Ok I'm having a really hard time undertanding questions D, E and then onto F, G and H.

Not sure if D) and E) are the Normal Approximation to Poisson (fair bit greater than 0.5) or could it stil be Binomial?

Then when it comes to F), G) and H) I'm completely confused and don't know where to start!

Any help would be greatly appreciated.

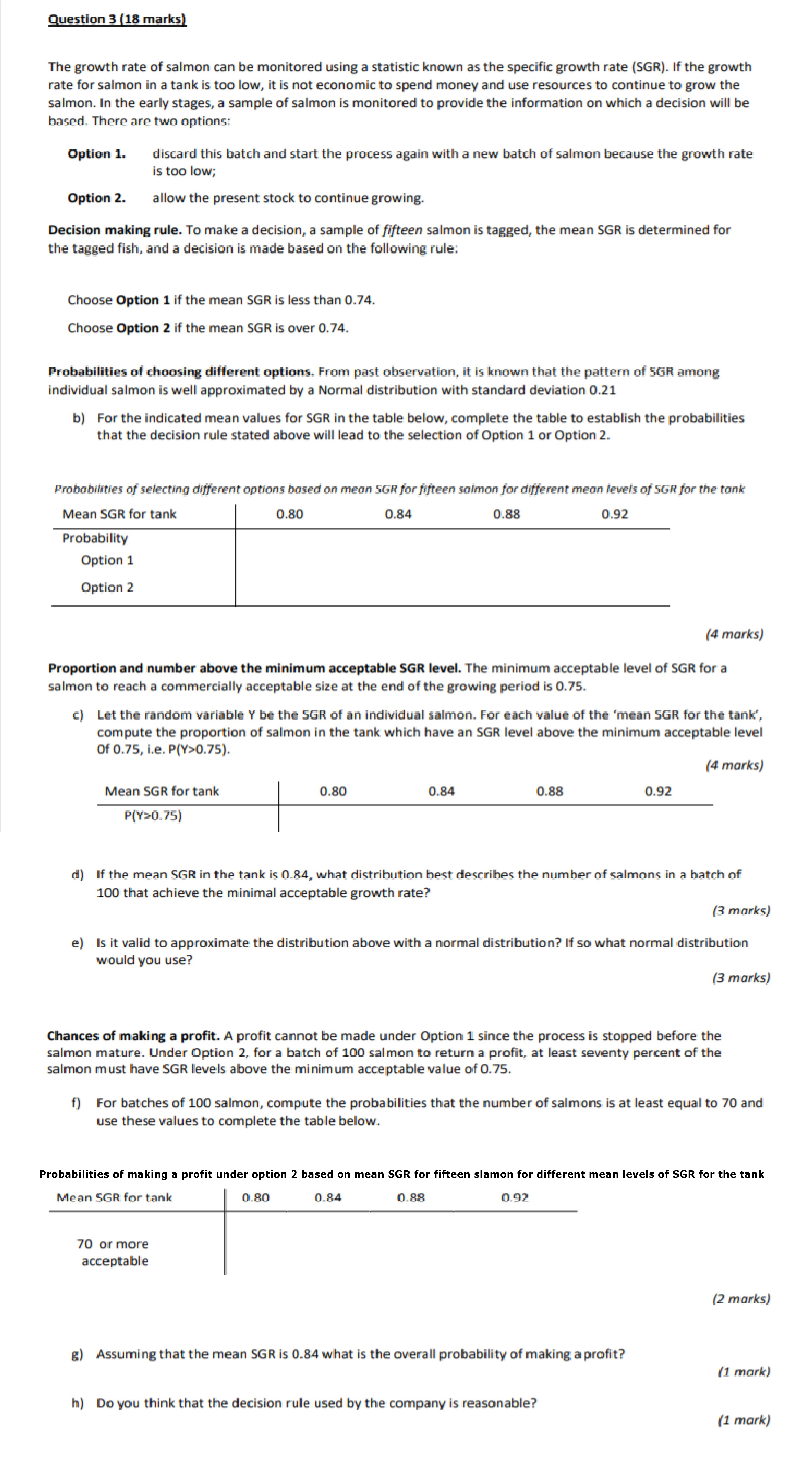

Question 3 (18 marks) The growth rate of salmon can be monitored using a statistic known as the specific growth rate (SGR). If the growth rate for salmon in a tank is too low, it is not economic to spend money and use resources to continue to grow the salmon. In the early stages, a sample of salmon is monitored to provide the information on which a decision will be based. There are two options: Option 1. discard this batch and start the process again with a new batch of salmon because the growth rate is too low; Option 2. allow the present stock to continue growing. Decision making rule. To make a decision, a sample of fifteen salmon is tagged, the mean SGR is determined for the tagged fish, and a decision is made based on the following rule: Choose Option 1 if the mean SGR is less than 0.74. Choose Option 2 if the mean SGR is over 0.74. Probabilities of choosing different options. From past observation, it is known that the pattern of SGR among individual salmon is well approximated by a Normal distribution with standard deviation 0.21 b) For the indicated mean values for SGR in the table below, complete the table to establish the probabilities that the decision rule stated above will lead to the selection of Option 1 or Option 2. Probabilities of selecting different options based on mean SGR for fifteen salmon for different mean levels of SGR for the tank Mean SGR for tank 0.80 0.84 0.88 0.92 Probability Option 1 Option 2 (4 marks) Proportion and number above the minimum acceptable SGR level. The minimum acceptable level of SGR for a salmon to reach a commercially acceptable size at the end of the growing period is 0.75. c) Let the random variable Y be the SGR of an individual salmon. For each value of the 'mean SGR for the tank', compute the proportion of salmon in the tank which have an SGR level above the minimum acceptable level Of 0.75, i.e. P(Y>0.75). (4 marks) Mean SGR for tank 0.80 0.84 0.88 0.92 P(Y>0.75) d) If the mean SGR in the tank is 0.84, what distribution best describes the number of salmons in a batch of 100 that achieve the minimal acceptable growth rate? (3 marks) e) Is it valid to approximate the distribution above with a normal distribution? If so what normal distribution would you use (3 marks) Chances of making a profit. A profit cannot be made under Option 1 since the process is stopped before the salmon mature. Under Option 2, for a batch of 100 salmon to return a profit, at least seventy percent of the salmon must have SGR levels above the minimum acceptable value of 0.75. f) For batches of 100 salmon, compute the probabilities that the number of salmons is at least equal to 70 and use these values to complete the table below. Probabilities of making a profit under option 2 based on mean SGR for fifteen slamon for different mean levels of SGR for the tank Mean SGR for tank 0.80 0.84 0.88 0.92 70 or more acceptable (2 marks) g) Assuming that the mean SGR is 0.84 what is the overall probability of making a profit? (1 mark) h) Do you think that the decision rule used by the company is reasonable? (1 mark)