Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Often, we wish to track an index I, but for practical reasons (such as to avoid transactions costs) we cannot invest in all

![(b) Now, come back to the problem in (0.1): min Var [r(A) ri] s.t. F(A)=FATT= 1. Show that the optimal](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/12/657955e961084_1702497468368.jpg)

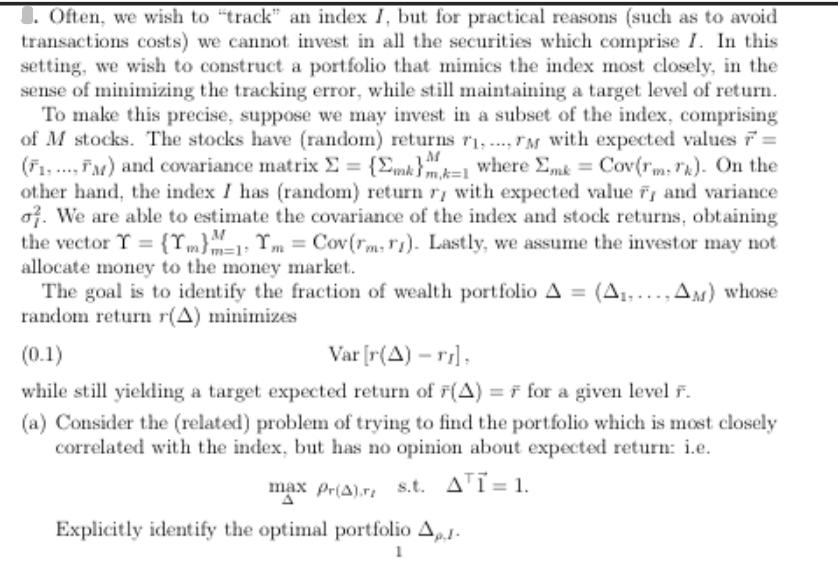

. Often, we wish to "track" an index I, but for practical reasons (such as to avoid transactions costs) we cannot invest in all the securities which comprise I. In this setting, we wish to construct a portfolio that mimics the index most closely, in the sense of minimizing the tracking error, while still maintaining a target level of return. M To make this precise, suppose we may invest in a subset of the index, comprising of M stocks. The stocks have (random) returns 71... TM with expected values F = (F1....FM) and covariance matrix = {Emkmk1 where Emk = Cov(rm). On the other hand, the index I has (random) return r, with expected value ry and variance o. We are able to estimate the covariance of the index and stock returns, obtaining the vector T = {m}m=1 Tm = Cov(rm, ry). Lastly, we assume the investor may not allocate money to the money market. The goal is to identify the fraction of wealth portfolio A = (AA) whose random return r(A) minimizes (0.1) Var[r(A) - ri], while still yielding a target expected return of F(A) = for a given level F. (a) Consider the (related) problem of trying to find the portfolio which is most closely correlated with the index, but has no opinion about expected return: i.e. max Pr(A).rz s.t. ATT= 1. Explicitly identify the optimal portfolio Ap- 1 (b) Now, come back to the problem in (0.1): min Var [r(A) ri] s.t. F(A)=FATT= 1. Show that the optimal portfolio admits the decomposition A = apdAp+aMAM + GAG

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a The problem is to maximize the correlation between the portfolio return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started