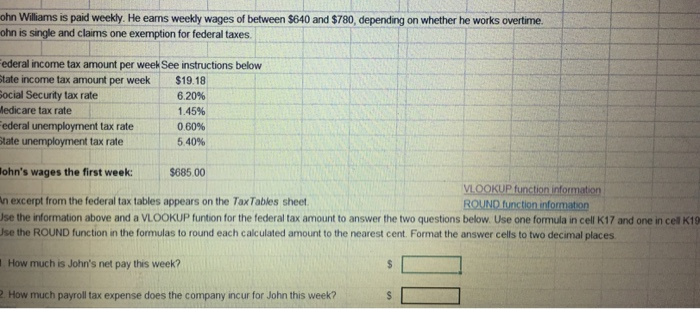

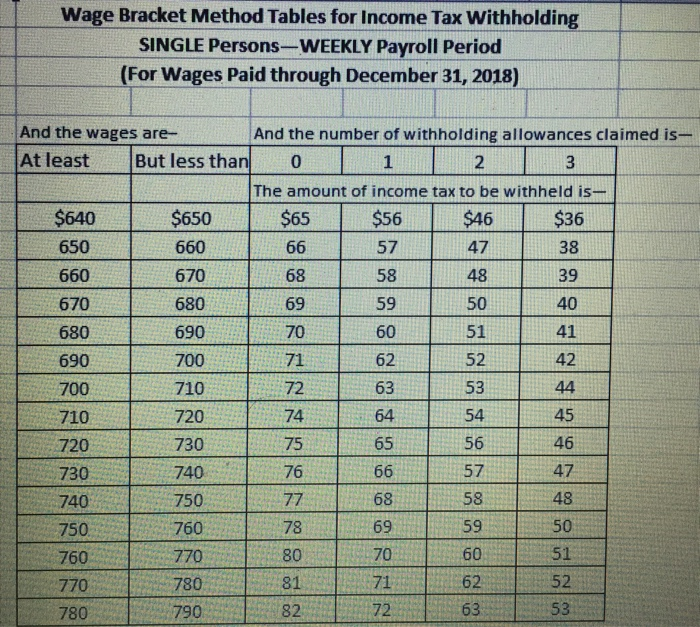

ohn Williams is paid weekly. He eams weekly wages of between $640 and $780, depending on whether he works overtime. ohn is single and claims one exemption for federal taxes ederal income tax amount per week See instructions below tate income tax amount per week $19.18 ocial Security tax rate edicare tax rate ederal unemployment tax rate tate unemployment tax rate 6.20% 1.45% 0 60% 5 40% ohn's wages the first week: $685.00 VLOOKUP function information ROUND function information n excerpt from the federal tax tables appears on the TaxTables sheet se the information above and a VLOOKUP funtion for the federal tax amount to answer the two questions below Use one formula in cell K17 and one in cel K19 se the ROUND function in the formulas to round each calculated amount to the nearest cent. Format the answer cells to two decimal places How much is John's net pay this week? 2 How much payroll tax expense does the company incur for John this week? Wage Bracket Method Tables for Income Tax Withholding SINGLE Persons-WEEKLY Payroll Period (For Wages Paid through December 31, 2018) And the wages are- At least But less than 0 And the number of withholding allowances claimed is The amount of income tax to be withheld is- $640 650 660 670 680 690 700 710 720 730 740 750 760 770 780 $650 660 670 680 690 700 710 720 730 740 750 760 770 780 790 $36 38 39 40 41 42 47 48 50 51 52 53 54 56 57 58 59 60 62 57 58 59 60 62 63 68 69 70 71 72 74 75 76 45 46 47 48 50 51 52 53 65 68 69 70 71 72 78 80 81 82 ohn Williams is paid weekly. He eams weekly wages of between $640 and $780, depending on whether he works overtime. ohn is single and claims one exemption for federal taxes ederal income tax amount per week See instructions below tate income tax amount per week $19.18 ocial Security tax rate edicare tax rate ederal unemployment tax rate tate unemployment tax rate 6.20% 1.45% 0 60% 5 40% ohn's wages the first week: $685.00 VLOOKUP function information ROUND function information n excerpt from the federal tax tables appears on the TaxTables sheet se the information above and a VLOOKUP funtion for the federal tax amount to answer the two questions below Use one formula in cell K17 and one in cel K19 se the ROUND function in the formulas to round each calculated amount to the nearest cent. Format the answer cells to two decimal places How much is John's net pay this week? 2 How much payroll tax expense does the company incur for John this week? Wage Bracket Method Tables for Income Tax Withholding SINGLE Persons-WEEKLY Payroll Period (For Wages Paid through December 31, 2018) And the wages are- At least But less than 0 And the number of withholding allowances claimed is The amount of income tax to be withheld is- $640 650 660 670 680 690 700 710 720 730 740 750 760 770 780 $650 660 670 680 690 700 710 720 730 740 750 760 770 780 790 $36 38 39 40 41 42 47 48 50 51 52 53 54 56 57 58 59 60 62 57 58 59 60 62 63 68 69 70 71 72 74 75 76 45 46 47 48 50 51 52 53 65 68 69 70 71 72 78 80 81 82