Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ok hi kindly complete the 3 boxes below and part 2 please Below is the income statement and balance sheet for Prufrock Company. Prufrock cash

ok

hi kindly complete the 3 boxes below and part 2 please

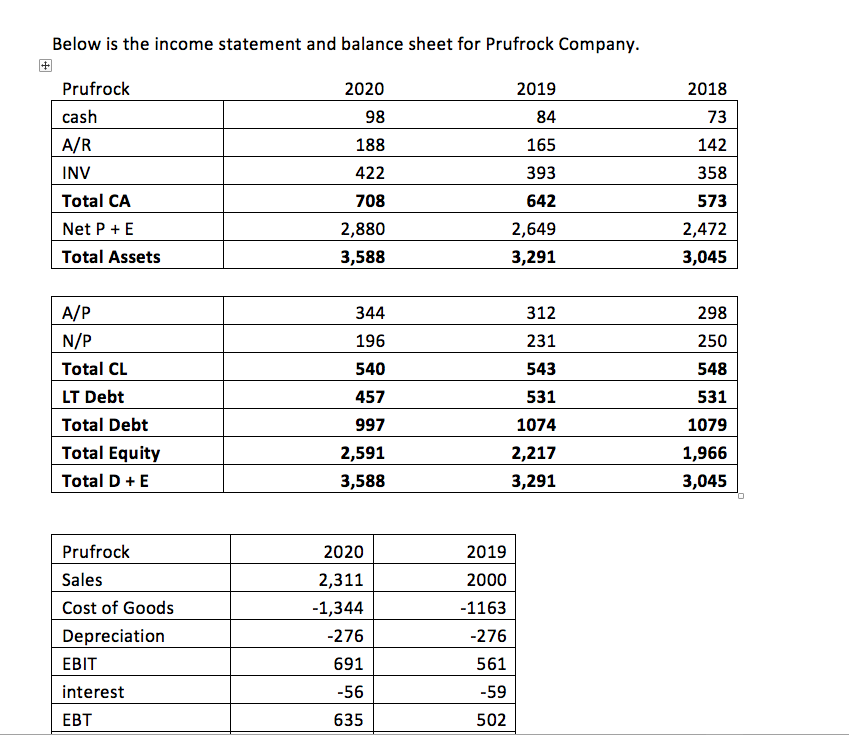

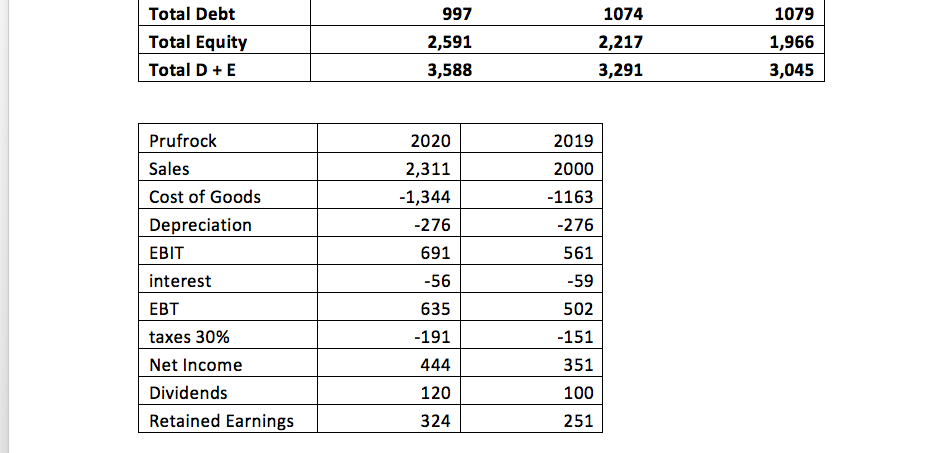

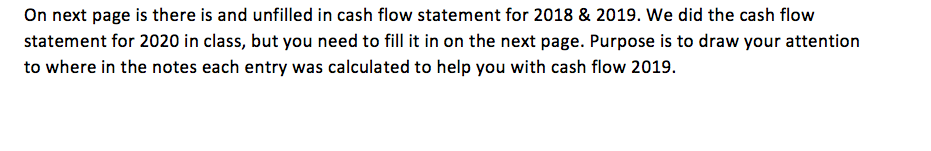

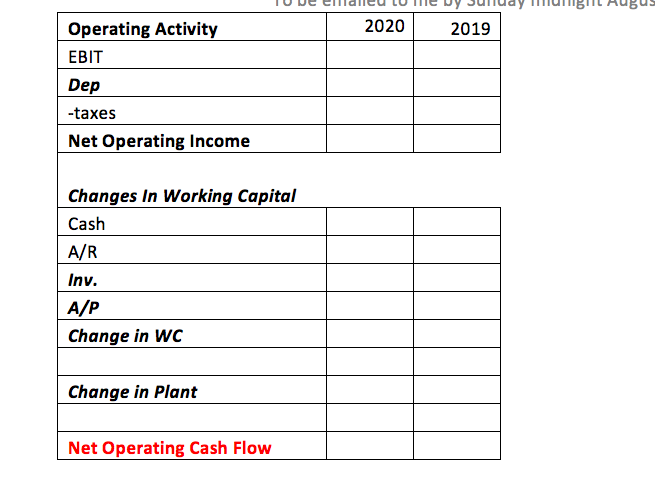

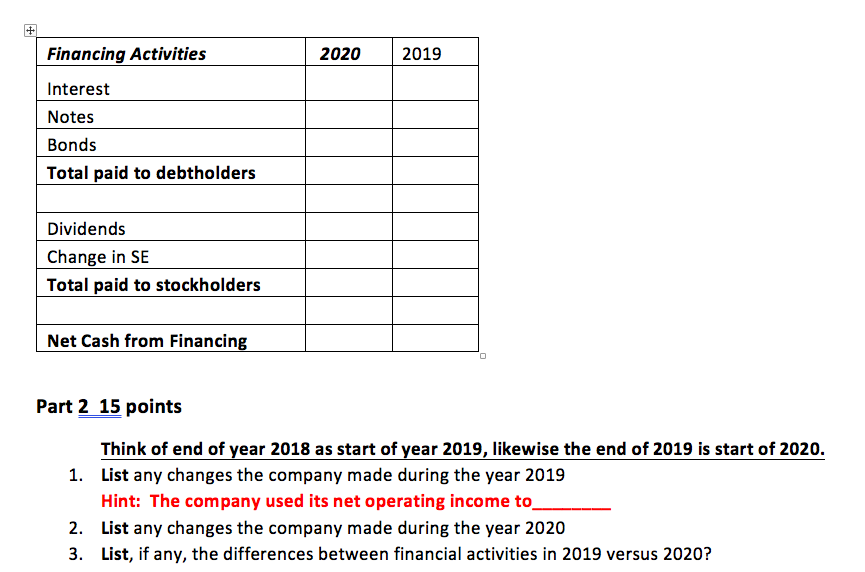

Below is the income statement and balance sheet for Prufrock Company. Prufrock cash 2019 84 165 A/R 2020 98 188 422 708 2,880 3,588 INV Total CA Net P+E Total Assets 393 2018 73 142 358 573 2,472 3,045 642 2,649 3,291 312 344 196 540 A/P N/P Total CL LT Debt Total Debt Total Equity Total D+E 231 543 531 457 997 2,591 3,588 298 250 548 531 1079 1,966 3,045 1074 2,217 3,291 Prufrock Sales Cost of Goods Depreciation EBIT interest EBT 2020 2,311 -1,344 -276 691 -56 2019 2000 -1163 -276 561 -59 635 502 997 1074 Total Debt Total Equity Total D+E 2,591 3,588 2,217 3,291 1079 1,966 3,045 2019 2000 2020 2,311 -1,344 -276 691 -1163 -276 561 Prufrock Sales Cost of Goods Depreciation EBIT interest EBT taxes 30% Net Income Dividends Retained Earnings -56 -59 635 502 -191 444 120 -151 351 100 324 251 On next page is there is and unfilled in cash flow statement for 2018 & 2019. We did the cash flow statement for 2020 in class, but you need to fill it in on the next page. Purpose is to draw your attention to where in the notes each entry was calculated to help you with cash flow 2019. "BIL RU54 2020 2019 Operating Activity EBIT Dep -taxes Net Operating Income Changes in Working Capital Cash A/R Inv. A/P Change in WC Change in Plant Net Operating Cash Flow + 2020 2019 Financing Activities Interest Notes Bonds Total paid to debtholders Dividends Change in SE Total paid to stockholders Net Cash from Financing Part 2 15 points Think of end of year 2018 as start of year 2019, likewise the end of 2019 is start of 2020. 1. List any changes the company made during the year 2019 Hint: The company used its net operating income to 2. List any changes the company made during the year 2020 3. List, if any, the differences between financial activities in 2019 versus 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started