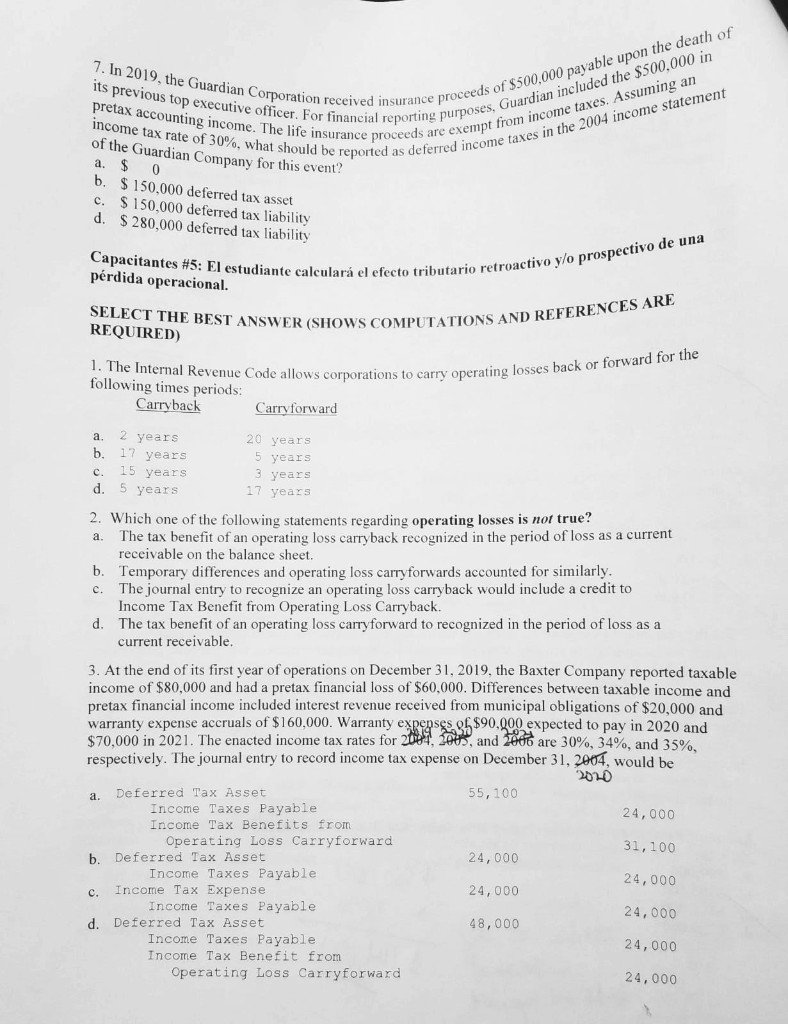

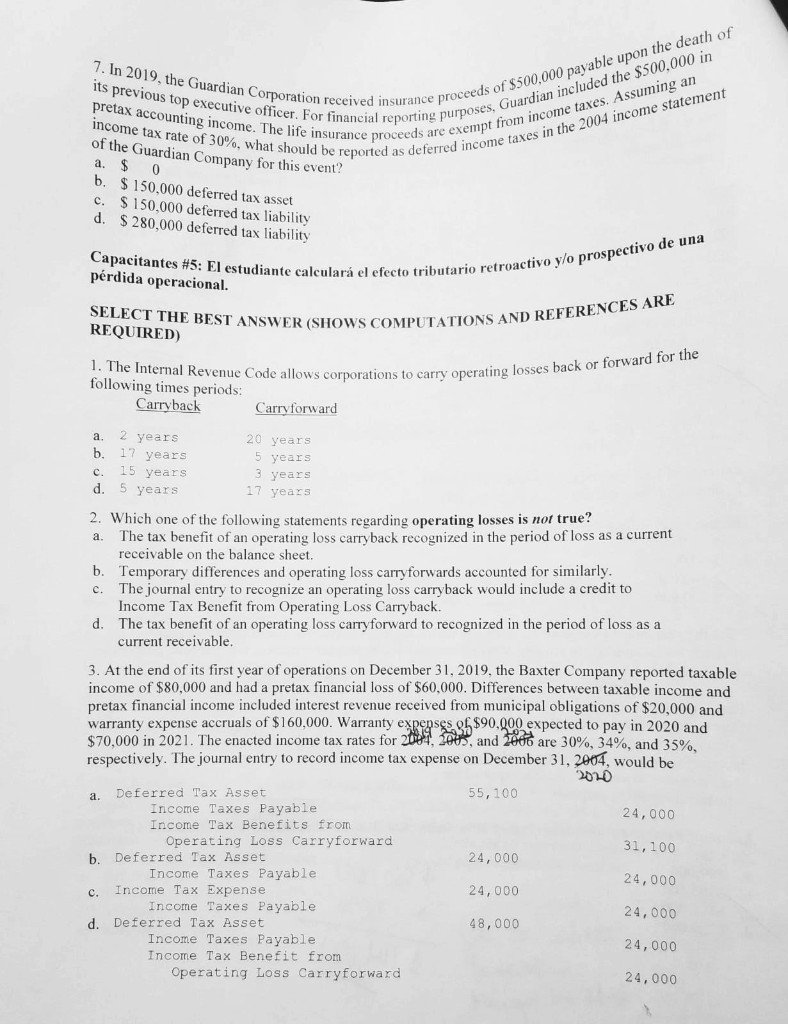

of the tax rat, & income Ticer. For received insurance proceeds of $500,000 pasahe $500.000 in 7. In 2019, the Guardian Corporation received vious top executive officer. For financial reportin pretax accounting income. The life insurance proce income tax rate of 30%, what should be reported of the Guardian Company for this event? a. $ 0 b. $ 150,000 deferred tax asset c. $ 150.000 deferred tax liability d. $ 280,000 deferred tax liability ance proceeds of $500.000 pavable upon the death of ing purposes, Guardian included the $500.000 in are exempt from income taxes. Assuming an erred income taxes in the 2004 income statement Capacitantes #5: El estudiante calcular prdida operacional. diante calcular el efecto tributario retroactivo y/OP etroactivo y/o prospectivo de una SELECT THE BEST ANSWER (SI REQUIRED) TATIONS AND REFERENCES ARE 1. The Internal Revenue Code allows corporati following times periods: Carryback Carryforward ode allows corporations to carry operating losses back or forwar a. 2 years b. 17 years c. 15 years d. 5 years 20 years 5 years 3 years 17 years 2. Which one of the following statements regarding operating losses is not true? a. The tax benefit of an operating loss carryback recognized in the period of loss as a current receivable on the balance sheet. b. Temporary differences and operating loss carryforwards accounted for similarly. c. The journal entry to recognize an operating loss carryback would include a credit to Income Tax Benefit from Operating Loss Carryback. d. The tax benefit of an operating loss carry forward to recognized in the period of loss as a current receivable. 3. At the end of its first year of operations on December 31, 2019, the Baxter Company reported taxable income of $80,000 and had a pretax financial loss of $60,000. Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20,000 and warranty expense accruals of $160,000. Warranty expenses. $90,000 expected to pay in 2020 and $70,000 in 2021. The enacted income tax rates for 2004, 2005, and 2006 are 30%, 34%, and 35%. respectively. The journal entry to record income tax expense on December 31, 2004, would be 2020 a. Deferred Tax Asset 55,100 Income Taxes Payable 24,000 Income Tax Benefits from Operating Loss Carryforward 31,100 b. Deferred Tax Asset 24,000 Income Taxes Payable 24,000 c. Income Tax Expense 24,000 Income Taxes Payable 24,000 d. Deferred Tax Asset 48,000 Income Taxes Payable 24,000 Income Tax Benefit from Operating Loss Carryforward 24,000 of the tax rat, & income Ticer. For received insurance proceeds of $500,000 pasahe $500.000 in 7. In 2019, the Guardian Corporation received vious top executive officer. For financial reportin pretax accounting income. The life insurance proce income tax rate of 30%, what should be reported of the Guardian Company for this event? a. $ 0 b. $ 150,000 deferred tax asset c. $ 150.000 deferred tax liability d. $ 280,000 deferred tax liability ance proceeds of $500.000 pavable upon the death of ing purposes, Guardian included the $500.000 in are exempt from income taxes. Assuming an erred income taxes in the 2004 income statement Capacitantes #5: El estudiante calcular prdida operacional. diante calcular el efecto tributario retroactivo y/OP etroactivo y/o prospectivo de una SELECT THE BEST ANSWER (SI REQUIRED) TATIONS AND REFERENCES ARE 1. The Internal Revenue Code allows corporati following times periods: Carryback Carryforward ode allows corporations to carry operating losses back or forwar a. 2 years b. 17 years c. 15 years d. 5 years 20 years 5 years 3 years 17 years 2. Which one of the following statements regarding operating losses is not true? a. The tax benefit of an operating loss carryback recognized in the period of loss as a current receivable on the balance sheet. b. Temporary differences and operating loss carryforwards accounted for similarly. c. The journal entry to recognize an operating loss carryback would include a credit to Income Tax Benefit from Operating Loss Carryback. d. The tax benefit of an operating loss carry forward to recognized in the period of loss as a current receivable. 3. At the end of its first year of operations on December 31, 2019, the Baxter Company reported taxable income of $80,000 and had a pretax financial loss of $60,000. Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20,000 and warranty expense accruals of $160,000. Warranty expenses. $90,000 expected to pay in 2020 and $70,000 in 2021. The enacted income tax rates for 2004, 2005, and 2006 are 30%, 34%, and 35%. respectively. The journal entry to record income tax expense on December 31, 2004, would be 2020 a. Deferred Tax Asset 55,100 Income Taxes Payable 24,000 Income Tax Benefits from Operating Loss Carryforward 31,100 b. Deferred Tax Asset 24,000 Income Taxes Payable 24,000 c. Income Tax Expense 24,000 Income Taxes Payable 24,000 d. Deferred Tax Asset 48,000 Income Taxes Payable 24,000 Income Tax Benefit from Operating Loss Carryforward 24,000