Answered step by step

Verified Expert Solution

Question

1 Approved Answer

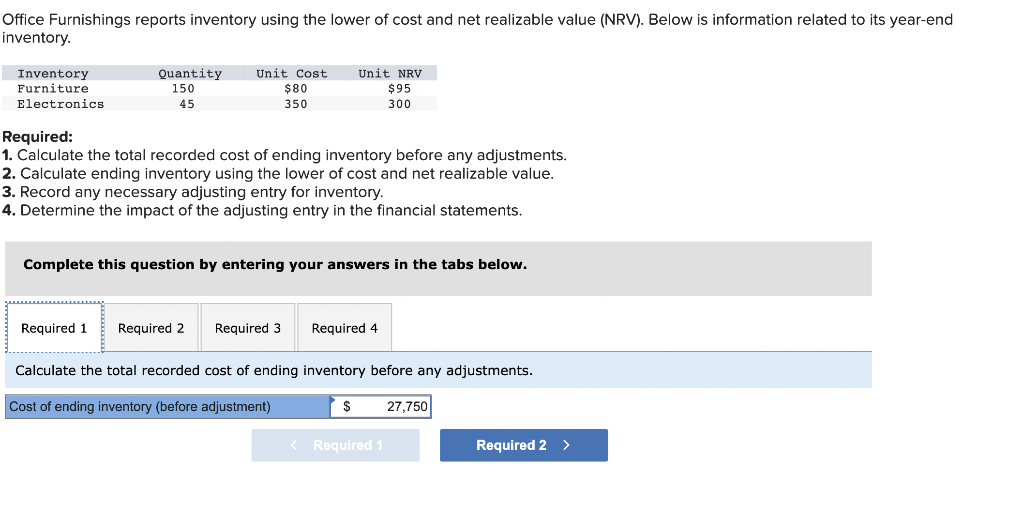

Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Required: 1. Calculate

Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory.

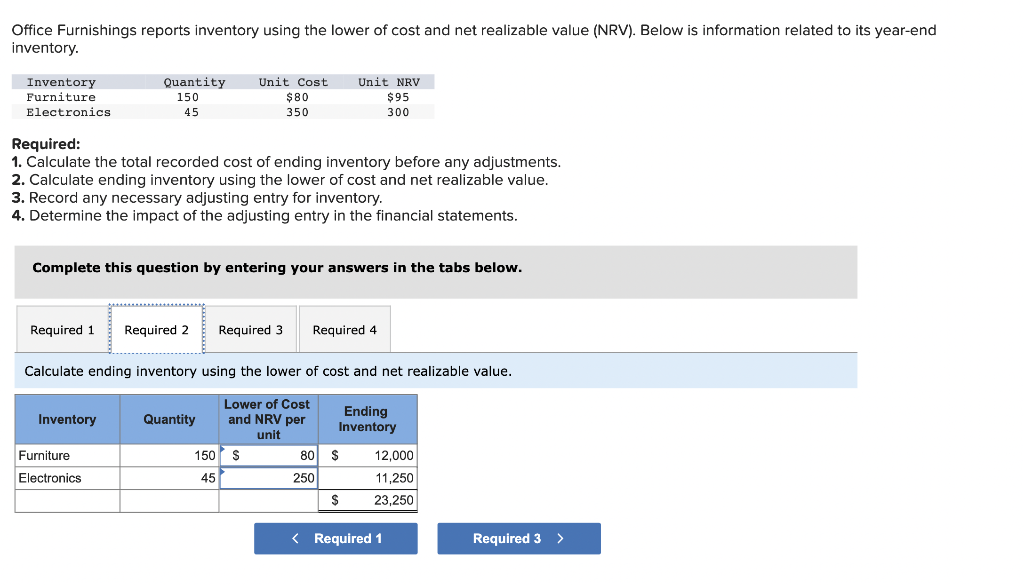

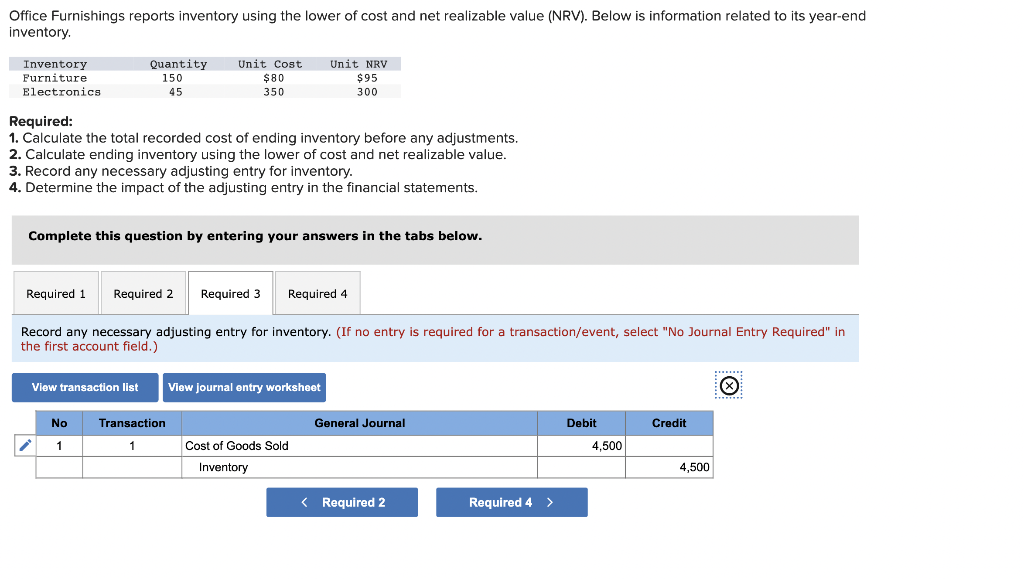

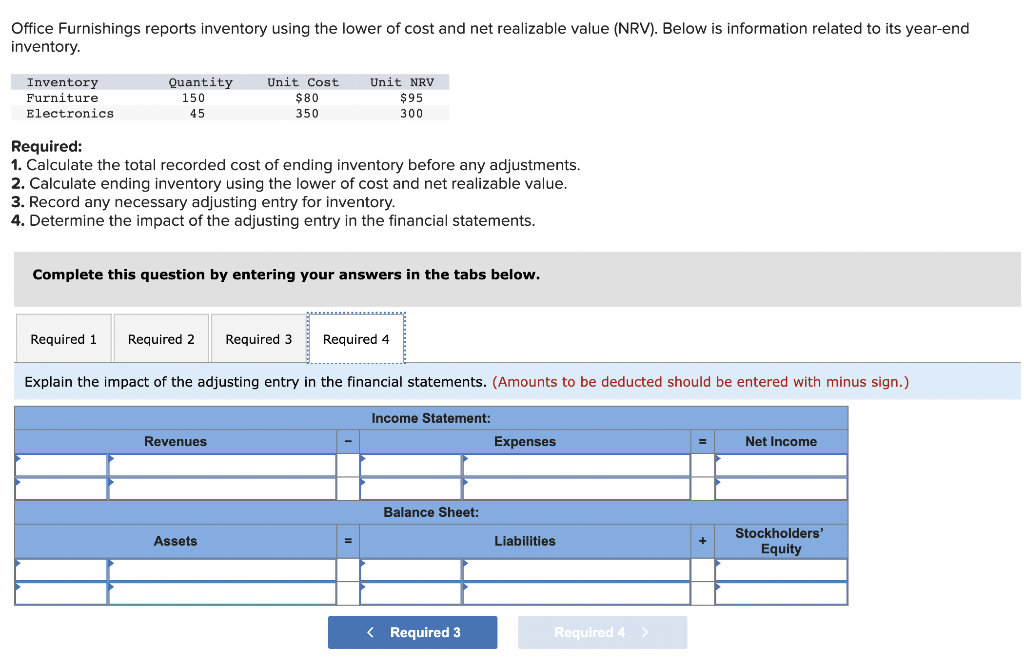

Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements.

Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Furniture Electronics Quantity 150 45 Unit Cost $80 350 Unit NRV $95 300 Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the total recorded cost of ending inventory before any adjustments. Cost of ending inventory (before adjustment) $ 27,750 Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Furniture Electronics Quantity 150 Unit Cost $80 350 Unit NRV $95 300 45 Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate ending inventory using the lower of cost and net realizable value. Inventory Quantity Lower of Cost and NRV per unit Ending Inventory $ Required 3 Furniture Electronics 150 45 80 $ 250 $ Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Furniture Electronics Quantity 150 45 Unit Cost $80 350 Unit NRV $95 300 Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Record any necessary adjusting entry for inventory. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet General Journal Debit Credit No 1 Cost of Goods Sold Inventory Transaction 1 4,500 4,500 Office Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Unit Cost Unit NRV Inventory Furniture Electronics Quantity 150 45 $80 350 $95 300 Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Explain the impact of the adjusting entry in the financial statements. (Amounts to be deducted should be entered with minus sign.) Income Statement: Revenues Expenses Net Income Balance Sheet: Assets Liabilities Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started