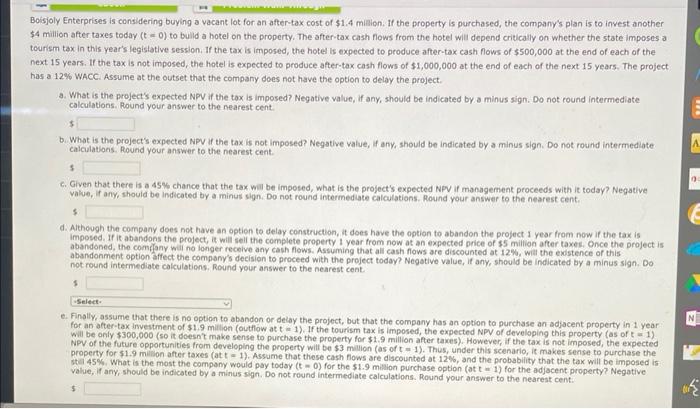

oisjoly Enterprises is considering buying a vacant lot for an after-tax cost of $1.4 mialon. If the property is purchased, the company's plan is to invest another 4 million after taxes today (t=0) to bulld a hotel on the property. The after-tax cash flows from the hotel will depend critically on whether the state imposes a ourism tax in this year's legistative session. If the tax is imposed, the hotet is expected to produce after-tax cash flows of $500,000 at the end of each of the ext 15 years. If the tax is not imposed, the hatel is expected to produce after-tax cash flows of $1,000,000 at the end of each of the next 15 years. The project Ias a 12\% WACC. Assume at the outset that the company does not have the option to delay the project. a. What is the projects expected NPV if the tox is imposed? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent. 3 b. What is the project's expected NPV if the tax is not imposed? Negative value, if any, should be indicated by a minus sign. Do not round intermediate. calculations. Round your answer to the nearest cent. 3 c. Given that there is a 45% chance that the tax wil be imposed, what is the project's expected NFV if management proceeds with it today? Negative value, If any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent. $ d. Athoogh the company does not have an option to delay construction, it does have the option to abandon the project I year from now if the tax is imposed. If it abandons the project, if will seli the complete property i year from now at an expected price of is million after taxes. Once the project is abandoned, the comfany wal no longer receive any cash flows. Assuming that all cash flows are discounted at i2\%, wial the existence of this abandonment option affect the company's decision to proceed with the project today? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent. $ e. Finally, assume that there is no option to abandon or deiay the project, but that the company has an option ta purchase an adjacent property in 1 year for an after-tax investment of $1.9 millon (outflow at t=1 ). If the tourism tax is imposed, the expected NPV of developing this property (as of t a 1 ). Will be only $300,000 (so it deesn't make sense to purchase the property for $1.9 million after taxes), However, if the tax is not imposed, the expected NPV of the future opportunities from developing the property will be $3 milion (as of t=1). Thus, under this scenario, it makes sense to purchase the property for 51.9 milinon after taxes (at t=1. Assume that these cash flows are discounted at 12%, and the probability that the tax will be imposed is walie. if any should be indicated by a minus sign. Do not round intermediate calculations. Preund your answer in for the adjacent property? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent. 5