Answered step by step

Verified Expert Solution

Question

1 Approved Answer

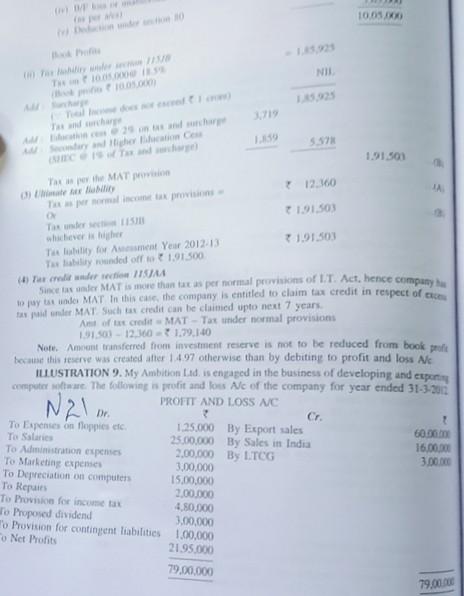

Old MathJax webview . 1001 NII 719 Tech en such the late 5.57 1.91501 12:160 1.91.503 1.91.500 MAT romanem provisions Tar der whichever is her

Old MathJax webview

.

1001 NII 719 Tech en such the late 5.57 1.91501 12:160 1.91.503 1.91.500 MAT romanem provisions Tar der whichever is her The litt for ment Year 2012-13 Tended off 1.91.500 Tax credere Sune tax ander MAT is more than tar as per normal provisions of LT. Act, hence company wyt under MAT In this case, the company is entitled to claim tax credit in respect of ele pidander MAT Such tat credit can be claimed upto next 7 years Am of tat credit MAT - Tat under normal provisions because this texere was created after 14 97 otherwise than by debiting to profit and loss Ale Nore. Amont tranferred from investment reserve is not to be reduced from book profit ILLUSTRATION 9. My Ambition Lad. is engaged in the business of developing and exporting computerowe. The following is profit and fous Ac of the company for year ended 31.3.2012 191.501 - 12.00 -1.79.140 N21 m 60.00 16.00.00 3.00 PROFIT AND LOSS A/C Dr. C. To Expenses on poppies etc. 1.25.000 By Export sales To Salarie 25.00.000 By Sales in India To Administration expenses 2,00.000 By LTCG To Marketing expenses 3.00.000 To Depreciation on computers 15.00.000 To Repairs 1.00.00 To Province for incetak 450.000 To Proposed dividend 3.00.000 To Provision for contingent liabilities 100,000 Net Profits 2195.000 79.00.000 79.00.00 19.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started