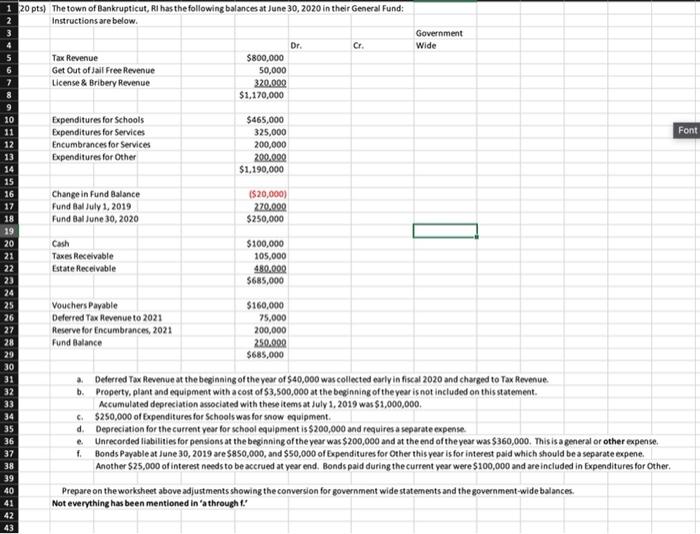

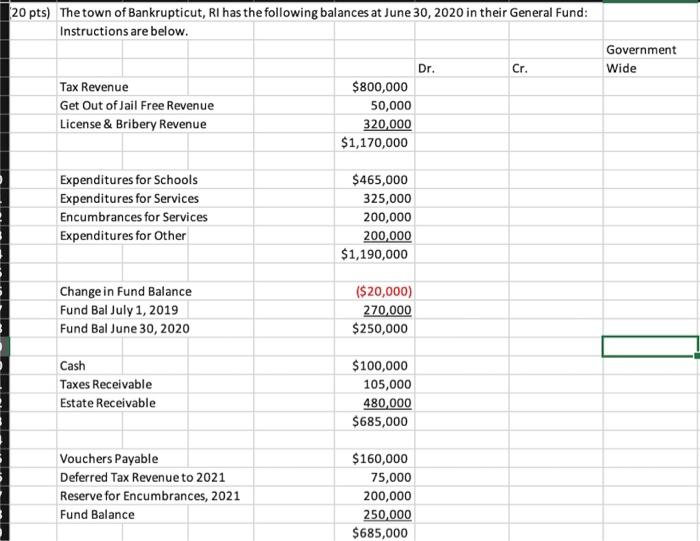

OFF Advanced Test 4(1) Insert Draw Page Layout Formulas Data Review View Tell me X Calibrl (Bodyl v 11 Wrap Tent General BIU A Merge & Carter XJx E L N D The town of Bakut, i ha the following balance 0.2020 in the Gener tructiebe Gover Wide O Get Out of free Line & Bribery Revenue 5.800.000 50.000 30.00 51.170,000 Expenditures for school Expenditures for Services Encumbrance for Services benditures for other | 5-65.000 335.000 200,000 200.000 51110.000 Change in fund Balance Fund My1.2019 Fund Blue 30, 2010 830.000 270.000 $250,000 Cach Tecelable Date Receivable $100.000 105.000 412.00 5685.000 Vouchers Payable Deferred to evento 2021 Here for me. 2011 fund Balance $100.000 75.000 200.000 240.000 5.000 Deferred Tax Ret the beginning of the 540.000 collected earlvin ca 7070 charged To Tome Property blant and equipment with a $1.500,000 of the years to this met Accumulated depreciation with these 1, 2019 a $1.000.000 5250 000 for Schools www wow we Depreciation to the current your fee school an 200.000 and resep Unrecorded for person the beginning of the year w5200,000 and the end of the www.360,000. This rather pen + Bondale lune 10, 2015 $850.000, 550.000 obres for the year for interest which would be repene Another 525.000 fires to be your and add the current you were $100.000 and reinches Prepare on the worksheeting the converterents and the vice Problems Problem 1 Problem 2 Problem 4 Problem 3 Rer 1 20 pts) The town of Bankrupticut, Ri has the following balances at June 30, 2020 in their General Fund: Instructions are below. Government Wide Cr. Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue Dr. $800,000 50,000 320.000 $1,170,000 Font Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200.000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 20,000) 270.000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480.000 $685,000 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250.000 $685,000 a. Deferred Tax Revenue at the beginning of the year of $40,000 was collected early in fiscal 2020 and charged to Tax Revenue. b. Property, plant and equipment with a cost of $3,500,000 at the beginning of the year is not included on this statement Accumulated depreciation associated with these items at July 1, 2019 was $1,000,000 $250,000 of Expenditures for Schools was for snow equipment. d. Depreciation for the current year for school equipment is $200,000 and requires a separate expense. Unrecorded liabilities for pensions at the beginning of the year was $200,000 and at the end of the year was $360,000. This is a general or other expense, 1. Bonds Payable at June 30, 2019 are $850,000, and $50,000 of Expenditures for Other this year is for interest paid which should be a separate expene. Another $25,000 of interest needs to be accrued at year end. Bonds paid during the current year were $100,000 and are included in Expenditures for Other Prepare on the worksheet above adjustments showing the conversion for government wide statements and the government-wide balances. Not everything has been mentioned in a through t.' 20 pts) The town of Bankrupticut, Ri has the following balances at June 30, 2020 in their General Fund: Instructions are below. Government Wide Dr. Cr. Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue $800,000 50,000 320,000 $1,170,000 Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200,000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 ($20,000) 270,000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480,000 $685,000 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250,000 $685,000 20 pts) The town of Bankrupticut, RI has the following balances at June 30, 2020 in their General Fund: Instructions are below. Dr. Cr. Government Wide Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue $800,000 50,000 320,000 $1,170,000 Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200,000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 ($ 20,000) 270,000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480,000 $685,000 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250,000 $685,000 OFF Advanced Test 4(1) Insert Draw Page Layout Formulas Data Review View Tell me X Calibrl (Bodyl v 11 Wrap Tent General BIU A Merge & Carter XJx E L N D The town of Bakut, i ha the following balance 0.2020 in the Gener tructiebe Gover Wide O Get Out of free Line & Bribery Revenue 5.800.000 50.000 30.00 51.170,000 Expenditures for school Expenditures for Services Encumbrance for Services benditures for other | 5-65.000 335.000 200,000 200.000 51110.000 Change in fund Balance Fund My1.2019 Fund Blue 30, 2010 830.000 270.000 $250,000 Cach Tecelable Date Receivable $100.000 105.000 412.00 5685.000 Vouchers Payable Deferred to evento 2021 Here for me. 2011 fund Balance $100.000 75.000 200.000 240.000 5.000 Deferred Tax Ret the beginning of the 540.000 collected earlvin ca 7070 charged To Tome Property blant and equipment with a $1.500,000 of the years to this met Accumulated depreciation with these 1, 2019 a $1.000.000 5250 000 for Schools www wow we Depreciation to the current your fee school an 200.000 and resep Unrecorded for person the beginning of the year w5200,000 and the end of the www.360,000. This rather pen + Bondale lune 10, 2015 $850.000, 550.000 obres for the year for interest which would be repene Another 525.000 fires to be your and add the current you were $100.000 and reinches Prepare on the worksheeting the converterents and the vice Problems Problem 1 Problem 2 Problem 4 Problem 3 Rer 1 20 pts) The town of Bankrupticut, Ri has the following balances at June 30, 2020 in their General Fund: Instructions are below. Government Wide Cr. Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue Dr. $800,000 50,000 320.000 $1,170,000 Font Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200.000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 20,000) 270.000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480.000 $685,000 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250.000 $685,000 a. Deferred Tax Revenue at the beginning of the year of $40,000 was collected early in fiscal 2020 and charged to Tax Revenue. b. Property, plant and equipment with a cost of $3,500,000 at the beginning of the year is not included on this statement Accumulated depreciation associated with these items at July 1, 2019 was $1,000,000 $250,000 of Expenditures for Schools was for snow equipment. d. Depreciation for the current year for school equipment is $200,000 and requires a separate expense. Unrecorded liabilities for pensions at the beginning of the year was $200,000 and at the end of the year was $360,000. This is a general or other expense, 1. Bonds Payable at June 30, 2019 are $850,000, and $50,000 of Expenditures for Other this year is for interest paid which should be a separate expene. Another $25,000 of interest needs to be accrued at year end. Bonds paid during the current year were $100,000 and are included in Expenditures for Other Prepare on the worksheet above adjustments showing the conversion for government wide statements and the government-wide balances. Not everything has been mentioned in a through t.' 20 pts) The town of Bankrupticut, Ri has the following balances at June 30, 2020 in their General Fund: Instructions are below. Government Wide Dr. Cr. Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue $800,000 50,000 320,000 $1,170,000 Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200,000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 ($20,000) 270,000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480,000 $685,000 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250,000 $685,000 20 pts) The town of Bankrupticut, RI has the following balances at June 30, 2020 in their General Fund: Instructions are below. Dr. Cr. Government Wide Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue $800,000 50,000 320,000 $1,170,000 Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other $465,000 325,000 200,000 200,000 $1,190,000 Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 ($ 20,000) 270,000 $250,000 Cash Taxes Receivable Estate Receivable $100,000 105,000 480,000 $685,000 Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $160,000 75,000 200,000 250,000 $685,000