Answered step by step

Verified Expert Solution

Question

1 Approved Answer

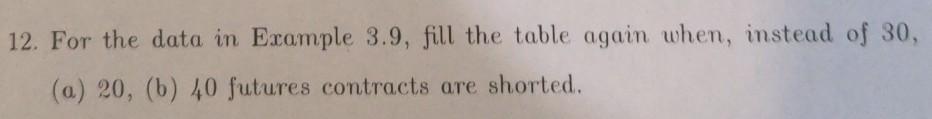

Old MathJax webview 12. For the data in Example 3.9, fill the table again when, instead of 30, (a) 20, (b) 40 futures contracts are

Old MathJax webview

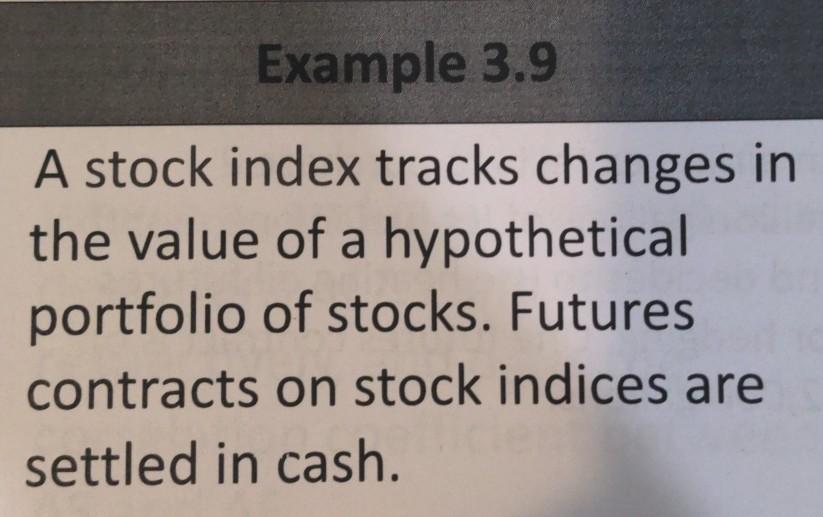

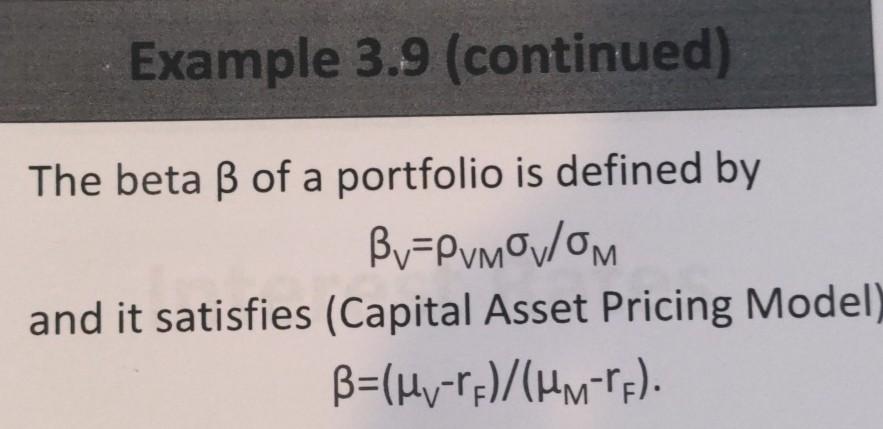

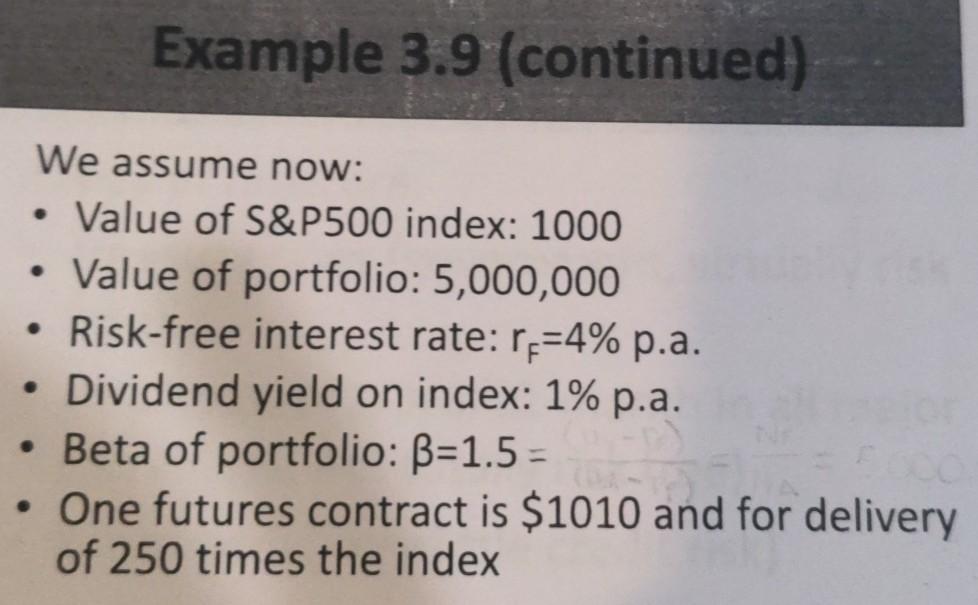

12. For the data in Example 3.9, fill the table again when, instead of 30, (a) 20, (b) 40 futures contracts are shorted. Example 3.9 A stock index tracks changes in the value of a hypothetical portfolio of stocks. Futures contracts on stock indices are settled in cash. Example 3.9 (continued) The beta of a portfolio is defined by Bv=PvMO/OM and it satisfies (Capital Asset Pricing Model) B=(Mv-rp)/(um-rp). Example 3.9 (continued) We assume now: Value of S&P500 index: 1000 Value of portfolio: 5,000,000 Risk-free interest rate: r=4% p.a. Dividend yield on index: 1% p.a. Beta of portfolio: B=1.5 = One futures contract is $1010 and for delivery of 250 times the index 12. For the data in Example 3.9, fill the table again when, instead of 30, (a) 20, (b) 40 futures contracts are shorted. Example 3.9 A stock index tracks changes in the value of a hypothetical portfolio of stocks. Futures contracts on stock indices are settled in cash. Example 3.9 (continued) The beta of a portfolio is defined by Bv=PvMO/OM and it satisfies (Capital Asset Pricing Model) B=(Mv-rp)/(um-rp). Example 3.9 (continued) We assume now: Value of S&P500 index: 1000 Value of portfolio: 5,000,000 Risk-free interest rate: r=4% p.a. Dividend yield on index: 1% p.a. Beta of portfolio: B=1.5 = One futures contract is $1010 and for delivery of 250 times the index

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started