Question

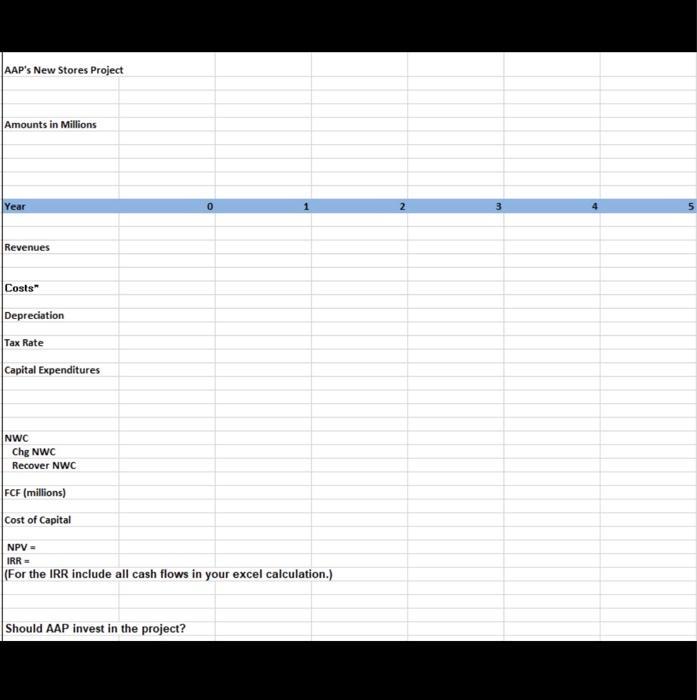

Your next assignment is to determine if AAP should invest in new stores so you need to determine net cash flows and NPV and determine

Your next assignment is to determine if AAP should invest in new stores so you need to determine net cash flows and NPV and determine if the project is viable or not.

Capital expenditures to produce the new stores will initially require an investment of $1.9 billion. Other development costs that will be required to finish the store's project is $800 million this year. Any ongoing costs for upgrades will be covered in the margin calculation below. The store project is expected to have a life of five years. First-year revenues for the new stores are expected to be $4,300,000,000 ($4,300 million). The ride revenues are expected to grow by 37% for the second year, and then increase by 5% for the third, decrease by 15% for the 4th and finally decrease by 25% for the 5th (final) year of operation. Your job is to determine the rest of the cash flows associated with this project. Your boss has indicated that the operating costs and net working capital requirements are similar to the rest of the company’s products. Since your boss hasn’t been much help, here are some tips to guide your analysis:

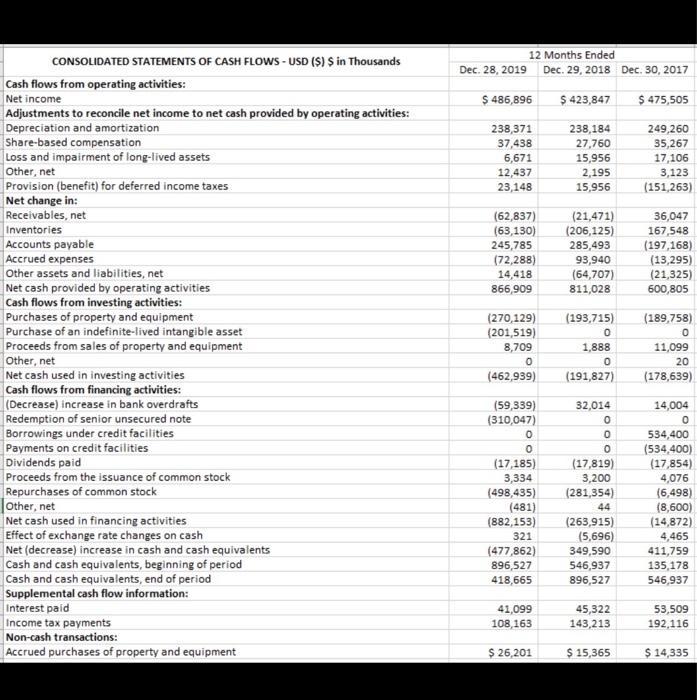

1. You will need to use the Financial Statements that you downloaded in Part 1.

2.You are now ready to determine the free cash flow. Compute the free cashflow based on the information above for each year using :

Free Cash Flow = (Revenues – Costs- Depreciation) x (1- Tax Rate) + Depreciation – Capex – Change in NWC

Set up the timeline and computation of the free cash flow in separate, contiguous columns for each year of the project life. Be sure to make outflows negative and inflows positive.

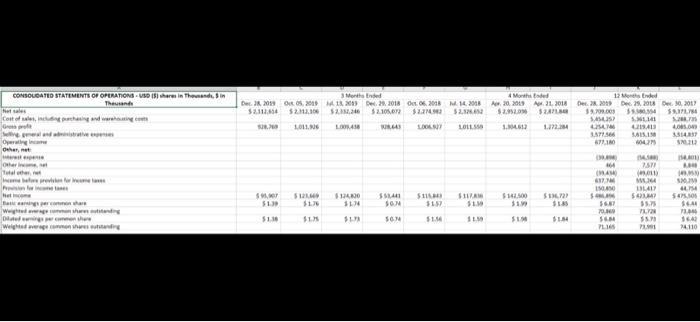

a.Assume that the project’s profitability will be similar to AAP’s existing projects and estimate costs for each year of your project by using the average ratio of non-depreciation costs to revenue for the last 2 fiscal years (in practice you really tend to use at least 4 years worth of data, but for this exercise 2 years will suffice):

(Costs of Goods Sold* + SG&A)/Sales

*AAP calls cost of goods sold, cost of sales

You should assume that this ratio will hold for this project as well. You do not need to break out the individual components of operating costs in your forecast.

Simply the forecast to the Total Cost of Goods Sold (or cost of revenue) + SG&A +R&D for each year.

Determine AAP’s tax rate as 1- (Income After Tax/Income Before Tax) in the last fiscal year reported. Recalculate the WACC form Part 1 using this tax rate. What should you use if this number is negative?

Calculate the net working capital required each year by assuming that the level of NWC will be a constant percentage of the project’s sales. Use AAP’s last 2 fiscal year average NWC/Sales to estimate the required percentage. (Use only accounts receivable, accounts payable, and inventory to measure working capital. Other components of current assets and liabilities are harder to interpret and are not necessarily reflective of the project’s required NWC—e.g., AAP’s cash holdings.)

To determine the free cash flow, calculate the additional capital investment and the change in net-working capital each year.

Determine the NPV of the project with WACC calculated in Part 1 step 10 and the project IRR

For the NPV calculation remember to add the first CF when you are using the excel function =NPV(rate, CF1:CF5) + CF0

For the IRR include all cash flows in your excel calculation.

Should AAP invest in the project?

CONSOLIDATED STATEMENTS OF CASH FLOWS - USD ($) $ in Thousands Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Loss and impairment of long-lived assets Other, net Provision (benefit) for deferred income taxes Net change in: Receivables, net Inventories Accounts payable Accrued expenses Other assets and liabilities, net Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchase of an indefinite-lived intangible asset Proceeds from sales of property and equipment Other, net Net cash used in investing activities Cash flows from financing activities: (Decrease) increase in bank overdrafts Redemption of senior unsecured note Borrowings under credit facilities Payments on credit facilities Dividends paid Proceeds from the issuance of common stock Repurchases of common stock Other, net Net cash used in financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Supplemental cash flow information: Interest paid Income tax payments Non-cash transactions: Accrued purchases of property and equipment Dec. 28, 2019 12 Months Ended Dec. 29, 2018 Dec. 30, 2017 $ 423,847 $ 486,896 238,371 37,438 6,671 12,437 23,148 (62,837) (63,130) 245,785 (72,288) 14,418 866,909 (270,129) (201,519) 8,709 0 (462,939) (59,339) (310,047) 0 0 (17,185) 3,334 (498,435) (481) (882,153) 321 (477,862) 896,527 418,665 41,099 108,163 $ 26,201 238,184 27,760 15,956 2,195 15,956 (21,471) (206,125) 285,493 93,940 (64,707) 811,028 (193,715) 0 1,888 0 (191,827) 32,014 0 0 0 (17,819) 3,200 (281,354) 44 (263,915) (5,696) 349,590 546,937 896,527 45,322 143,213 $ 15,365 $ 475,505 249,260 35,267 17,106 3,123 (151,263) 36,047 67,548 (197,168) (13,295) (21,325) 600,805 (189,758) 0 11,099 20 (178,639) 14,004 0 534,400 (534,400) (17,854) 4,076 (6,498) (8,600) (14,872) 4,465 411,759 135,178 546,937 53,509 192,116 $ 14,335

Step by Step Solution

3.41 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

AAP should invest in the project Based on the financial analysis and the assumptions outlined above the Net Present Value NPV of the project is positive and the Internal Rate of Return IRR is higher t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started