Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview 1st drop down: Swiss Francs or US Dollars 2nd: Higher or Lower 3rd: Swiss Franc or US Dollars 4th Swiss Franc or

Old MathJax webview

1st drop down: Swiss Francs or US Dollars

2nd: Higher or Lower

3rd: Swiss Franc or US Dollars

4th Swiss Franc or US Dollar

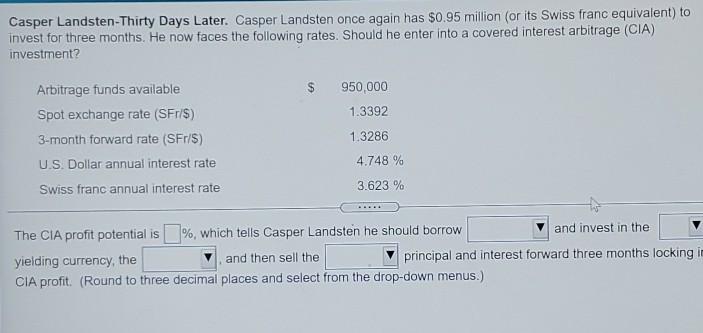

Casper Landsten-Thirty Days Later. Casper Landsten once again has $0.95 million (or its Swiss franc equivalent) to invest for three months. He now faces the following rates. Should he enter into a covered interest arbitrage (CIA) investment? $ Arbitrage funds available Spot exchange rate (SFr/S) 3-month forward rate (SFr/S) U.S. Dollar annual interest rate Swiss franc annual interest rate 950,000 1.3392 1.3286 4.748 % 3.623 % The CIA profit potential is %, which tells Casper Landsten he should borrow and invest in the yielding currency, the and then sell the principal and interest forward three months locking i CIA profit. (Round to three decimal places and select from the drop-down menus.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started