Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You find a medium-sized vacant lot in Claremont, CA, where you'd like to build SMMF housing. Your plan is to build six units, each

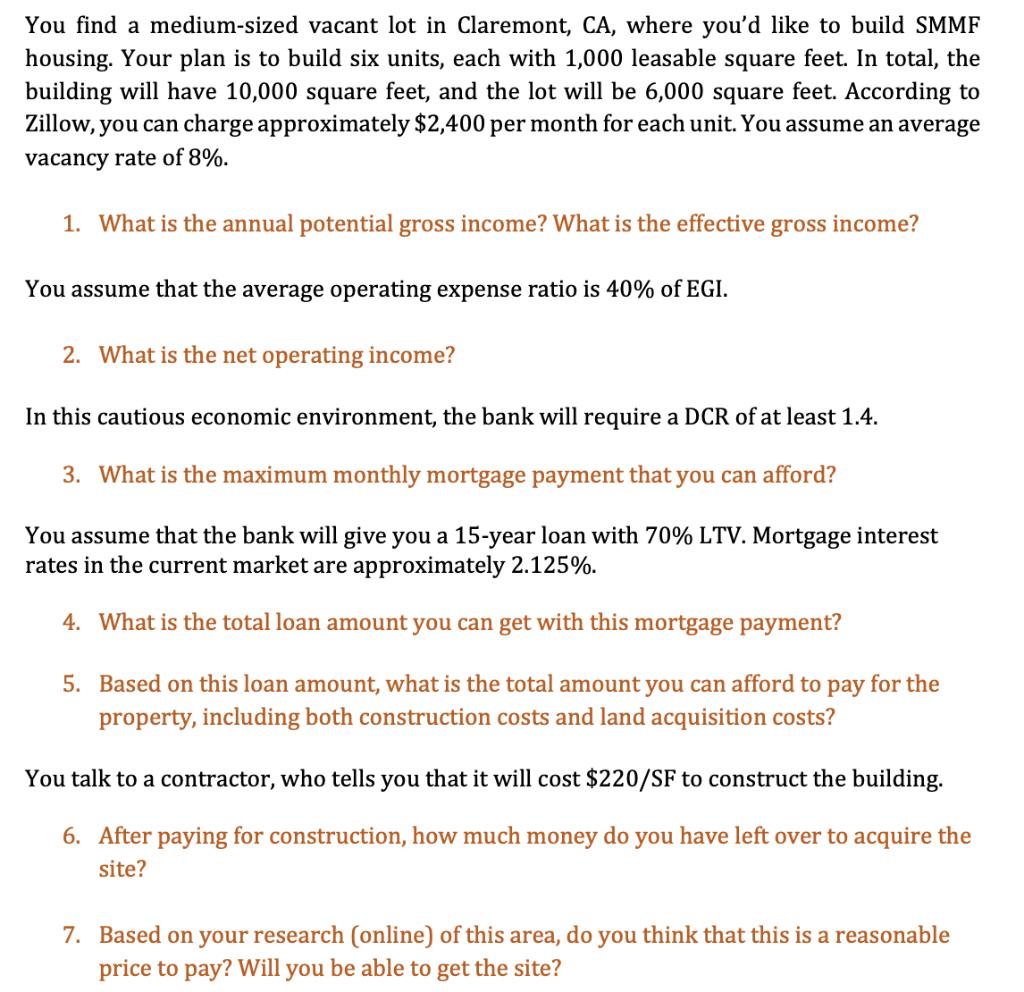

You find a medium-sized vacant lot in Claremont, CA, where you'd like to build SMMF housing. Your plan is to build six units, each with 1,000 leasable square feet. In total, the building will have 10,000 square feet, and the lot will be 6,000 square feet. According to Zillow, you can charge approximately $2,400 per month for each unit. You assume an average vacancy rate of 8%. 1. What is the annual potential gross income? What is the effective gross income? You assume that the average operating expense ratio is 40% of EGI. 2. What is the net operating income? In this cautious economic environment, the bank will require a DCR of at least 1.4. 3. What is the maximum monthly mortgage payment that you can afford? You assume that the bank will give you a 15-year loan with 70% LTV. Mortgage interest rates in the current market are approximately 2.125%. 4. What is the total loan amount you can get with this mortgage payment? 5. Based on this loan amount, what is the total amount you can afford to pay for the property, including both construction costs and land acquisition costs? You talk to a contractor, who tells you that it will cost $220/SF to construct the building. 6. After paying for construction, how much money do you have left over to acquire the site? 7. Based on your research (online) of this area, do you think that this is a reasonable price to pay? Will you be able to get the site? You find a medium-sized vacant lot in Claremont, CA, where you'd like to build SMMF housing. Your plan is to build six units, each with 1,000 leasable square feet. In total, the building will have 10,000 square feet, and the lot will be 6,000 square feet. According to Zillow, you can charge approximately $2,400 per month for each unit. You assume an average vacancy rate of 8%. 1. What is the annual potential gross income? What is the effective gross income? You assume that the average operating expense ratio is 40% of EGI. 2. What is the net operating income? In this cautious economic environment, the bank will require a DCR of at least 1.4. 3. What is the maximum monthly mortgage payment that you can afford? You assume that the bank will give you a 15-year loan with 70% LTV. Mortgage interest rates in the current market are approximately 2.125%. 4. What is the total loan amount you can get with this mortgage payment? 5. Based on this loan amount, what is the total amount you can afford to pay for the property, including both construction costs and land acquisition costs? You talk to a contractor, who tells you that it will cost $220/SF to construct the building. 6. After paying for construction, how much money do you have left over to acquire the site? 7. Based on your research (online) of this area, do you think that this is a reasonable price to pay? Will you be able to get the site?

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Number of units 6 Rent pm per unit 2400 1 Potential gross annual income 6 2400 12 172800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started