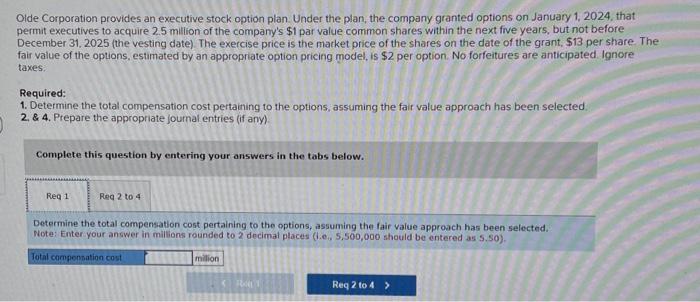

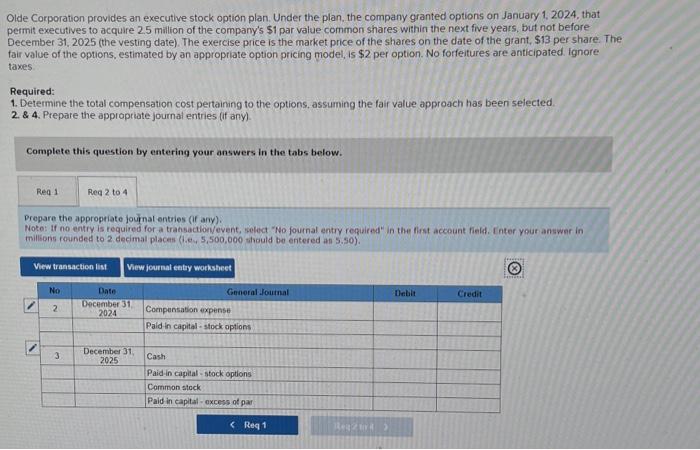

Oide Corporation provides an executive stock option plan. Under the plan, the company granted options on January 1, 2024, that permit executives to acquire 2.5 million of the company's \\( \\$ 1 \\) par value common shares within the next five years, but not before December 31, 2025 (the vesting date). The exercise price is the market price of the shares on the date of the grant, \\$13 per share The fair value of the options, estimated by an appropriate option pricing model, is \\( \\$ 2 \\) per option. No forfeitures are anticipated. Ignore taxes: Required: 1. Determine the total compensation cost pertaining to the options, assuming the fair value approach has been selected 2. \\& 4. Prepare the appropriate journal entries (if any) Complete this question by entering your answers in the tabs below. Determine the total compensation cost pertaining to tho options, assuming the fair value approach has been selected. Note: Enter your answer in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50\\( ) \\). Olde Corporation provides an executive stock option plan. Under the plan. the company granted options on January 1, 2024, that permit executives to acquire 2.5 milion of the company's \\( \\$ 1 \\) par value common shares within the next five years, but not before December 31, 2025 (the vesting date). The exercise price is the market price of the shares on the date of the grant, \\( \\$ 13 \\) per share. The fair value of the options, estimated by an appropriate option pricing model, is \\( \\$ 2 \\) per option. No forfeitures are anticipated. ignore taxes. Required: 1. Determine the total compensation cost pertaining to the options, assuming the fair value approach has been selected. 2. \\& 4. Prepare the appropriate journal entries (if any). Complete this question by entering your answers in the tabs below. Prepare the approperate jonal entries (if ary). Noto: If no entry is required for a transaction/event, select \"No fournal entry required\" in the first acceunt field. Inter your answar in millsons rounded to 2 decimal places (i.e, \\( 5,500,000 \\) should be entered an 5.50 )