Answered step by step

Verified Expert Solution

Question

1 Approved Answer

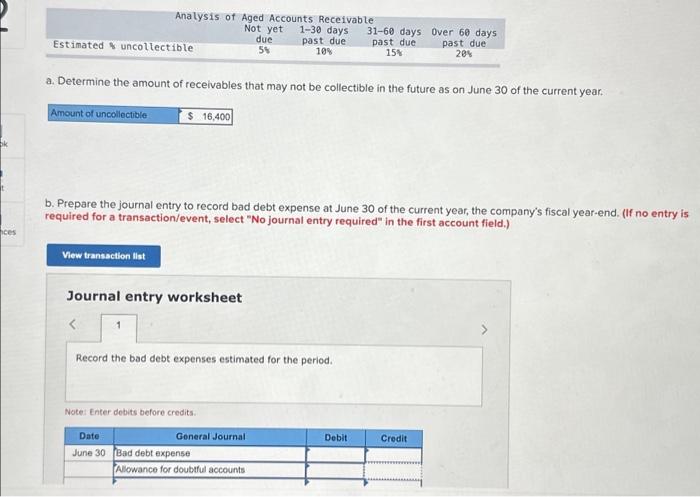

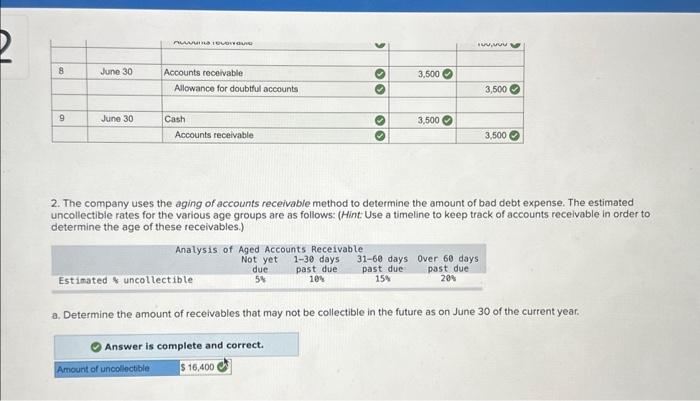

ok ces Estimated % uncollectible Amount of uncollectible Analysis of Aged Accounts Receivable Not yet 1-30 days past due 10% a. Determine the amount of

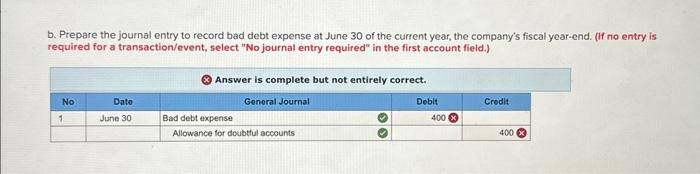

ok ces Estimated % uncollectible Amount of uncollectible Analysis of Aged Accounts Receivable Not yet 1-30 days past due 10% a. Determine the amount of receivables that may not be collectible in the future as on June 30 of the current year. View transaction list $ 16,400 b. Prepare the journal entry to record bad debt expense at June 30 of the current year, the company's fiscal year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 Date June 30 Record the bad debt expenses estimated for the period. Note: Enter debits before credits. due 5% General Journal Bad debt expense Allowance for doubtful accounts 31-60 days Over 60 days past due 20% past due 15% Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started