Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ogress=false Comprehensive Problem 2-2A Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria

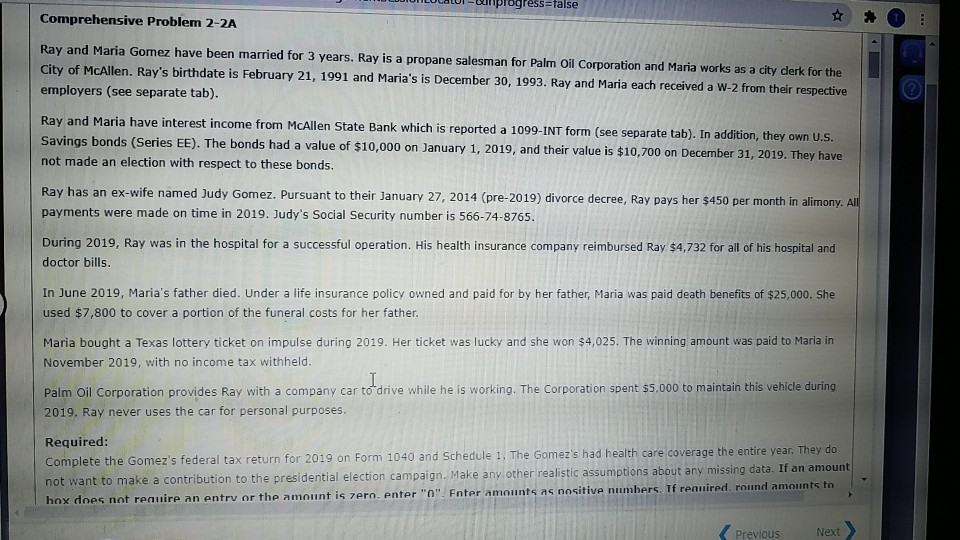

ogress=false Comprehensive Problem 2-2A Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray's birthdate is February 21, 1991 and Maria's is December 30, 1993. Ray and Maria each received a W-2 from their respective employers (see separate tab). Ray and Maria have interest income from McAllen State Bank which is reported a 1099-INT form (see separate tab). In addition, they own U.S. Savings bonds (Series EE). The bonds had a value of $10,000 on January 1, 2019, and their value is $10,700 on December 31, 2019. They have not made an election with respect to these bonds. Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2014 (pre-2019) divorce decree, Ray pays her $450 per month in alimony. All payments were made on time in 2019. Judy's Social Security number is 566-74-8765. During 2019, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2019, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2019. Her ticket was lucky and she won $4,025. The winning amount was paid to Maria in November 2019, with no income tax withheld. I Palm Oil Corporation provides Ray with a company car to drive while he is working. The Corporation spent $5,000 to maintain this vehicle during 2019. Ray never uses the car for personal purposes. Required: Complete the Gomez's federal tax return for 2019 on Form 1040 and Schedule 1. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter "O". Enter amounts as nositive numbers. If required. round amounts to Previous Next ogress=false Comprehensive Problem 2-2A Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray's birthdate is February 21, 1991 and Maria's is December 30, 1993. Ray and Maria each received a W-2 from their respective employers (see separate tab). Ray and Maria have interest income from McAllen State Bank which is reported a 1099-INT form (see separate tab). In addition, they own U.S. Savings bonds (Series EE). The bonds had a value of $10,000 on January 1, 2019, and their value is $10,700 on December 31, 2019. They have not made an election with respect to these bonds. Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2014 (pre-2019) divorce decree, Ray pays her $450 per month in alimony. All payments were made on time in 2019. Judy's Social Security number is 566-74-8765. During 2019, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2019, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2019. Her ticket was lucky and she won $4,025. The winning amount was paid to Maria in November 2019, with no income tax withheld. I Palm Oil Corporation provides Ray with a company car to drive while he is working. The Corporation spent $5,000 to maintain this vehicle during 2019. Ray never uses the car for personal purposes. Required: Complete the Gomez's federal tax return for 2019 on Form 1040 and Schedule 1. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter "O". Enter amounts as nositive numbers. If required. round amounts to Previous Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started