Answered step by step

Verified Expert Solution

Question

1 Approved Answer

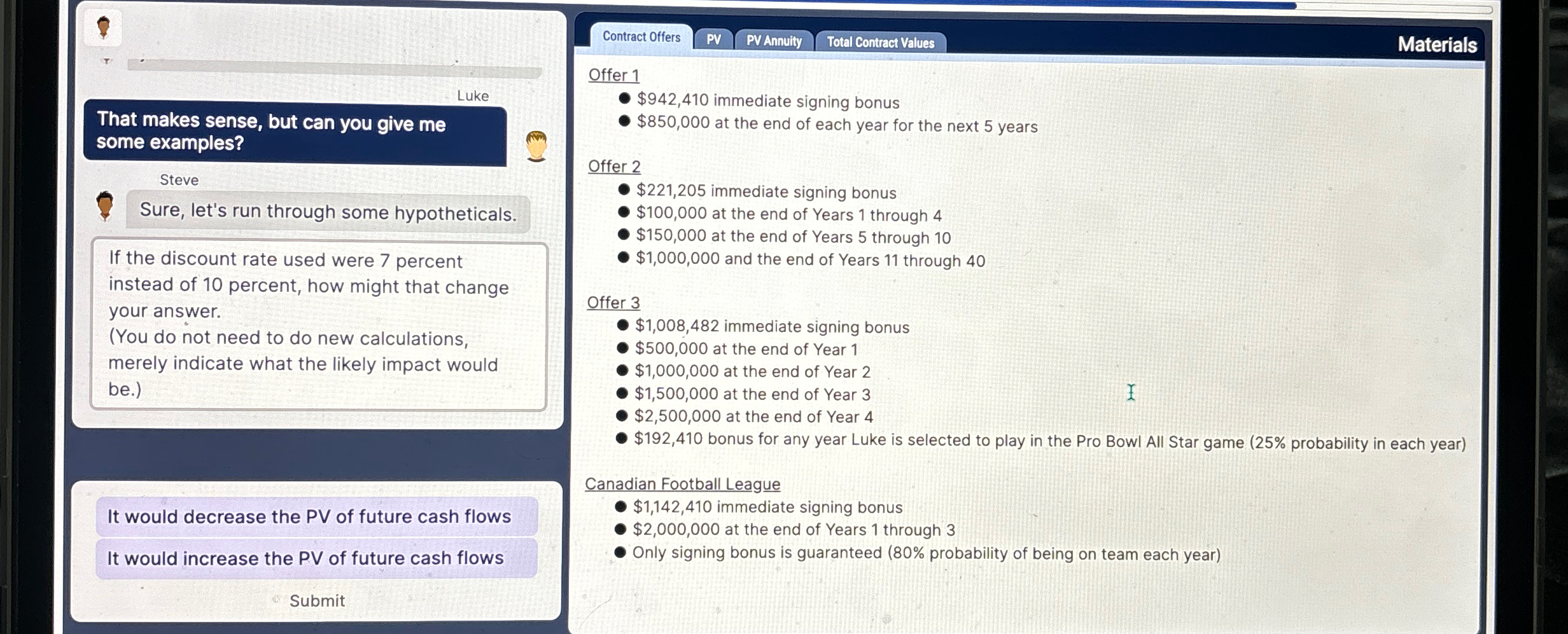

Offer 1 That makes sense, but can you give me some examples? Steve Sure, let's run through some hypotheticals. If the discount rate used were

Offer

That makes sense, but can you give me

some examples?

Steve

Sure, let's run through some hypotheticals.

If the discount rate used were percent

instead of percent, how might that change

your answer.

You do not need to do new calculations,

merely indicate what the likely impact would

be

It would decrease the PV of future cash flows

It would increase the PV of future cash flows

$ immediate signing bonus

$ at the end of each year for the next years

Offer

$ immediate signing bonus

$ at the end of Years through

$ at the end of Years through

$ and the end of Years through

Offer

$ immediate signing bonus

$ at the end of Year

$ at the end of Year

$ at the end of Year

$ at the end of Year

$ bonus for any year Luke is selected to play in the Pro Bowl All Star game probability in each year

Canadian Football League

$ immediate signing bonus

$ at the end of Years through

Only signing bonus is guaranteed probability of being on team each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started