Answered step by step

Verified Expert Solution

Question

1 Approved Answer

of work-in-progress nor in finished goods. The working capital calculated by ignoring depreciation is known as cash basis working capital. In case, depreciation is included

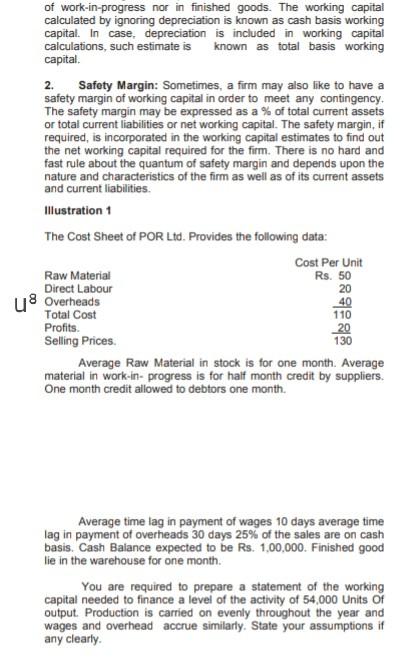

of work-in-progress nor in finished goods. The working capital calculated by ignoring depreciation is known as cash basis working capital. In case, depreciation is included in working capital calculations, such estimate is known as total basis working capital. 2. Safety Margin: Sometimes, a firm may also like to have a safety margin of working capital in order to meet any contingency. The safety margin may be expressed as a % of total current assets or total current liabilities or net working capital. The safety margin, if required, is incorporated in the working capital estimates to find out the net working capital required for the firm. There is no hard and fast rule about the quantum of safety margin and depends upon the nature and characteristics of the firm as well as of its current assets and current liabilities Illustration 1 The Cost Sheet of POR Ltd. Provides the following data: Cost Per Unit Raw Material Rs. 50 Direct Labour 20 u Overheads 40 Total Cost 110 Profits 20 Selling Prices 130 Average Raw Material in stock is for one month. Average material in work-in-progress is for half month credit by suppliers. One month credit allowed to debtors one month. Average time lag in payment of wages 10 days average time lag in payment of overheads 30 days 25% of the sales are on cash basis. Cash Balance expected to be Rs. 1,00,000. Finished good lie in the warehouse for one month. You are required to prepare a statement of the working capital needed to finance a level of the activity of 54,000 units of output. Production is carried on evenly throughout the year and wages and overhead accrue similarly. State your assumptions if any clearly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started