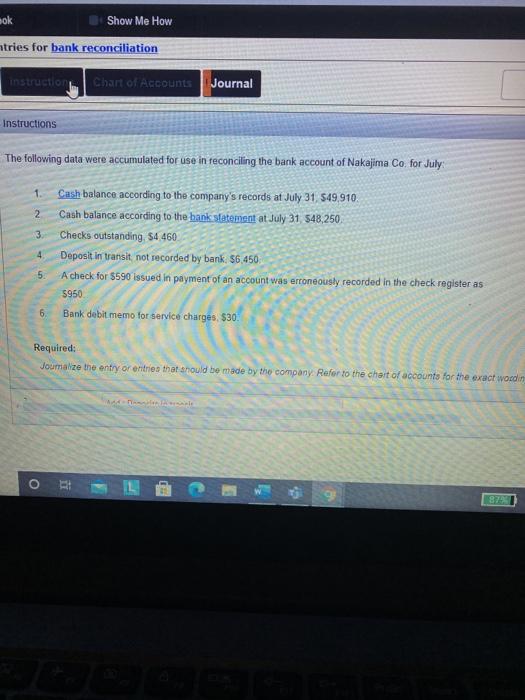

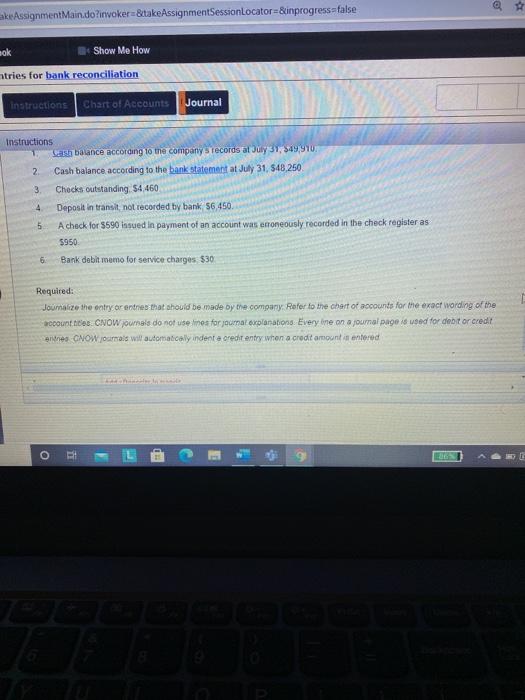

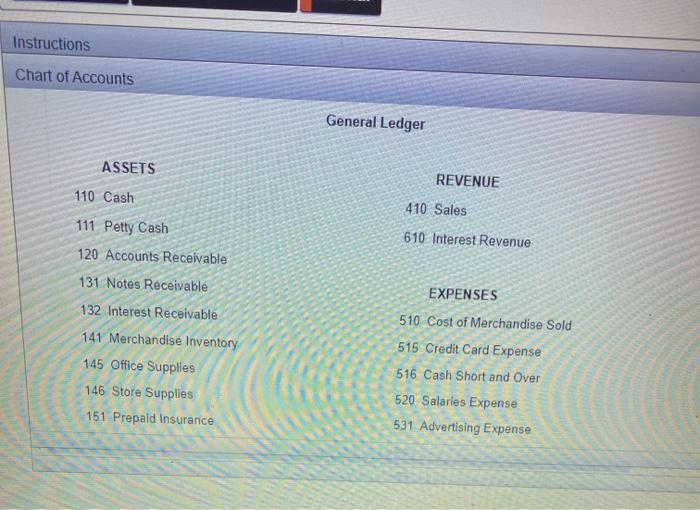

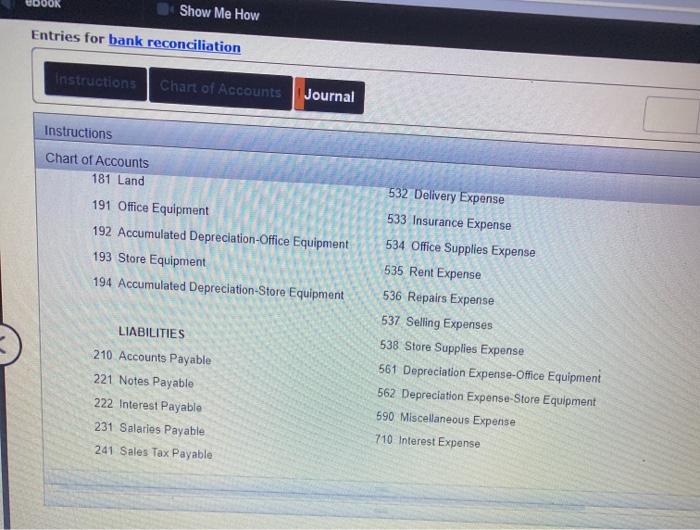

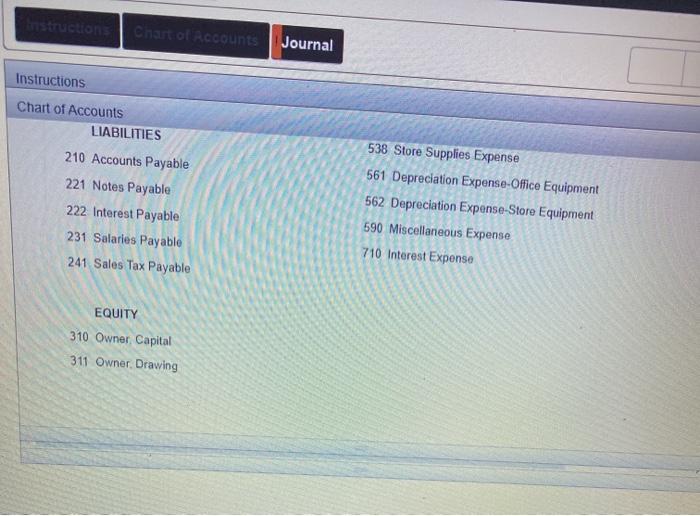

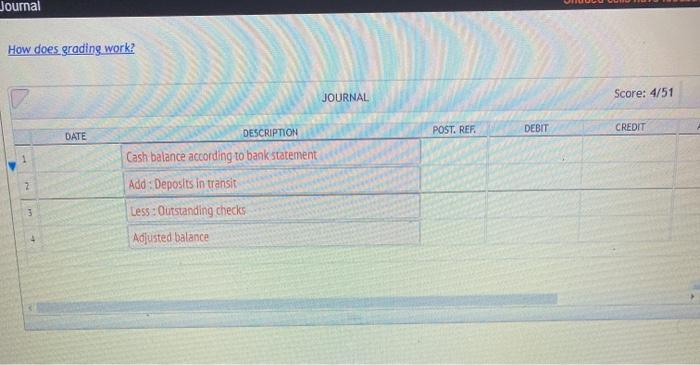

ok Show Me How atries for bank reconciliation instruction Chart of Accounts Journal Instructions The following data were accumulated for use in reconciling the bank account of Nakajima Co, for July 1 2 3 4 Cash balance according to the company's records at July 31. 549,910 Cash balance according to the bank statement at July 31 548,250 Checks outstanding. 54 460 Deposit in transit not recorded by bank 56,450 A check for $590 issued in payment of an account was erroneously recorded in the check register as 5950 Bank debit memo for service charges. $30 5. 6. Required: Joumalize the entry or entries that should be made by the company. Refer to the chart of accounts for the exact woodlin O L keAssignmentMain.do?invokera&take AssignmentSessionLocator &inprogressfalse ok Show Me How stries for bank reconciliation instructions Chart of Accounts Journal Instructions 1 Lash balance according to the company records at July 31, 349,910 2 Cash balance according to the bank statement at July 31, $48,250 3 Checks outstanding $4.460 4 Deposit in transit not recorded by bank 56,450 5 A check for 5590 insued in payment of an account was erroneously recorded in the check register as $950 6 Bank debit memo for service charges $30 Required: Journalize the entry or entries that should be made by the company. Refer to the chart of accounts for the exact wording of the account is CNOW journals do not use lines for journal explanations. Every one on a journal page is woed for debitor credit enes NOW formals will automatically indente credit entry when a credit amount intered O - E Instructions Chart of Accounts General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance EXPENSES 510 Cost of Merchandise Sold 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 531 Advertising Expense Show Me How Entries for bank reconciliation Instructions Chart of Accounts Journal Instructions Chart of Accounts 181 Land 191 Office Equipment 192 Accumulated Depreciation Office Equipment 193 Store Equipment 194 Accumulated Depreciation-Store Equipment 532 Delivery Expense 533 Insurance Expense 534 Office Supplies Expense 535 Rent Expense 536 Repairs Expense 537 Selling Expenses 538 Store Supplies Expense 561 Depreciation Expense-Office Equipment 562 Depreciation Expense-Store Equipment 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Notes Payable 222 Interest Payable 231 Salarios Payable 241 Sales Tax Payable ristruction Chart of Accounts Journal Instructions Chart of Accounts LIABILITIES 210 Accounts Payable 221 Notes Payable 222 Interest Payable 231 Salaries Payable 241 Sales Tax Payable 538 Store Supplies Expense 561 Depreciation Expense-Office Equipment 562 Depreciation Expense-Store Equipment 690 Miscellaneous Expense 710 Interest Expense EQUITY 310 Owner Capital 311 Owner Drawing Journal How does.grading work? JOURNAL Score: 4/51 DESCRIPTION POST. REF DEBIT DATE CREDIT 2 Cash balance according to bank statement Add : Deposits in transit Less: Outstanding checks Adjusted balance 3