Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oilco Canada Limited sells refined petroleum products. The company's balance sheet includes reserves of oil assets. Suppose that Oilco paid $15 million cash for an

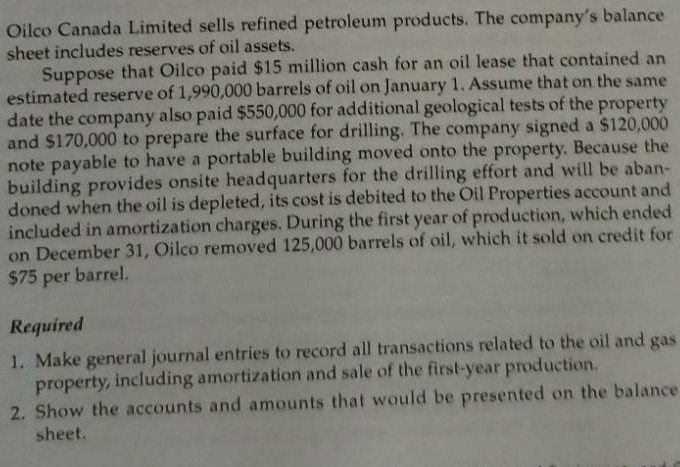

Oilco Canada Limited sells refined petroleum products. The company's balance sheet includes reserves of oil assets. Suppose that Oilco paid $15 million cash for an oil lease that contained an estimated reserve of 1,990,000 barrels of oil on January 1. Assume that on the same date the company also paid $550,000 for additional geological tests of the property and $170,000 to prepare the surface for drilling. The company signed a $120,000 note payable to have a portable building moved onto the property. Because the building provides onsite headquarters for the drilling effort and will be aban- doned when the oil is depleted, its cost is debited to the Oil Properties account and included in amortization charges. During the first year of production, which ended on December 31, Oilco removed 125,000 barrels of oil, which it sold on credit for $75 per barrel. Required 1. Make general journal entries to record all transactions related to the oil and gas property, including amortization and sale of the first-year production. 2. Show the accounts and amounts that would be presented on the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started