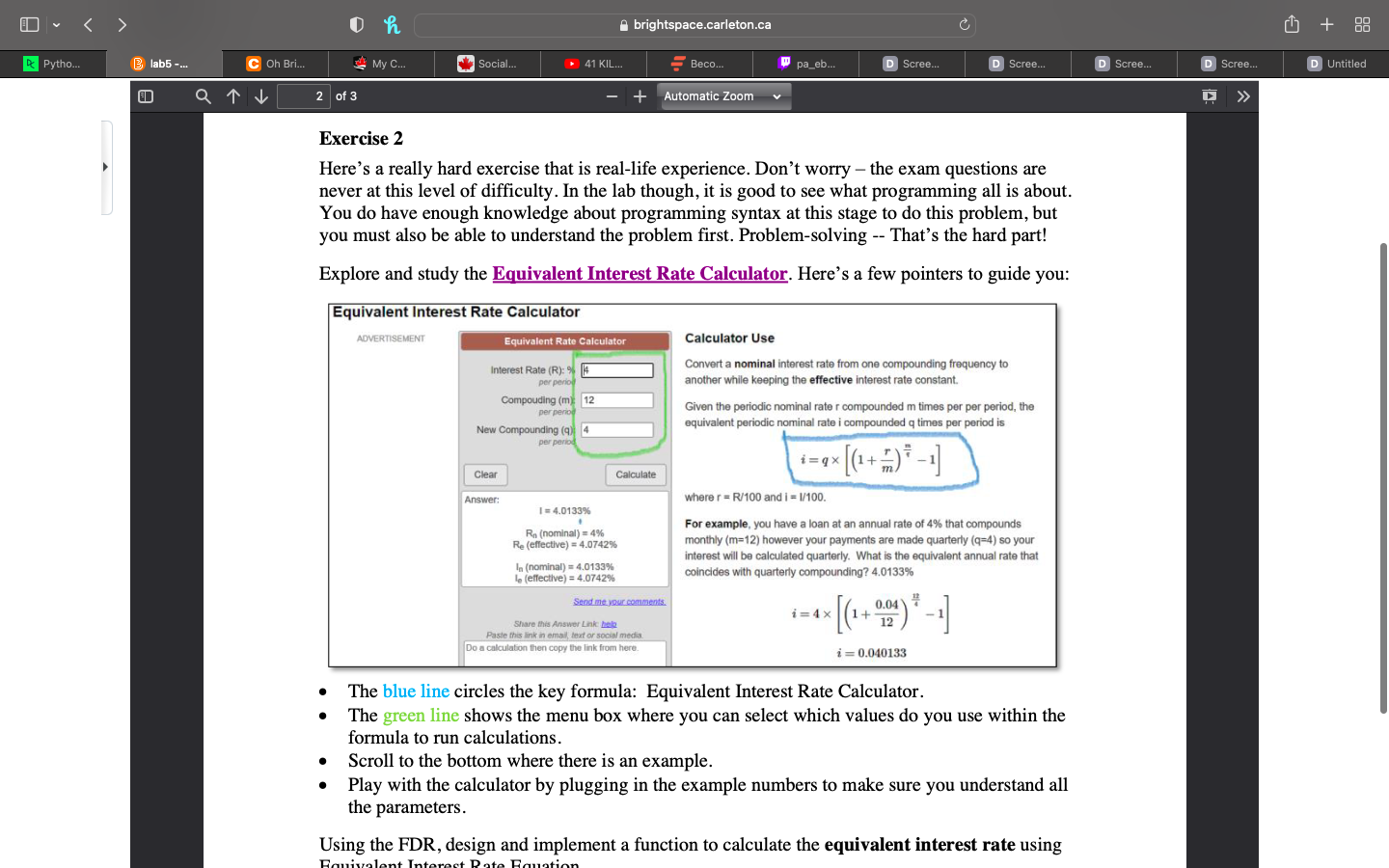

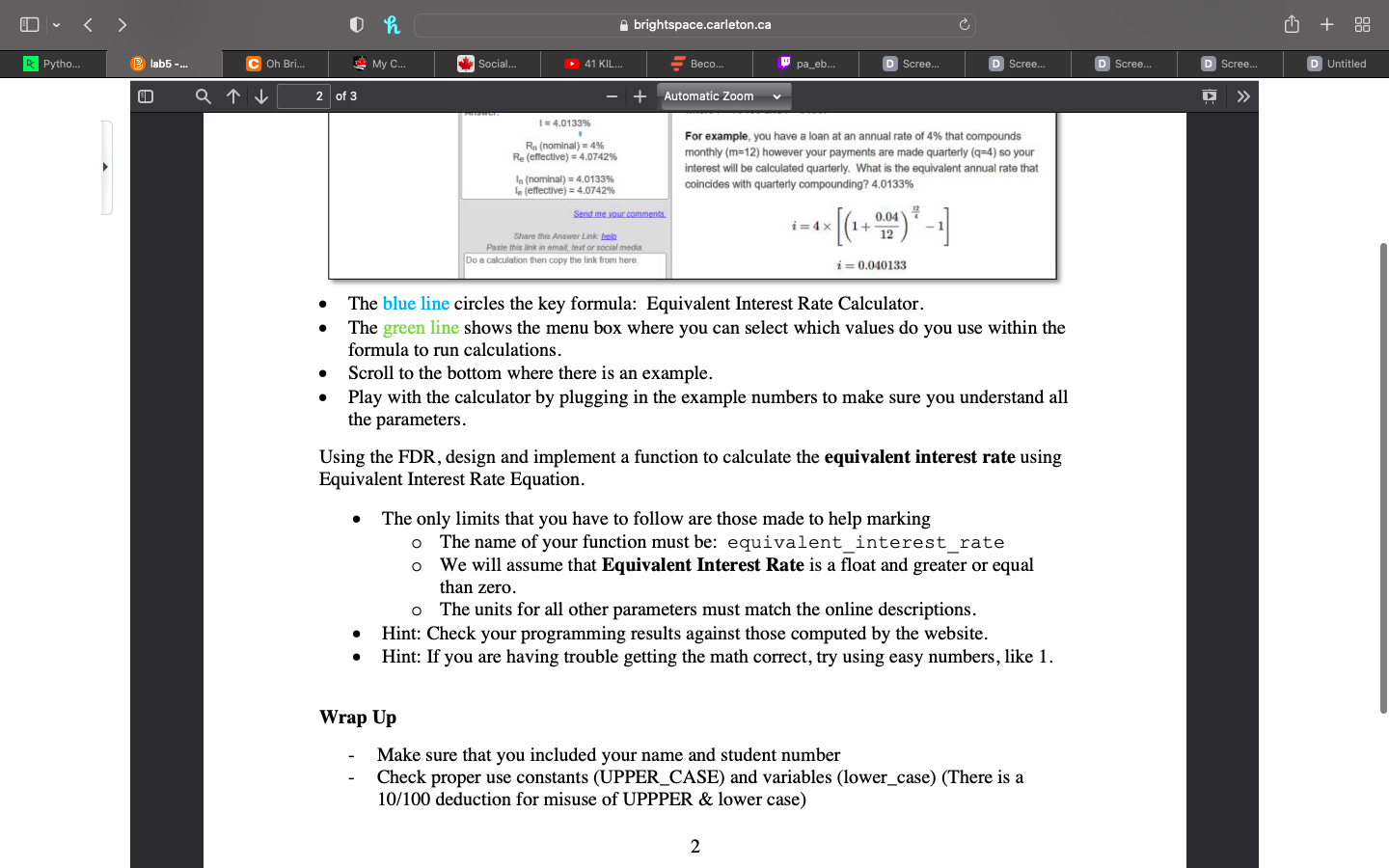

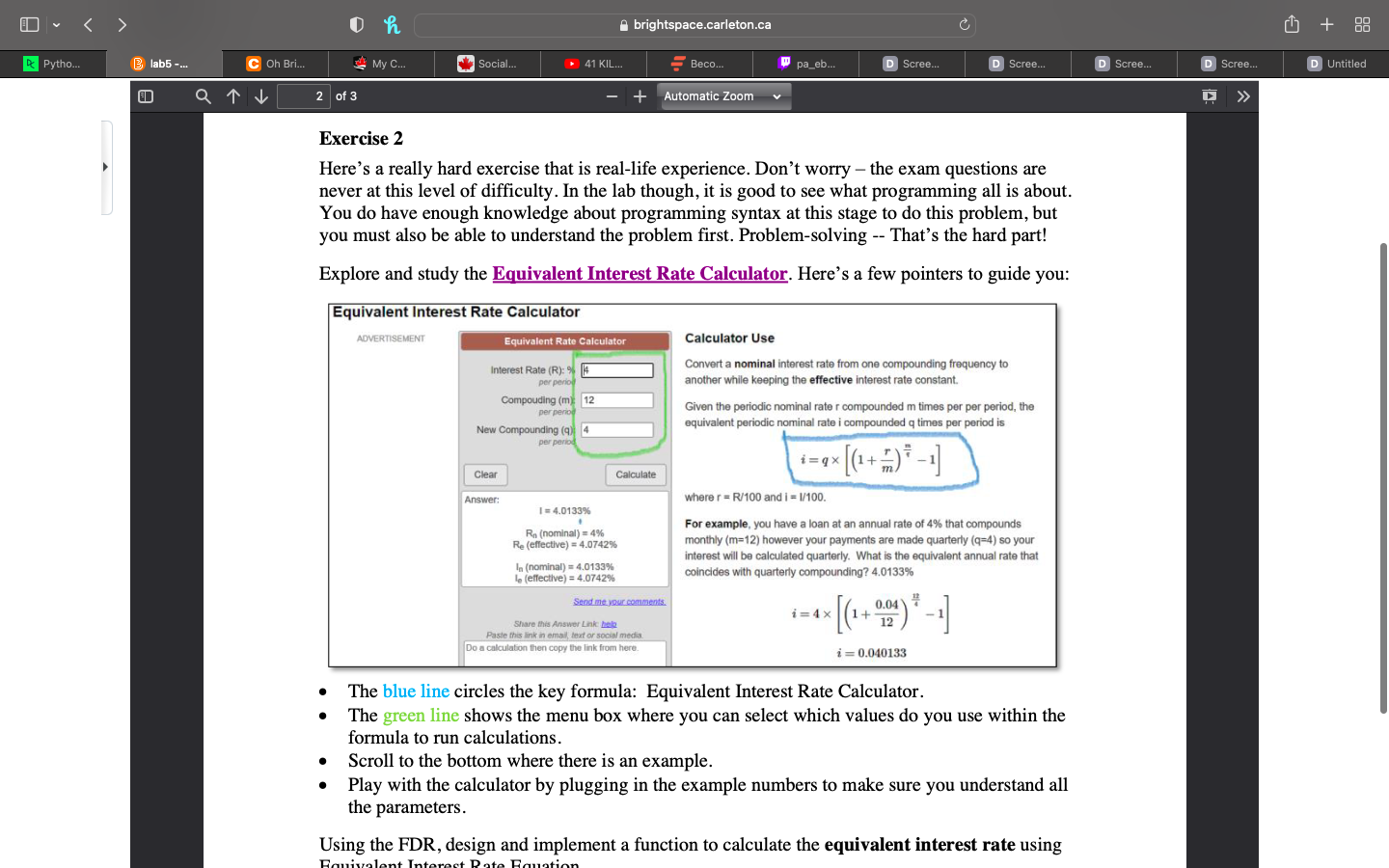

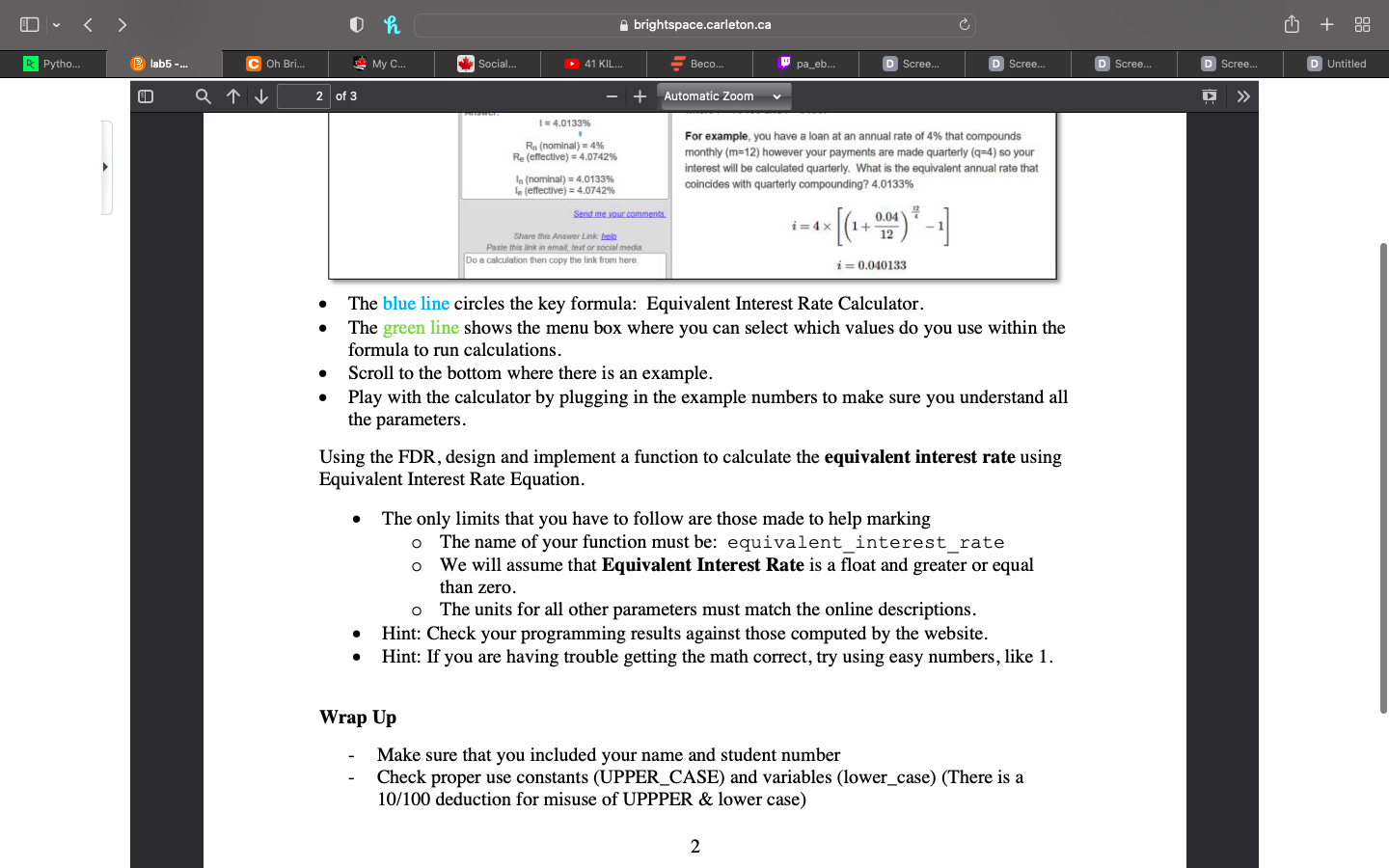

Oh brightspace.carleton.ca G + 68 RPytho... Blab5 -... C Oh Bri... My C... Social... 41 KIL... Beco... pa_eb... D Scree... Scree... D Scree... D Scree... D Untitled Q v 2 of 3 Automatic Zoom >> Exercise 2 Here's a really hard exercise that is real-life experience. Don't worry the exam questions are never at this level of difficulty. In the lab though, it is good to see what programming all is about. You do have enough knowledge about programming syntax at this stage to do this problem, but you must also be able to understand the problem first. Problem-solving -- That's the hard part! Explore and study the Equivalent Interest Rate Calculator. Here's a few pointers to guide you: Equivalent Interest Rate Calculator ADVERTISEMENT Equivalent Rate Calculator Calculator Use Interest Rate (R): % 4 per period Convert a nominal interest rate from one compounding frequency to another while keeping the effective interest rate constant. Compouding (m: 12 per period New Compounding (9) 4 per period Given the periodic nominal rater compounded times per per period, the equivalent periodic nominal rate i compounded times per period is i=qX [(1+) -1] Clear Calculate Answer: whererR/100 and 1=1/100. 14.0133% . R. (nominal) = 4% Re (effective) = 4.0742% In (nominal) = 4.0133% le (effective) = 4.0742% For example, you have a loan at an annual rate of 4% that compounds monthly (m=12) however your payments are made quarterly (q=4) so your interest will be calculated quarterly. What is the equivalent annual rate that coincides with quarterly compounding? 4.0133% Send me your comments 0.04 i=4 --[(0-0) - Share this Answer Link hele Paste this link in email eat or social media Do a calculation then copy the link from here. i=0.040133 . The blue line circles the key formula: Equivalent Interest Rate Calculator. The green line shows the menu box where you can select which values do you use within the formula to run calculations. Scroll to the bottom where there is an example. Play with the calculator by plugging in the example numbers to make sure you understand all the parameters. Using the FDR, design and implement a function to calculate the equivalent interest rate using . Equivalent Interest Rate Equation Oh brightspace.carleton.ca G + 68 RPytho... Blab5 -... C Oh Bri... My C... Social... 41 KIL... Beco... pa_eb... D Scree... Scree... D Scree... D Scree... D Untitled a 1 2 of 3 Automatic Zoom >> 14.0133% R. (nominal) = 4% Re (effective) = 4.0742% For example, you have a loan at an annual rate of 4% that compounds monthly (m=12) however your payments are made quarterly (q=4) so your interest will be calculated quarterly. What is the equivalent annual rate that coincides with quarterly compounding? 4.0133% In (nominal) - 4.0133% le (effective) = 4.0742% Send me your comments. i=4X 0.04 1+ Share this Answer Link hele Paste this link in email, text or social media Do a calculation then copy the link from here i=0.040133 . . The blue line circles the key formula: Equivalent Interest Rate Calculator. The green line shows the menu box where you can select which values do you use within the formula to run calculations. Scroll to the bottom where there is an example. Play with the calculator by plugging in the example numbers to make sure you understand all the parameters. Using the FDR, design and implement a function to calculate the equivalent interest rate using Equivalent Interest Rate Equation. O The only limits that you have to follow are those made to help marking The name of your function must be: equivalent interest rate o We will assume that Equivalent Interest Rate is a float and greater or equal than zero. The units for all other parameters must match the online descriptions. Hint: Check your programming results against those computed by the website. Hint: If you are having trouble getting the math correct, try using easy numbers, like 1. . Wrap Up Make sure that you included your name and student number Check proper use constants (UPPER_CASE) and variables (lower_case) (There is a 10/100 deduction for misuse of UPPPER & lower case) 2