Answered step by step

Verified Expert Solution

Question

1 Approved Answer

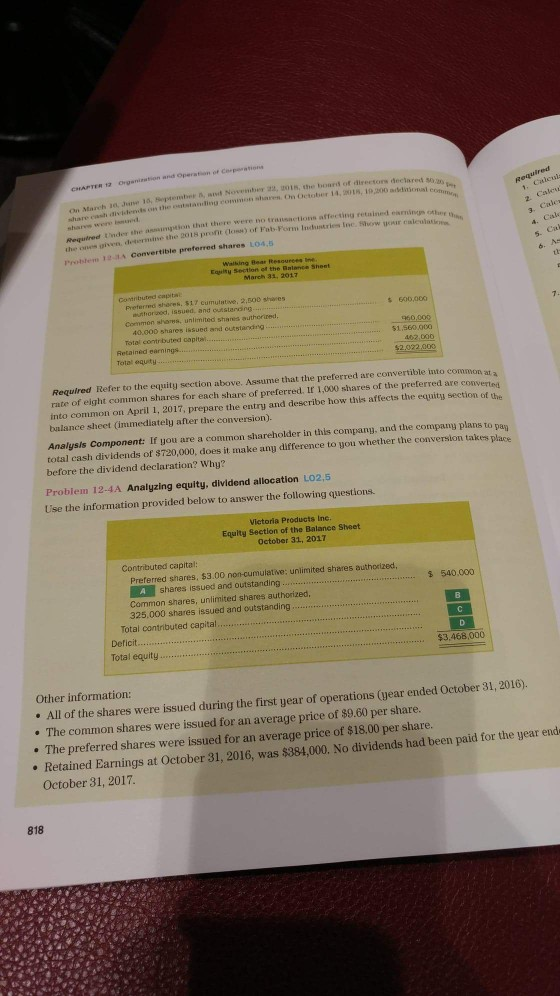

oHAPTER 12 Organization and Operation of Corperations Reaulred Calee and November 22, 018, the board of , a ng commts shares On October 14, 2018

oHAPTER 12 Organization and Operation of Corperations Reaulred Calee and November 22, 018, the board of , a ng commts shares On October 14, 2018 t0 , Jine March cas div atad there were no transactions affecting ded nder the the 2018 profit (loss) of Fab Form Induntries Ine a Cal 4 Cale the ones gven Problem 12-aA Convertible preferred shares 104 m 5. Ca March 31, 2017 Contributed cnpt tas 2.500 shares Prefrnod, issued. and ou theried. s 600.000 40.000 shares issued and outstanding 960,000 $1,560,000 Total contributed capital $2.022.000 Total equity Required Refer to ares for each share of preferred. If 1,000 s ommon on April 1, 2017, prepare the entry and describe bo ffects the equity section of the a section above. Assume that the preferred are convertible in od are con rate of balance sheet (immediately after the conversion) Analysis Component: If you are a common shareh total cash dividends of $720.000. this compang, and the commpany plans to pay before the dividend declaration? make any difference to you whether the conversion takes place W Problem 12-4A Analyzing equity, dividend allocation LO2,5 Use the information provided below to answer the following questions. Vietoria Products Inc Equity Section of the e Sheet October Contributed capital: Preferred shares, n-cumulative: unlimited shares authorized utstanding Common shares, unlimited shares authorized 325.000 shares issued and outstanding $ 540.000 B C Total contributed capital. Deficit 468 000 Total equity Other information: All of the shares were issued during the first year of operations (year ended October 31, 2016). The common shares were issued for an average price of $9.60 per share. . The preferred shares were issued for an average price of $18.00 per share. Retained Earnings at October 31, 2016, was $384,000. No dividends had been paid for the year ende October 31, 2017. 818

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started