in the December 31.2025 , balance sheet (including land)? Complete this question by entering your answers in the tabs below. What book values wovid toe reported in the December 31,2025 , bolance sheet (including land)