Answered step by step

Verified Expert Solution

Question

1 Approved Answer

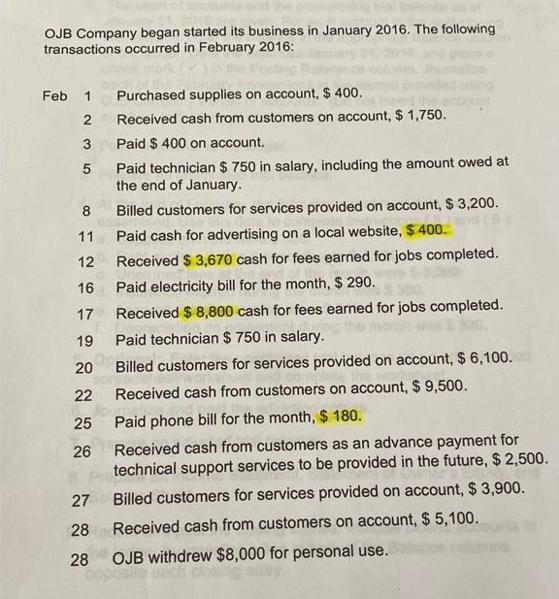

OJB Company began started its business in January 2016. The following transactions occurred in February 2016: Feb 1 Purchased supplies on account, $ 400.

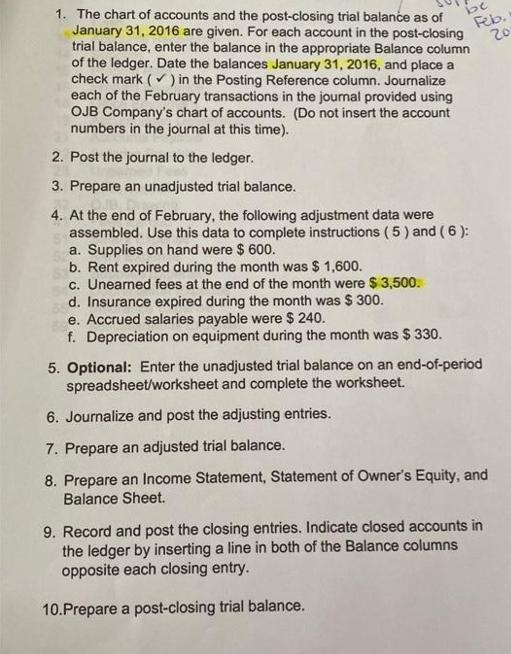

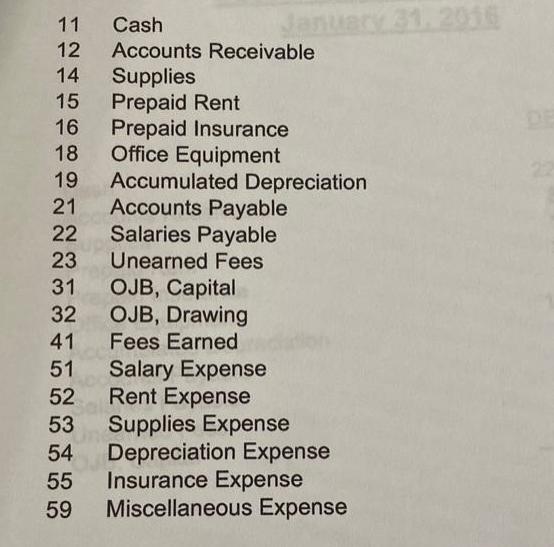

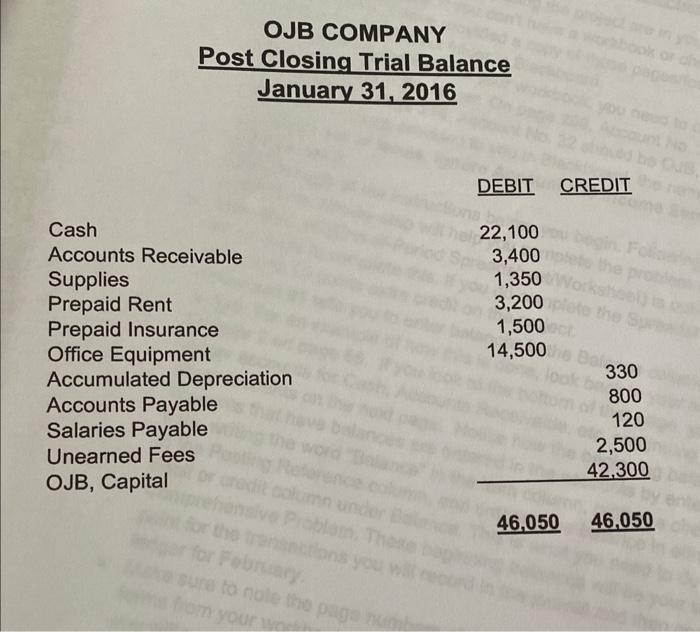

OJB Company began started its business in January 2016. The following transactions occurred in February 2016: Feb 1 Purchased supplies on account, $ 400. 2 3 5 8 11 12 16 17 19 20 22 25 26 27 28 28 Received cash from customers on account, $ 1,750. Paid $400 on account. Paid technician $ 750 in salary, including the amount owed at the end of January. Billed customers for services provided on account, $ 3,200. Paid cash for advertising on a local website, $ 400. Received $ 3,670 cash for fees earned for jobs completed. Paid electricity bill for the month, $ 290. Received $8,800 cash for fees earned for jobs completed. 320, Paid technician $ 750 in salary. Billed customers for services provided on account, $ 6,100. Received cash from customers on account, $ 9,500. Paid phone bill for the month, $ 180. Received cash from customers as an advance payment for technical support services to be provided in the future, $ 2,500. Billed customers for services provided on account, $ 3,900. Received cash from customers on account, $ 5,100. OJB withdrew $8,000 for personal use. 1. The chart of accounts and the post-closing trial balance as of January 31, 2016 are given. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of the ledger. Date the balances January 31, 2016, and place a check mark () in the Posting Reference column. Journalize each of the February transactions in the journal provided using OJB Company's chart of accounts. (Do not insert the account numbers in the journal at this time). 2. Post the journal to the ledger. 3. Prepare an unadjusted trial balance. 4. At the end of February, the following adjustment data were assembled. Use this data to complete instructions (5) and (6): a. Supplies on hand were $ 600. b. Rent expired during the month was $ 1,600. c. Unearned fees at the end of the month were $ 3,500. be Feb. 20 d. Insurance expired during the month was $ 300. e. Accrued salaries payable were $ 240. f. Depreciation on equipment during the month was $330. 5. Optional: Enter the unadjusted trial balance on an end-of-period spreadsheet/worksheet and complete the worksheet. 6. Journalize and post the adjusting entries. 7. Prepare an adjusted trial balance. 8. Prepare an Income Statement, Statement of Owner's Equity, and Balance Sheet. 9. Record and post the closing entries. Indicate closed accounts in the ledger by inserting a line in both of the Balance columns opposite each closing entry. 10.Prepare a post-closing trial balance. 11 Cash 12 Accounts Receivable 14 Supplies 15 Prepaid Rent 16 18 19 21 22 23 31 32 41 51 52 53 54 55 59 January 31, 2016 Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees OJB, Capital OJB, Drawing Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense OJB COMPANY Post Closing Trial Balance January 31, 2016 Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees OJB, Capital ansactions you will sure to note the page numb om your week DEBIT CREDIT 22,100 the pro 3,400mplete 1,350 Work 3,200 plete the Spra ksheel) 1,500 oct 14,500 46,050 330 800 120 2,500 42,300 46,050

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Journalize each of the February transactions in the journal provided using OJB Companys chart of accounts Date Account Debit Credit Feb 1 Supplies 400 Accounts Payable Feb 2 Cash 1750 Accounts Recei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started