Question

Office Depot, Inc., is a leading global provider of products, services, and solutions for workplaces. The following is an excerpt from a disclosure note in

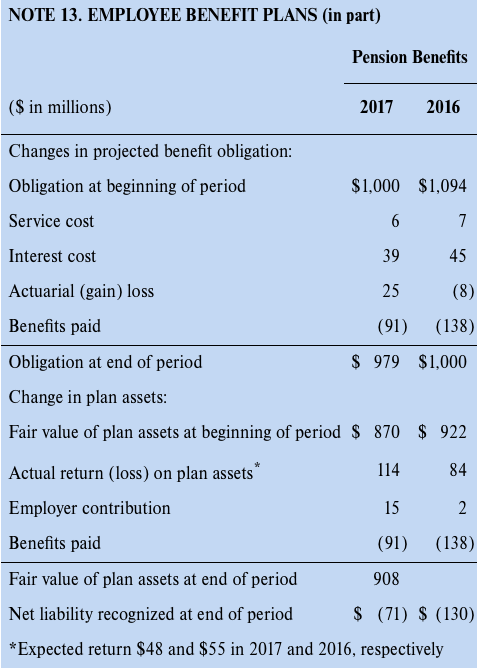

Office Depot, Inc., is a leading global provider of products, services, and solutions for workplaces. The following is an excerpt from a disclosure note in the company's annual report for the fiscal year ended December 31, 2017:

1. What amount did Office Depot report in its balance sheet related to the pension plan at December 31, 2017?

2. When calculating pension expense at December 31, what amount, if any, did Office Depot include in its income statement as the amortization of unrecognized net actuarial loss (net loss-AOCI)? This AOCI account had a balance of $38 million at the beginning of the year and was the only AOCI account related to pensions. The average remaining service life of employees was 10 years.

3. What was the pension expense?

4. What were the appropriate journal entries to record Office Depot's pension expense and to record gains and/or losses related to the pension plan?

NOTE 13. EMPLOYEE BENEFIT PLANS (in part) Pension Benefits ($ in millions) 2017 2016 Changes in projected benefit obligation: Obligation at beginning of period $1,000 $1,094 Service cost 6 7 Interest cost 39 45 Actuarial (gain) loss 25 (8) Benefits paid (91) (138) Obligation at end of period $ 979 $1,000 Change in plan assets: Fair value of plan assets at beginning of period $ 870 $ 922 Actual return (loss) on plan assets 114 84 Employer contribution 15 2 Benefits paid (91) (138) Fair value of plan assets at end of period 908 Net liability recognized at end of period $ (71) $ (130) *Expected return $48 and $55 in 2017 and 2016, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started